European Commission (EC)

Stress ahead for European insurers

Ready for the roll-out

Inconsistency could lead to arbitrage

Consistency is key

Mifid’s tough line on investor protection worries dealers

A sense of propriety

New regulations leave retail structured products on shaky ground in France

One step forwards, three steps back

The encroachment of Solvency II

The encroachment of Solvency II

Banks ready with solutions for Solvency II

Solvency II solutions

Leave liquidity rules out of Basel III legislation, says EBF

Industry group fears European Union legislative process will set LCR and NSFR flaws in stone

EC's Van Hulle responds to industry's Solvency II broadside

EC head of insurance and pensions Karel Van Hulle acknowledged industry concerns at Risk's European conference this week - but pushed back against doom-mongering

Risk Europe: S&P slammed for linking Greece, Portugal downgrades to ESM

Eurozone bail-out vehicle doesn't hurt existing bondholders, EC official argues

Risk Europe: Expanding the scope of Emir needs careful consideration, says Pearson

A Council of the European Union proposal to expand the scope of new European market infrastructure regulation to include exchange-traded derivatives should be carefully thought through, says the EC’s Patrick Pearson

Risk Europe: Dodd-Frank rating requirement has competitive implications under Basel III

The requirement under the Dodd-Frank Act to eliminate any reliance on external credit ratings could put US banks at a competitive disadvantage under Basel III, says the Basel Committee’s Stefan Walter

EU Council questions Esma’s power to determine clearing eligibility

Legal precedent suggests European Commission might have to determine which contracts should be cleared under new derivatives rules, rather than Esma as originally planned

Sovereign debt managers criticise ban on naked CDSs

Sovereign debt managers criticise ban on naked credit default swaps

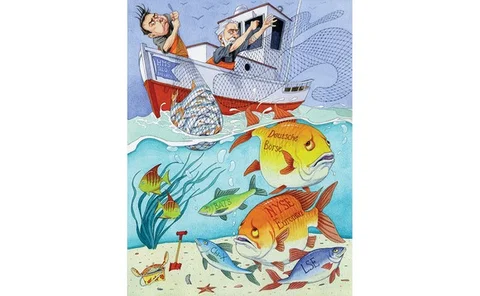

European legislators squabble over Emir

The derivatives catch-all

Sovereign risk weights under threat

Weight gain

Preparing for Solvency II

Solvency II: insuring for change

Triple threat to sovereign default-risk-free status

European policymakers and regulators are considering dramatic changes to the capital treatment for government bonds

EU Council leans towards special treatment for FX

Industry's concerns starting to be reflected in legislation proposals

QIS 5 demonstrates EPIFP in Tier III for Solvency II not “economically consistent”

Montalvo moves closer to the industry’s position on future profits as Tier I capital – but does not agree that all should be included

Opposition grows to Prips risk indicator proposal

Publication of responses to European consultation paper reveals widespread dislike of risk indicator plans

European parliament embraces Tobin tax

Lawmakers throw their weight behind Tobin tax on financial transactions; say global difference of opinion should not stop Europe implementing levy

Dealers and issuers protest European ban on ‘naked’ CDS

Ban could harm government debt markets, according to UK DMO – dealers say any prohibition would backfire

Bail-in proposals are not necessarily bad for investors – M&G

Bondholders: Time to take your medicine

The Nava-gator

Safe-keeping