This article was paid for by a contributing third party.More Information.

Fundamentals fuelling smart beta in China

As Chinese equity markets mature and become increasingly driven by fundamentals, the time is right for international investors to invest in smart beta strategies, say Vincent Yam, head of trading, and Weiwei Wang, senior derivatives trader at Guotai Junan International in Hong Kong

Why are Chinese equity markets becoming more driven by fundamentals?

Vincent Yam: Historically, the Chinese market has been dominated by retail investors. But now there is a trend for more institutional players becoming active in the market – and their investment styles are more professional. Analysts and portfolio managers covering and investing in China now tend to estimate companies’ quarterly or annual earnings, which has started to become a big signal base for each individual stock, rather than retail investor sentiment, as was the case previously.

The Chinese market used to deviate from its international peers in terms of segmentation and performance, but a combination of macro trends and moves by Chinese policy-makers to encourage more international investors to invest in domestic markets is changing the landscape. Now there is a trend for Chinese markets to act more like developed markets and trade on fundamentals rather than pure sentiment. Such a shift of investment styles affects the onshore market, which in turn changes the behaviour of the Hong Kong market as well.

Weiwei Wang: In addition, the China Securities Regulatory Commission now mandates stronger transparency of daily operations and promotes more comprehensive disclosure requirements for listed companies,1,2 which enables deeper coverage and more accurate understanding and prediction by analysts. All these changes benefit fundamental investment themes. As a consequence, investment strategies based on market fundamentals – which have proved successful for market outperformance in the US, for example – can now be applied to China.

Chinese equity markets’ low correlation with advanced economies has been a major reason for international investors to enter the Chinese market. How does low correlation affect Guotai Junan International’s more fundamentals-based approach?

Vincent Yam: Guotai Junan International’s earning growth index is based on earning revision, rather than value or growth. Our fundamentals-based approach is not affected by whether the Chinese market has a low correlation with the developed market or not, as long as investors realise the importance of the investment logic we use.

In fact, our observation may suggest that the correlation between the Chinese market and developed markets – particularly the US – has been trending upwards recently, considering the ongoing trade war between the world’s two largest economies and the general macro picture.

How does this economic evolution translate into investment products?

Weiwei Wang: Guotai Junan International believes stock selection is crucial, especially going forward, as not all companies will perform well in an environment in which the government emphasises the quality of economic growth. This increased focus on fundamentals is a major reason Guotai Junan International was able to launch its H Share Earning Growth Index, which uses a quantitative approach, focusing on earnings growth – a classic fundamental indicator. This ‘quantamental’ strategy is interesting because it incorporates technical indicators as well as fundamental factors.

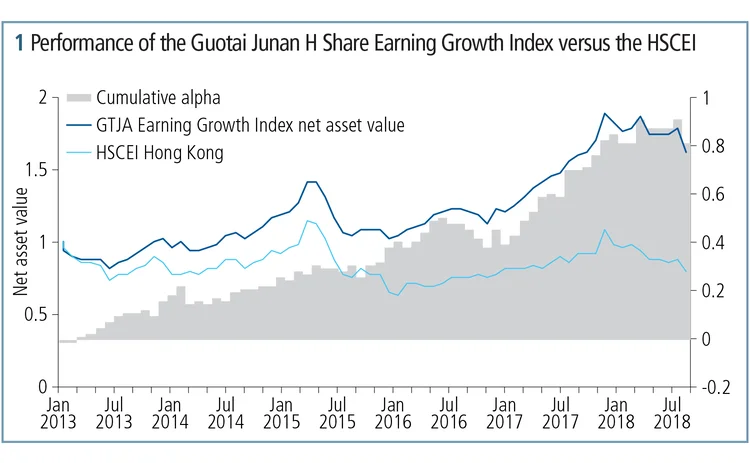

It therefore provides a unique solution for investors that see the Chinese market’s evolution and want a more fundamentals-based investment option, but that also require an actively managed index. The H Share Earning Growth Index has outperformed the Hang Seng China Enterprises Index (HSCEI) by 13% annually (see figure 1). Guotai Junan International’s A Share Earning Growth Index will also soon be online with preliminary results showing annualised returns of more than 15%.

