$1.5bn subprime hit at HSBC dwarfs other op risk losses

Megan van Ooyen from SAS rounds up the top five op risk losses for June

Megan van Ooyen is a senior associate business operations specialist in the OpRisk Global Data group at SAS in North Carolina

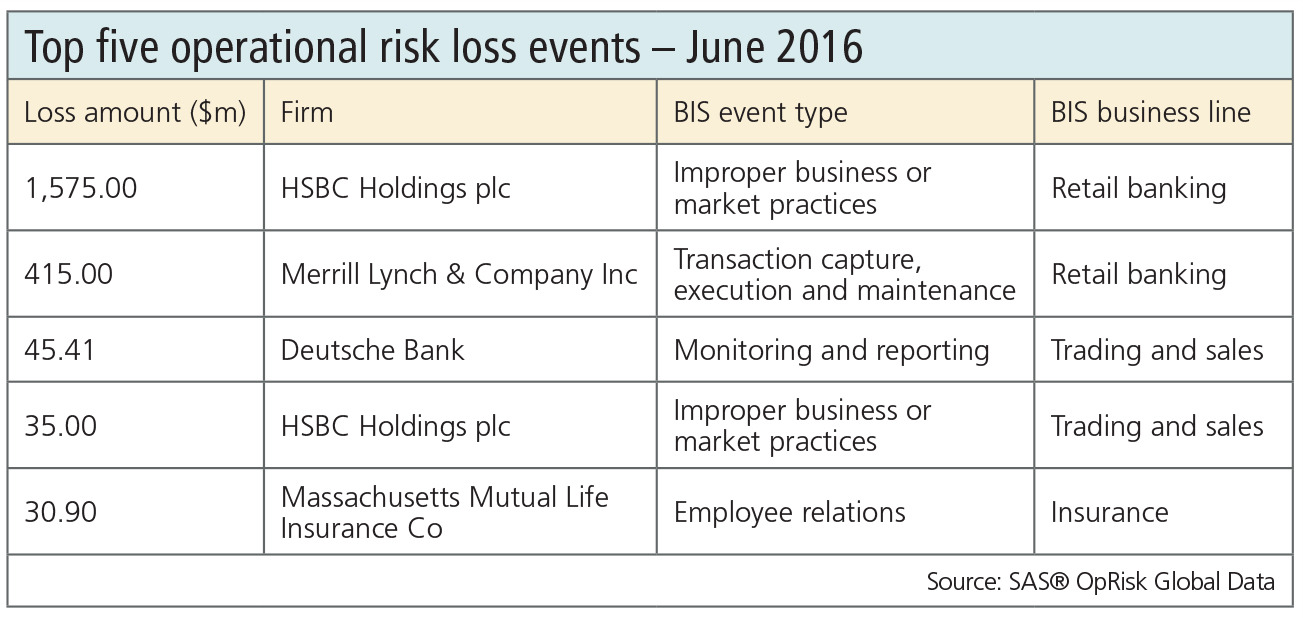

The top five operational risk losses for June are a smorgasbord of delights – from the more commonplace market manipulation to rare delicacies such as benefits mishandling. Most of these are relatively light fare, but HSBC's $1.58 billion settlement with Household International investors is a weighty entrée indeed.

If any firm was a bellwether for the impending financial crisis, it was US subprime lender Household International. In 2001, approximately seven years before the housing market collapsed, consumer lending advocates filed lawsuits accusing it of predatory lending, misrepresenting loan terms and hiding cost information from borrowers.

Household International's share price plunged 50% over the next year, but the situation only got worse. Accounting irregularities forced it to restate its financial statements in August 2002, effectively erasing $386 million in earnings. Unsurprisingly, investors filed a lawsuit. They claimed the firm intentionally misled them about the quality of its loan portfolio and its accounting practices in order to inflate its stock price.

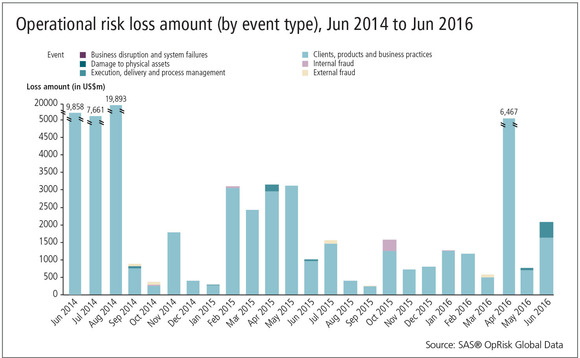

Click here to enlarge, or tap image on app

HSBC waded into the mess when it acquired Household International in November 2002. Despite HSBC's arguments on behalf of its newest subsidiary, a jury ruled in favour of the investors in May 2009. After four years of appeals, a judge finally ordered the firm and several executives to pay almost $2.5 billion in damages. A US Court of Appeals sent the case back to trial in May 2015, but HSBC cut its losses and announced a $1.58 billion settlement in June this year.

