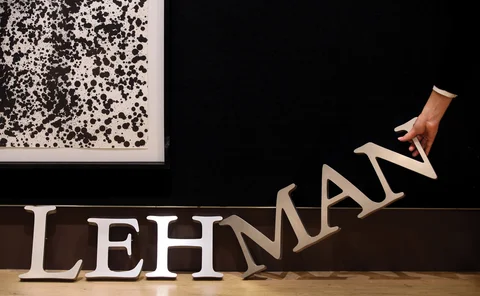

Lehman Brothers

Regulators urged to use Dora reporting to track systemic risk

Risk Live: Bankers and regulator say governance requirements for new rules are complex to implement

Archegos revives Lehman-era trade booking controversy

Experts debate whether defaulted TRS positions should have become house exposures immediately

Geopolitical risk models not ‘rigorous’ enough, says quant

Joseph Simonian believes game theory and reinforcement learning could improve matters

Rethinking regulation of the modern financial system

Rules must address uncertainty and risks, and not be too complex, says Bank of Italy's Trapanese

People moves: five leave JP Morgan, MS names co-presidents, and more

Latest job changes across the industry

Hedge funds and the rebound in collateral velocity

Reuse rate of collateral points to growing fragility and interconnectedness in financial markets

How Credit Suisse fell victim to its own success

Roots of Archegos loss can be traced to business strategy the bank embraced back in 2006

The unintended impact of swap stays on financial stability

As swaps leverage shrinks, bankruptcy stay rules are not guaranteed to reduce systemic risk, says economist

FRTB comes too late for Covid crisis

Expected shortfall would stop Basel 2.5 duplicate capital charges, but backtesting still a problem

Clearing house of the year: LCH

Risk Awards 2020: CCP conquers Brexit threat to deliver banner year for RFRs, margin and forex

OTC client clearer of the year: Bank of America

Risk Awards 2020: Pivot to Europe pays off with market share growth and big client wins

Banks warn of trader crunch at CCP default auctions

Risk USA: dealers hope for more cross-CCP fire drills

People moves: ING fills two top roles, RBS confirms Rose as CEO, and more

Latest job changes across the industry

Virtue bonds, Hong Kong FRTB and letting go of Lehman

The week on Risk.net, August 24–30, 2019

CME no longer looking back to Lehman

Changes to rates margin model move CCP into line with rivals

BIS slams Nasdaq Clearing for risk management failures

Clearing member says it is giving notice to quit bourse, citing concerns over concentration of risk on venue

Lehman’s ghost: how three CCPs anchor models to crash

The Lehman crash still haunts the margin models of LCH, CME and Eurex, albeit in different ways

Counterparty credit exposure won't spark the next Lehman

Curbing of riskiest exposures and shedding of assets means banks in far better shape 10 years on

To be resolved: the FDIC and the future of bank failure

Will Jelena McWilliams finally nail down the FDIC’s role as a resolution authority?

Mifid II, RFQs and the future of Europe’s G-Sibs

The week on Risk.net, August 11-17, 2018

Asia moves: Citi expands Treadwell’s role, Credit Suisse makes Australian appointments, and more

Latest job changes across the industry