China Securities Regulatory Commission (CSRC)

China ETFs look offshore

Looking across borders

China looks to offshore ETFs

Looking beyond the border

China prepares for launch of cross-border ETF market

In the tightly regulated Chinese economy, the launch of ETFs linked to overseas shares marks a new form of investment vehicle available to mainland investors. However, challenges still remain due to structural differences in Chinese manufactured ETFs

Chinese government hampering financial industry, World Bank warns

New World Bank report sees flaws in China's regulatory system

China's financial regulation 'needs improvement'

The World Bank's first assessment of the financial sector in China finds inadequacies in its regulation

CSRC’s Shang takes over from Liu at CBRC; industry veterans selected to head CSRC and CIRC

A round of new chairships was completed in October across three Chinese financial regulators in a move that saw the heads of two Chinese state-owned commercial banks promoted to lead the securities and insurance regulators

Asia Risk Congress 2011: Clashes with CFOs more likely as CRO role gains prominence in Asia

The role of a chief risk officer (CRO) is becoming increasingly relevant at institutions in Asia – sometimes creating friction with the CFO. And Chinese CROs face additional challenges, according to participants at an Asia Risk Congress 2011 CRO…

Challenges ahead for access derivatives in Asian markets

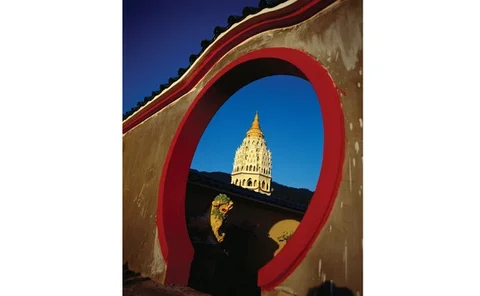

Gateway to Asia

New central securities company to facilitate short selling in China

One of China's leading securities houses sees a bright future for domestic investment banks developing hedge fund-like trading businesses, once securities short-selling is further liberalised on the mainland through the establishment of a central…

CSRC rules make it hard to tackle China ETF premium and tracking error issues

China conduit concerns

CBRC chief adviser Sheng brands financial engineering ‘a cancer’

Andrew Sheng, a veteran regulator who acts as a chief adviser to China’s top banking regulator, believes ‘creative destruction’ needs to take place when financial engineering goes beyond an optimal level, as it did in 2007-2008.

Dealers bet on onshore commodities units in China

The local touch

CSRC to ban QFII quota use for China derivatives; ETF providers hit

The CSRC plans to ban derivatives dealers from using QFII quotas to on-sell derivatives mirroring CSI 300 index futures contracts to offshore clients. The move looks set to challenge ETF fund managers when hedging China index-tracking funds.

Asian Financial Forum: China and Hong Kong to collaborate more on cross-border access and cross-listings of ETFs, says CSRC chief

Hong Kong and Shanghai are set to more closely align clearing and settlement systems enabling the cross-listing of instruments such as exchange-traded funds. Meanwhile, the Chinese authorities plan to encourage state-owned enterprises to launch so-called…

On the move

On the move

HKEx names former CSRC director to head mainland development

The Hong Kong Exchange's new hire, Yang Qiumei, was recently deputy director-general in the department of investment fund supervision at the China Securities Regulatory Commission, where she was in charge of matters related to QFII and QDII

China bond laws 'a problem' for investors

Economic reforms in China have gathered pace in recent years. But the country’s bond markets remain hampered by significant structural problems, including state-administered interest rates and a murky legal system subject to government interference.

Managed account platform gives new hope for investors seeking alpha in China

Currency restrictions, tight investment rules and concerns about asset segregation have made it difficult for foreign investors to gain alpha from mainland China investments. But a new managed account platform offering access to China ‘sunshine funds’…

New China regulations raise questions for QFII derivatives

Since its launch in 2002, China’s qualified foreign institutional investor (QFII) programme has been a boon for investment banks. But new regulations issued in September 2009 raise significant issues for the derivatives market. Jill Wong reports

China and the renminbi: A Risk.net article collection

The recent financial crisis in the west has presented China with a range of challenges as well as opportunities.

QFII investors may get access to exchange futures in China

SHFE considering allowing foreign institutional investors access to commodities futures contracts through QFII scheme