HSBC's $1.58 billion subprime hit dwarfs June's other op risk losses. It is more than three times the size of the second-largest loss, which involves Merrill Lynch.

The US Securities and Exchange Commission (SEC) requires that firms maintain a certain amount of money in a customer reserve account. Between 2009 and 2012, Merrill Lynch executed a series of complex options trades just before the calculations were due, which reduced the amount of cash it had to deposit into the reserve account each week. The firm used the extra money for its own trading activities and, luckily, never failed before replenishing the reserve account.

The SEC also cited Merrill Lynch for putting customer assets at risk. Between 2009 and 2016, it kept more than $60 billion in customer-owned securities in clearing accounts that were subject to liens. If the firm had become insolvent during that time, its creditors could have claimed customers' securities. Merrill Lynch acknowledged its shortcomings and agreed to pay $415 million in penalties, disgorgement and prejudgment interest.

June's third-largest op risk loss was a $45.51 million fine levied on Deutsche Bank by German regulator Bafin. In August 2015, German prosecutors charged seven current and former bank employees – including a commodities trader, an account manager, a tax department employee and an emissions trader – with tax evasion. The employees had embroiled the bank in a complex carousel fraud that took advantage of the European Union's cross-border value-added tax (VAT) laws.

Certificates traded across EU borders are tax-exempt, so six external carbon traders purchased carbon emissions certificates in one country and imported them into Germany tax-free. They then sold the certificates to each other, so it looked as if they had bought them in Germany, complete with VAT. Deutsche Bank purchased large numbers of certificates from the external traders in 2009 and 2010. Although the traders' activities raised a few eyebrows, bank employees ignored red flags and failed to report their suspicions to managers.

The trades proved profitable in the short term: Deutsche Bank received almost $250 million in tax refunds from the German government without ever paying taxes. In the long run, however, the trades turned out to be a costly albatross. After a thorough investigation, Bafin determined the bank's internal controls should have detected and reported the suspicious trades. Although the fine appeased Bafin, Deutsche Bank still faces thousands of lawsuits and regulatory investigations.

Megan van Ooyen

Megan van Ooyen

The fourth-largest op risk loss relates to a familiar subject: the Libor scandal. Investors filed a US lawsuit in 2012, criticising more than 20 banks for allowing interest rate derivatives traders to request favourable rate submissions from their treasury departments. The lawsuit presented internal communications and other evidence indicating traders knowingly manipulated rates in their favour, and encouraged colleagues at other banks to do the same. The judge dismissed Mizuho Bank, Resona Bank and UK broker Icap from the case due to jurisdictional issues, but allowed market manipulation charges to stand against the remaining defendants.

Unwilling to take their chances at trial, Citi settled in February this year, while HSBC settled for $35 million in June. Barclays, Royal Bank of Scotland, Lloyds Banking Group, Deutsche Bank, UBS and others continue to fight the lawsuit.

Finally, there is the $30.9 million op risk loss suffered by MassMutual for mishandling benefits. The US life insurer offers its employees two retirement plans whose administrators have a fiduciary duty to select investment options that provide the greatest benefits to beneficiaries. But, between November 2007 and March 2016, the administrators allegedly chose options – mainly MassMutual proprietary funds – that generated the most income for the company and its executives.

To make matters worse, MassMutual charged administrative fees up to four times higher than the going market rate and made it difficult for beneficiaries to find alternative retirement options. In November 2013, seven current and former employees filed a lawsuit claiming the company's actions constituted a conflict of interest and violated the US Employee Retirement Income Security Act. MassMutual denied the allegations, but offered a $30.9 million settlement to eligible beneficiaries.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Buy side would welcome more guidance on managing margin calls

FSB report calls for regulators to review existing standards for non-bank liquidity management

Japanese megabanks shun internal models as FRTB bites

Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

Benchmark switch leaves hedging headache for Philippine banks

If interest rates are cut before new benchmark docs are ready, banks face possible NII squeeze

Op risk data: Tech glitch gives customers unlimited funds

Also: Payback for slow Paycheck Protection payouts; SEC hits out at AI washing. Data by ORX News

The American way: a stress-test substitute for Basel’s IRRBB?

Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

Industry warns CFTC against rushing to regulate AI for trading

Vote on workplan pulled amid calls to avoid duplicating rules from other regulatory agencies

Top 10 op risks: change brings challenges as banks splash the cash

Higher interest margins and a trend toward insourcing drive major tech projects

Top 10 op risks: deepfakes drive rise in fraud fears

External fraud re-enters top 10 as artificial intelligence provides new tools for criminals

Most read

- Top 10 operational risks for 2024

- Top 10 op risks: third parties stoke cyber risk

- Japanese megabanks shun internal models as FRTB bites