This article was paid for by a contributing third party.More Information.

Managing pension risk: The UK leads the way

The world’s frontrunner in managing pension risk is the UK, says William McCloskey, vice president, longevity risk transfer, of Prudential Retirement. Expect increased activity worldwide in 2016 as the rest of the world takes inspiration from UK innovation.

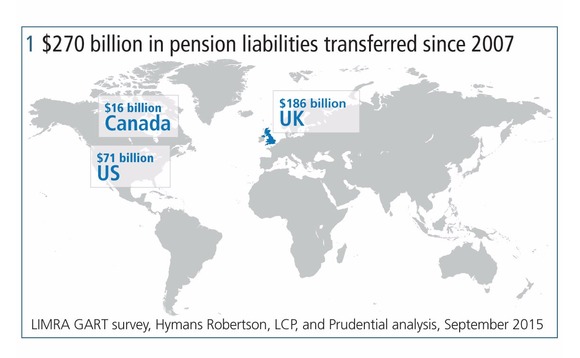

The global trend of de-risking defined-benefit pension funds with insurance solutions is certain to continue in 2016 – and in the years to come. The pension risk transfer marketplace is growing exponentially, with more than $270 billion in transactions since 2007. Recognising their exposure to longevity risk, greater numbers of pension fund managers are expected to proactively transfer that risk to insurers, which, in turn, will look to reinsurers for the capital-efficient longevity risk coverage they require and with the security they demand.

In fact, scores of companies in the UK, the US and Canada have already partnered with insurers and reinsurers to divest themselves of pension risk. Consider this: some 40 pension funds worldwide have executed agreements of over $1 billion. And, while each transaction is unique, all share a common goal – to secure pensioners’ benefits while achieving corporate finance advantages for the firm.

As the recognised leader in pension de-risking, the UK will continue to set the pace as this global trend continues. Over $186 billion of pension liabilities have been transferred in the UK since 2007, which is more than the US and Canada combined (figure 1).

UK transaction activity is remarkable considering the number of private sector defined-benefit pension schemes (10,760 as of 2012) compared to those in the US (44,163 as of 2013). And momentum is increasing in the UK because of competitive pressures in every industry peer group. Accordingly, the innovations and products introduced in the UK will serve as a paradigm for international fund managers, insurers and reinsurers in 2016.

The UK’s position as the global pension de-risking leader is indisputable. And, while the amount of pension buy-ins and buyouts in the UK is impressive, the nation’s market segment for longevity risk transfer is also the world’s largest. This important market reflects transactions covering only longevity risk – that is, the risk of annuitants and beneficiaries living longer than predicted. In their entirety, these transactions illustrate that UK pension trustees are making distinct choices and partnering with insurers and reinsurers to best achieve their specific objectives.

Some of the most sophisticated pension schemes in the UK have transferred longevity risk to the insurance and reinsurance community, including BMW, Rolls-Royce, Aviva, British Airways and British Telecom (BT). In fact, the BT Pension Scheme’s 2014 decision to reinsure almost $28 billion of longevity risk stands as the largest single longevity transaction on record. The first, and thus far only, longevity transaction to occur outside the UK took place in March 2015, when Bell Canada transferred C$5 billion of its pension liabilities. Longevity risk transfer is not just for pension funds – insurers also use this strategy to manage risk and optimise capital in their annuity portfolios. Rothesay Life, Pension Corporation and Legal & General are the leading pension insurers that have used longevity reinsurance to manage their annuity risks, reaping considerable benefits under Solvency II.

For the past decade, pension fund sponsors, insurers and reinsurers in North America have observed developments in the UK with mounting interest. In 2012, the US market achieved a breakthrough when The Prudential Insurance Company of America (PICA) executed large pension buyout transactions with General Motors and Verizon. These milestone agreements established PICA as the leader in the US pension de-risking space, and the firm is now focused on bringing UK solutions to scale in the US.

When we look at the UK, we see the shape of things to come for the risk transfer market in other countries. We also see an increase in the number of insurers participating in this space, as well as growing insurance and reinsurance capacity. Pension funds and insurers in the UK are making longevity risk transfer decisions that are unique to their resources, constraints, objectives and definitions of success. These decisions lead to highly customised de-risking strategies that are rapidly going global.

As pension funds and insurers worldwide manage annuity risks, all eyes will focus on the innovative UK insurance and reinsurance market for direction.

The author

William McCloskey, CFA • Vice President, Longevity Risk Transfer, Prudential Retirement®

T +1 973 367 8510

E william.mccloskey@prudential.com

W pensionrisk.prudential.com

Read/download the article in PDF format

Insurance and reinsurance products are issued by either Prudential Retirement Insurance and Annuity Company (PRIAC), Hartford, CT, or The Prudential Insurance Company of America (PICA), Newark, NJ. Both are wholly owned subsidiaries of Prudential Financial, Inc. (PFI) and have no affiliation with Prudential plc of the United Kingdom. Each company is solely responsible for its financial condition and contractual obligations. Neither PRIAC nor PICA are authorised by the Prudential Regulation Authority or the Financial Conduct Authority, nor do they offer insurance or reinsurance in the UK. PRIAC and PICA do provide offshore reinsurance to companies that have acquired UK pension risks through transactions with UK plan sponsors. PRIAC and PICA are not authorised or regulated by the Office of Superintendent of Financial Institutions for Canada or by the Financial Services Commission of Ontario. © 2016 PFI and its related entities. Prudential, the Prudential logo, the Rock symbol, and Bring Your Challenges are service marks of PFI, and its related entities, registered in many jurisdictions worldwide. Prudential Retirement is a Prudential Financial business. 0287007-00001-00

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net