Profile

Constant reminders

Power

James Newsome

Power

Aspect Capital, Trading Fund, Martin Lueck - Sep 2004

Trading in around 100 futures markets, Aspect Capital’s Trading Fund had produced a net return of 45% since its inception in 2000. Then-research director, Martin Lueck, explained what drove the program to profits.

Global Advisors, Daniel Masters - September 2004

Hedge Funds Review spoke with Daniel Masters of Global Advisors about Global Advisors Discretionary Program, which had returned 15.6% between September 1999 and 31 July 2004, prospecting for resources profit

The oil baron whodigs gold

HFR talks to Daniel Masters of Global Advisors about prospecting for profit as the fissures open up in oil, energy and metals prices

Macro economics makes going tough for managers

Several strategies have proved less than lucrative as troubled times leave markets without direction

Systematic profits

Trading in around 100 futures markets, Aspect Capital's Trading Fund has produced a net return of 45% since its inception in 2000. While the programme behind the fund is completely systematic, Martin Lueck, research director at the London firm, explains…

Manfred Schepers

profile

Anatomy of a merger

Dealer profile

Booming Banorte

Profile

Samantha Unger

Weather risk

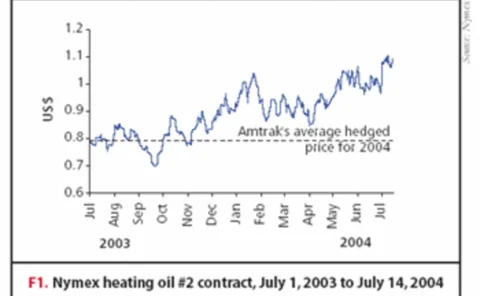

Dealings in diesel

Weather risk

Winton CM, David Harding - August 2004

David Harding, Winton CM's CEO, spoke on the importance of research, the spread of Winton's managed futures program, and what market conditions favoured the strategy.

Investec Private Bank - August 2004

Investec Private Bank explains its approach to manager selection, and the challenges of the institutionalisation of the industry.

Taking requests

Investec Private Bank has been selecting hedge fund managers for many years to create bespoke investment portfolios for its ultra-high-net-worth clients. Sophie Huang, on behalf of Investec Private Bank, explains the process behind finding and selecting…

Managers look increasingly to East and specialists

Funds of hedge funds are allocating more heavily to Japan, emerging markets and niche managers in search of returns

Seb Walhain

Technology

Tudor Investment Corp, Paul Tudor Jones - July 2004

Hedge fund founder Paul Tudor Jones wanted to extend a two decade run of returning 26% annually, to July 2004, by stepping up investment in China.

New England revolution

The Massachusetts state pension plan has just stumped up $1.6 billion for its first foray into hedge fund investment. Navroz Patel talks to treasurer Tim Cahill's team about the challenges associated with its asset reallocation plans

Massachusetts state pension plan - July 2004

The Massachusetts state pension plan is an active enthusiast about hedge funds. Treasurer Tim Cahill explained why to Navroz Patel.

Adapt or die

Hedge fund founder Paul Tudor Jones wants to extend a two-decade run of returning 26% annually by stepping up investment in China

Emerging markets promise pushes fixed income from portfolios

While long/short managers in the Japanese market report strong returns, the latest Hedge Funds Review survey of hedge fund managers suggests that emerging markets offer the best opportunities