People

AEP snaps up Enron's Nordic power team

Ohio-based utility American Electric Power (AEP) is set to enter the Nordic power market after its London-based European trading arm, AEP Energy Services, assumed operation of Enron's offices in Oslo and Stockholm.

Hungarian netting legislation welcomed by Isda

The International Swaps and Derivatives Association (Isda) today said it welcomed the implementation of Act CXX of 2001 on the Capital Markets (CMA), which provides legal certainty to the enforceability of close-out netting in Hungary. The CMA, passed by…

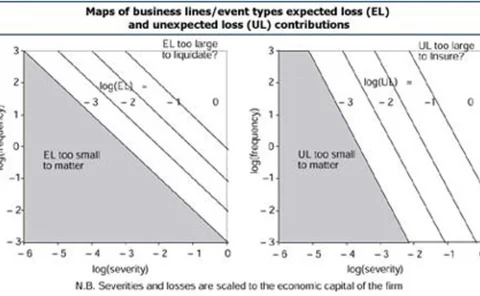

In search of clarity and focus

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Regulators want active dialogue on op risk

BASEL - Active dialogue between banks and their supervisors is the key to the continued development of approaches to managing operational risk, global banking regulators said in a much-delayed paper on op risk sound practices issued in December.

Approach with caution

Indicators of operational risk are not for the faint of heart, nor are they necessarily bearers of good news. But used properly and effectively, they can help businesses identify potential losses before they happen.

Sound practices paper gets positive response

Bankers generally responded positively to the guidance on sound practices for managing operational risk issued by global banking regulators in December.

Basel II sets the pace for operational risk reform

Basel II is set to come into play in 2005, bringing a host of opportunities for vendors along with the new framework for banking supervision. Andrew Partridge examines the potential and some of the challenges for the suppliers and users of financial…

The Basel Accord: A tough nut to crack

Crafting a capital charge for operational risk has proven to be a project fraught with controversy. International regulators’ first attempt raised the industry’s hackles. David Keefe reports on recent – and further expected – compromises by the Basel…

2002 the year ahead

Market overview

Also on the move...

People

Bondholders rights: the gloves are off

Restructuring

Utilities: Enron’s ripple effect

Cover story

Regulators want active dialogue on op risk

BASLE II UPDATE

In search of clarity and focus

BASLE II UPDATE

Risk awards

The third annual Risk awards recognise excellence and innovation in the fast-changing risk management and over-the-counter derivatives businesses

The silver lining

Enron’s collapse could ironically give a boost to the telecoms market, as Enron Broadband Services bows out of the limelight. By Laurence Neville

Job moves

QUOTE OF THE MONTH: - “The FSA has successfully put the fear of God into senior managers” Simon Gleeson, a partner in the regulatory group at Allen & Overy in London, on the FSA’s new unlimited liability rules for risk management errors Source: RiskNews,…

Race to replace Enron in freight

Sarfraz Thind talks to firms with the potential to take up the slack following Enron’s departure from the freight derivatives market

Fallout for energy markets

Enron’s collapse led to short-lived increases in electricity and natural gas volatility. As the markets settle down, the question now is who will fill Enron’s shoes? By Kevin Foster