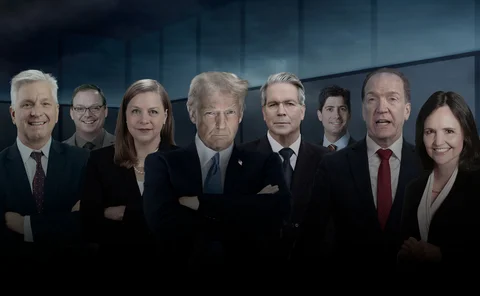

Donald Trump

‘The models are not bloody wrong’: a storm in climate risk

Risk Benchmarking: Risk.net’s latest benchmarking exercise shows banks confronting decades-long exposures, while grappling with political headwinds, limited resources and data gaps

Why a Trumpian world could be good for trend

Trump’s U-turns have hit returns, but the forces that put him in office could revive the investment strategy

Who is Selig? CFTC pick is smart and social, but some say too green

Colleagues praise crypto smarts and collegial style, but views on prediction markets and funding trouble Senate

Real money looks to dynamic hedges after tariff bout

Buy-siders are adopting more responsive FX hedging strategies after correlations broke down

Cyber risk triggers alarm bells for credit portfolio managers

Attack on Jaguar Land Rover highlights difficulties modelling unpredictable impact of outages

Accounting fix brings FICC agent clearing a step closer

SEC accepts Sifma interpretation, but firms still need their own opinion and capital clarity

Asia’s bank risk managers brace for tariff stress

Banks keep a close eye on clients, and dust off risk transfer toolkit

How Amundi’s options strategy profited from dollar slump

French asset manager grabbed euro call options at low prices in tactical pivot for its FX absolute return fund

Johnson warns of governance vacuum as she leaves CFTC

Lack of commissioners risks stalling rulemaking at critical juncture for new crypto initiatives

How FX pricing is adapting to Trumpian markets

Dealers are tying pricing engines to new signals in effort to cope with out-of-the-blue moves

The investors who aren’t fretting over Trump’s stat sulk

Some see dismissal of statistics agency chief as an assault on US institutional integrity; for others it offers a chance to throw off outdated methods

Judy Shelton on gold, tariffs and where the Fed went wrong

Potential successor to Jerome Powell makes the case for cutting rates and tamping down dollar volatility

Taco trades and fake news fatigue

Is another era of ‘will he, won’t he’ numbing rates and FX traders to its jeopardy?

Mutual funds were USD bulls going into April’s tariff chaos

Counterparty Radar: Positioning in Q1 reflected market sentiment that tariffs would lead to a dollar rally

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

BoE official plays down fears of global regulatory fragmentation

Risk Live: UK expects close co-operation with US, while others express concern over Basel III endgame

Trump getting stuck in Washington ‘swamp’, says Scaramucci

Risk Live: Former White House comms director says lobbyists have become effective constraint on Trump agenda

US Basel III delay to 2026 seen as almost inevitable

Reprioritisation and leadership changes cast doubts on timing of new proposals

‘I feel like a guinea pig’ – lessons from an early IMA adopter

Risk Live: Nomura’s Epperlein urges flexible approach to backtesting exceptions

Bankers feeling even more bullish after tariff selloff

Risk Live: “This is a powerful bull market that has legs to run,” says former Credit Suisse CIO

Allocators try to stay strategic in a world turned upside down

Investors are revisiting long-held assumptions about how to allocate large pools of assets