Bridging theory and practice: Setting investment objectives

Yoram Lustig and Sébastien Page

Foreword: Preparing for change: Notes from an asset management leader

Preface

Introduction

The evolution of portfolio theory

Factor investing for practitioners

Introduction to alternative risk premium investing

Systematic credit investing

Enhanced risk parity and factor investing: ATP’s surplus investment strategy based on risk allocation to investment factors

Integrating climate risk considerations within portfolios: An investor’s viewpoint

Bridging theory and practice: Setting investment objectives

Bridging theory and practice: Developing an investment strategy and implementing a solution

Optimisation of trading portfolios under regulatory capital constraints

The wealth management perspective

The asset management challenge

Ignorance is bliss: Applying risk management techniques from alternatives to long only investing

The digitalisation of portfolio construction – Part 1

The digitalisation of portfolio construction – Part 2

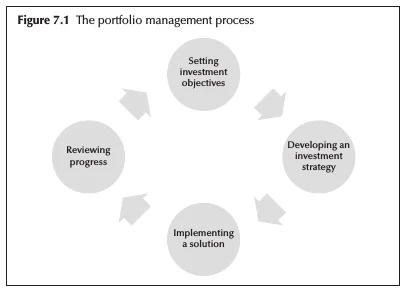

This chapter will detail the first step of the portfolio management process: setting investment objectives (see Figure 7.1). It highlights how goals, risks and investment constraints impact portfolio construction. Before constructing and managing a portfolio, investors must clarify what they are trying to achieve, and they must realise that risk means a chance of not achieving their goals.

Investment objectives must cover both return and risk. Portfolio construction strikes the balance between the potential reward (the desired outcome) and risk (the chance of not achieving the goal). Investing is probabilistic, not deterministic. Unlike uncertainty, which is not quantifiable, risk is quantifiable (Knight, 1921), so investors can estimate the distribution of potential outcomes. Investors should have reasonable expectations, calibrated with prevalent market conditions, and appreciate the element of luck and timing, hoping for the best but preparing for the worst. Investing requires patience, while recognising and respecting the different risks.

Portfolio construction must also account for constraints that prevent investors from constructing the

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net