Is smart beta particularly suited to the Chinese market?

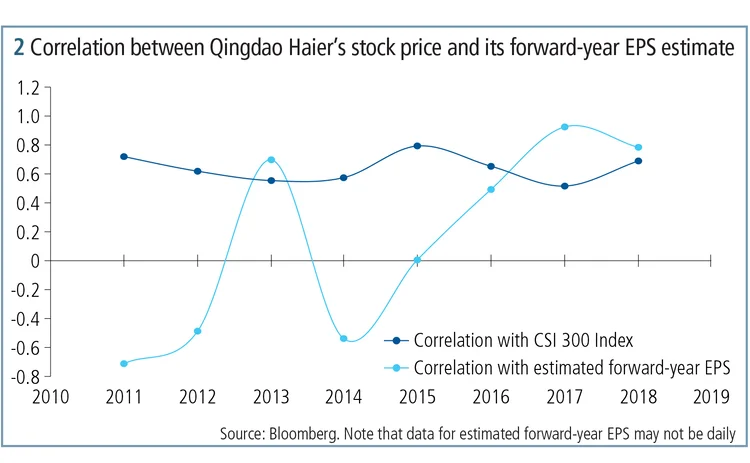

Weiwei Wang: Yes – the Chinese market has developed to an extent that it is now possible to execute smart beta strategies in a way that was not previously possible. This is a result of a number of policy developments – such as the Stock Connect arrangement between Hong Kong and Shanghai – which, by introducing more sophisticated investors to the market, have helped the onshore Chinese equity market become more institutionalised and fundamentals-driven (see figure 2 as an example).

Smart beta strategies have been successful under a number of circumstances in different markets – such as the US – for a while, and now the Chinese market is showing potential for this investment approach. It pays to be early in the game.

Why is Guotai Junan International well placed to provide China-based smart beta strategies?

Vincent Yam: There is a combination of factors. Guotai Junan International is a cross-border business between mainland and offshore investors; being based in Hong Kong, and its parent company Guotai Junan Securities being based in Shanghai, means it has a strong position across both sides of the divide. A leading presence in Hong Kong since 1995, Guotai Junan International serves as a bridge to connect enterprises and investors in China and the world. It provides channels for Chinese investors to access international capital markets, while at the same time enabling international investors to gain access to the dynamic growth of the Chinese markets.

But it is not just a question of connectivity. Guotai Junan International always strives to be at the forefront of innovation, and the firm looks back on many achievement milestones. For example, within our department we have very experienced sales, trading, quant and marketing teams with international industry backgrounds. The combined expertise and experience fuels the integration and implementation of smart beta strategies.

How important is having such a well-known Chinese parent firm?

Vincent Yam: It is definitely very helpful – Guotai Junan International has a view on all business that comes through the headquarters of its parent company and its affiliated asset management and insurance companies. An understanding of the preferences of Guotai Junan Securities’ onshore clients also helps us fine-tune our index strategies.

What other products are available on Guotai Junan International’s platform?

Vincent Yam: Guotai Junan International currently has two main smart beta strategies. Alongside the Earning Growth Index we have the A/H Relative Value Index. Bespoke equity derivatives solutions and indexes are also provided to corporate and institutional investors. As of late, more and more hedge funds are becoming active as well. We have devised and implemented bespoke trading strategies for a large number of insurance companies and asset managers.

Arbitraging price differentials between A and H shares has been an active trade since the shares were launched. What is special about your A/H Relative Value Index?

Weiwei Wang: Prior to the launch of Stock Connect, the performance behaviour of the A and H market was very different compared with our situation today. We therefore decided to follow a different approach. In addition, most A/H strategies hitherto focused on simply using two instruments and included two steps. The first was to look for dual-listed companies, and the second was to just buy the A‑share and short the H‑share – or vice versa. Perhaps a third step was to simply hope it went well.

