Boom time for distressed debt

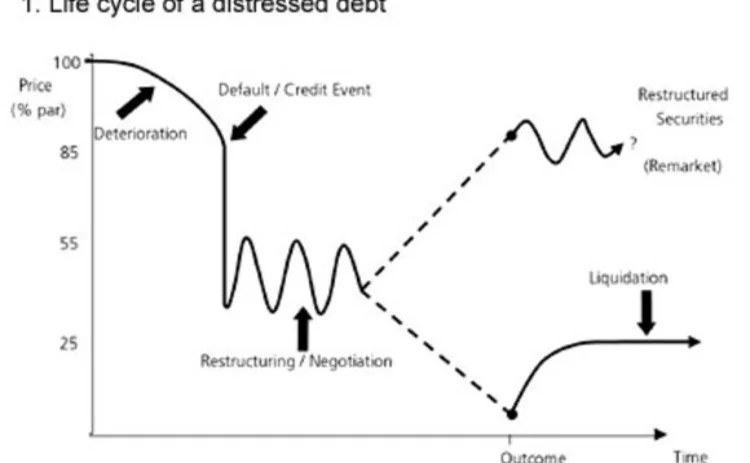

Investors in European distressed debt are enjoying rich pickings this year. But it is a risky business. Lisa Cooper finds out which types of investments could make them a fortune – and which could lose them one.

With downgrades outnumbering upgrades by eight to one in Europe over the last 18 months and high-profile companies collapsing in quick succession, it is hardly surprising that banks and hedge funds have been busy establishing new funds and proprietary investment units to take advantage of the spoils by buying up European distressed debt.

Distressed debt investors (sometimes disparagingly

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on People

SocGen’s head of US Treasury clearing preparations to depart

Bank’s head of product for FX and fixed income prime brokerage for the Americas set to leave later this month

People: You’re fired! US agency rejig, new CROs at ING, StanChart, and more

Latest job changes across the industry

SocGen’s PB clearing head departs for SwapAgent role

Jamie Gavin takes external consulting role for LSEG’s non-cleared swaps platform

Robertson leaves Barclays’ prime services in New York

Head of prime derivatives services unit departs after seven years with the bank for Carbon Point

Citadel Securities hires former Eisler CRO

Pregnell joins market-maker after demise of hedge fund

People: Fishwick hands over BlackRock CRO role, Citi expands Asia FX team, and more

Latest job changes across the industry

Nomura shuffles risk methodology team

Epperlein takes advisory role six months after Japanese bank’s FRTB IMA go-live

Andy Ross leaves StanChart

CurveGlobal veteran confirms his departure as bank’s global head of prime brokerage