Alan Greenspan

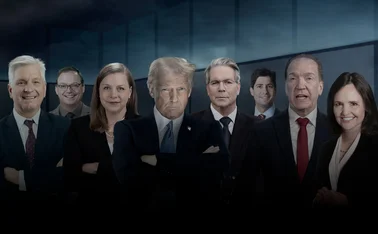

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

Congress: US needs regulatory overhaul

At a US congressional hearing of the committee of oversight and government reform on October 23, speakers called for far-reaching regulatory reforms. These included demands for greater scrutiny of derivatives, increased capital charges on securitised…

Dearth of direction

Editor's letter

Time to keep a cool head

EDITOR'S LETTER

Greenspan joins Deutsche Bank

Alan Greenspan, former chairman of the US Federal Reserve, has joined Deutsche Bank's investment banking division as a senior adviser.

Greenspan lashes out at credit derivatives industry

Alan Greenspan, former chairman of the US Federal Reserve Board, has found it “appalling” that banks were trading credit default swaps (CDS) and documenting them on scraps of paper. Speaking at the Bond Market Association’s (BMA) 30th anniversary dinner…

Greenspan fears investor backlash against hedge funds and CDOs

Federal Reserve chairman Alan Greenspan believes investors' pursuit of improving yields by investing in hedge funds and complex investment products – notably collateralised debt obligations (CDOs) – may spark a backlash when the results fail to perform…

Basel IIBetter for everyone?

On June 26, 2004, international banking supervisors agreed in Basel, Switzerland to a new framework that will alter the way many banks calculate their capital requirements. The new Basel Capital Accord is to be phased in during 2007 and is scheduled for…

Basel II is a bonus for economic stability, says Greenspan

Better management of banking risk and new rules on capital hold the promise of a stronger banking system that will contribute to economic growth, according to US Federal Reserve chairman Alan Greenspan.

Derivatives both a help and a danger, says BoE deputy governor

Derivatives are both a help and a danger to global financial stability, according to the deputy governor of the Bank of England, Andrew Large.

From a gas crunch to a crisis

In this month’s Market Focus, GlobalView Software takes a look at the factors contributing to the current US natural gas crunch, which is drawing the attention of major political and financial figures

Fed links op risk and disclosure

WASHINGTON, DC - Two Federal Reserve speeches in May highlighted the links between corporate governance and risk management.

Greenspan defends role of derivatives

In a speech today, Alan Greenspan, chairman of the US Federal Reserve, defended the use of derivatives as hedging tools, especially credit derivatives. His comments come in the wake of Warren Buffett’s criticism of derivatives as potential “time bombs”.

BarCap chief hits back at Buffett’s derivatives 'time bomb' comments

Robert Diamond, chief executive of Barclays Capital, the investment banking arm of the UK’s Barclays Bank, has hit back at comments made by US investor Warren Buffett, who said on Monday that derivatives were “time bombs”. “[Buffett] should be wary of…

Sponsor's article > Don't count on buffers

One possible mitigator of the pro-cyclical impact of risk-sensitive capital requirements would be counter-cyclical changes in capital buffers. Empirical evidence on this issue is scarce and a new regulatory capital regime could well induce a behavioural…

McDonough bows out from New York Fed

William McDonough, president and chief executive of the Federal Reserve Bank of New York for the past 10 years, will retire on July 21 this year.

McDonough bows out from New York Fed

William McDonough, president and chief executive of the Federal Reserve Bank of New York for the past 10 years, will retire on July 21 this year.

Greenspan says international rules reflect cultural differences

WASHINGTON – Efforts to synchronise individual countries' regulatory systems are far more than a technical exercise – they largely reflect differing conventions of business behaviour, especially attitudes toward competition, US Federal Reserve Board…

Fitch to investigate credit derivatives risk concentrations

Credit rating agency Fitch Ratings is concerned that the rapid growth and lack of transparency in the synthetic credit markets could be leading to alarming concentrations of risk with specific market participants.

Greenspan attacks regulation of OTC derivatives again

Federal Reserve chairman Alan Greenspan has again warned that forced disclosure of proprietary information would undercut innovation in the over-the-counter derivatives markets.