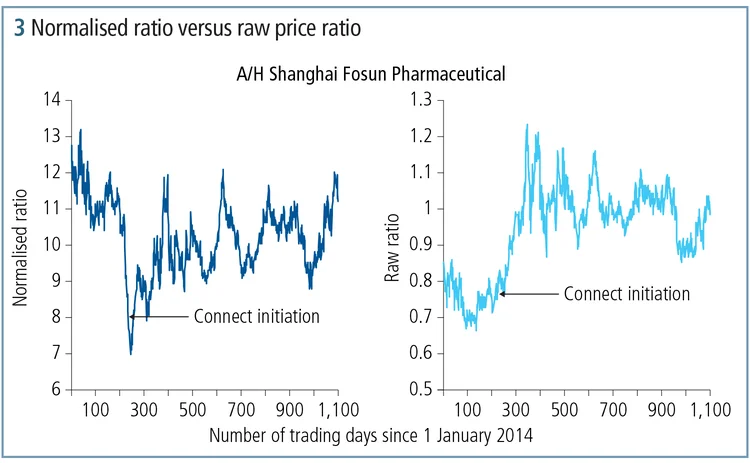

Guotai Junan International’s A/H Relative Value Index, however, involves more elements. While there may be a high overall correlation between the two markets, they can deviate from time to time on an individual stock level. Our A/H Relative Value Index is a combination of sub-strategies, and each involves only one dual-listed company. We use four instruments to manage the exposure: the A‑share, the H‑share, the HSCEI Index and the A50 Index. For each sub-strategy and occasion, we are long two instruments and short the other two. The purpose of having the HSCEI and A50 Index is to make sure the strategy is market-neutral, both onshore and offshore. Compared with the ‘raw A/H price ratio’, our normalised ratio – where the price is normalised to index level – shows a much stronger, persistent, mean-reverting pattern (see figure 3). It therefore enables investors to generate alpha in a more stable and less volatile manner.

Supporting the implementation of a more stable and market-neutral strategy, our quantitative model engine monitors dynamic entry and profit-taking levels rather than using static historical ranges. The feature helps investors avoid ‘statistical traps’. As a result, our Relative Value Index has performed well, gaining returns of 70% over the two-and-a-half years since it was launched.

How does Guotai Junan International risk-manage its earning growth index?

Weiwei Wang: There’s a hedging component on this index that can be customised based on investors’ preferences. For example, if an investor wishes to have a long bias, the index will provide up to 20 names each month that have upward revisions of earnings estimates by analysts, together with a partial hedge on the HSCEI Index. The hedge ratio can be static, such as a pre-set number of 50%, or a dynamic ratio based on market-implied volatility versus long-term historical volatility. With the optional hedging component, the expectation of the risk/return profile of investments can also be managed.

Guotai Junan International or its affiliates may trade for its own account as principal, or together with its directors, officers and employees may have a long or short position in securities or instruments or in any related instrument mentioned in the article. Brokerage or fees may be earned by Guotai Junan International or persons associated with Guotai Junan International in respect of any business transacted by them in all or any of the securities or instruments referred to in this article.

This article does not constitute or form part of an offer or invitation to subscribe to or purchase any securities. Past performance is not a guide to future performance, future returns are not guaranteed and a loss of original capital may occur. The opinions in this article constitute the present judgment, which is subject to change without notice. Any decision to purchase or subscribe to securities in any offering must be made solely on the basis of the information contained in the prospectus or other offering circular issued in connection with such offering.

Learn more

For further information on Guotai Junan International’s smart beta strategies, contact derivatives@gtjas.com.hk

Notes

1. China Securities Regulatory Commission, CSRC Annual Report 2012, July 2013.

2.China Securities Regulatory Commission, CSRC Annual Report 2014, June 2015.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net