European Parliament

CCPs object to ‘misleading’ Emir collateral clause

CCPs object to Emir collateral clause

EU support for naked CDS sets up collision with Parliament

Draft text would allow uncovered CDS but sketches out new reporting regime that could spook hedge funds

Esma chair fears clashes with US regulations

Maijoor says regulatory differences are unavoidable - but can be overcome

Sovereign debt managers criticise ban on naked CDSs

Sovereign debt managers criticise ban on naked credit default swaps

European politicians row over scope of Emir

Challenging Emir

European legislators squabble over Emir

The derivatives catch-all

Sovereign risk weights under threat

Weight gain

Triple threat to sovereign default-risk-free status

European policymakers and regulators are considering dramatic changes to the capital treatment for government bonds

Clearing back-loading provision removed from latest EU Council text

Council removes back-loading provision in Emir proposal

European parliament embraces Tobin tax

Lawmakers throw their weight behind Tobin tax on financial transactions; say global difference of opinion should not stop Europe implementing levy

FSA's Ross to join Esma

Head of international division moves to European market regulator

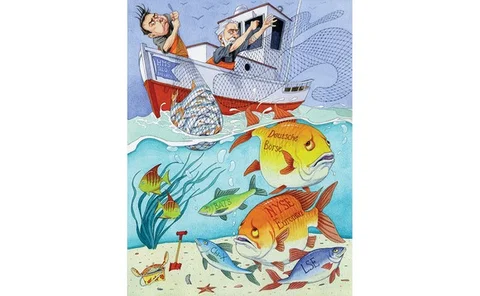

Draft European clearing rules threaten Eurex business model

Analysts warn Council of the European Union proposals could hurt trading revenues at Eurex, as its owner, Deutsche Börse, pursues merger talks with NYSE Euronext

Langen report: clearing rules will only apply to new trades

European Parliament calls for existing derivatives trades to be excluded from clearing rules, but proposes wider exemptions for public-sector bodies

European Parliament has neglected FX exemption question, says UK MEP

Kay Swinburne criticises colleagues in the European Parliament for failing to tackle the question of whether forex contracts need to be subjected to new clearing and reporting requirements

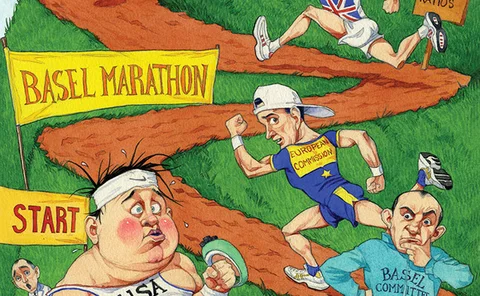

Fears over consistency of Basel III implementation

The power of peer pressure

Danish regulators push for more flexible Basel III liquidity rules

Shortage of high quality liquid assets prompts Danish regulators to push for changes to the liquidity coverage ratio within the European Union capital requirements directive

EU to examine commodity derivatives/physical market link

Following sustained calls from EU members to curb commodity derivative markets, the EU will research the link between derivative and physical markets

EBA, Esma and Eiopa appoint senior management

New European banking, securities and insurance regulators name their first chairs

New QIS for Europe to explore economic impact of CRD IV

A new quantitative impact study for Europe will be launched to analyse the impact of Capital Requirements Directive IV

EU quells dual-reporting fears over energy market proposals

EC makes sure dual reporting will not be an issue in latest energy market regulation proposals

The end of the beginning for Basel III

Basel III: in your own time...

EC: We don’t sit in an ivory tower finding solutions to problems that don’t exist

Despite having no evidence the EC says lack of pension portability is a major barrier to labour market mobility

European Parliament sets up future Basel III flashpoints

European Parliament sets up future Basel III flashpoints

EU proposals leave energy firms cold

The perfect storm