Japanese investors exit PRDC notes

Late-2005 dollar rally against the yen catches some investors out

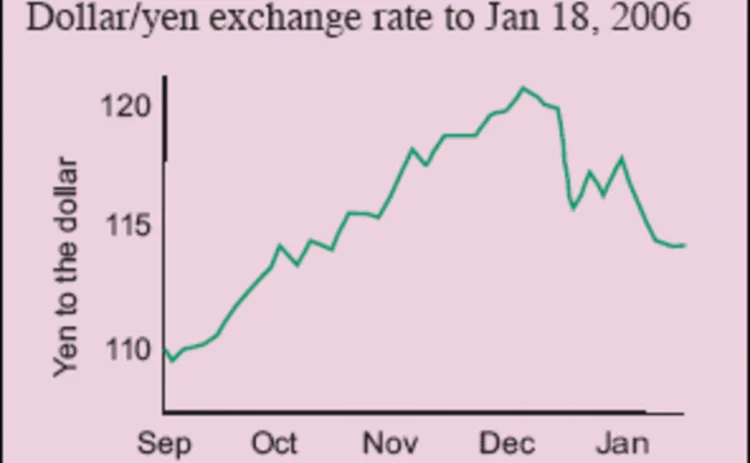

A significant number of Japanese investors that might have been locked into close to zero-coupon payouts for the next 30 years due to their investments in Bermudan multi-callable power-reverse dual-currency (PRDC) notes have managed to exit their positions, as dealers have been forced to call the notes.

The development follows a sustained rally by the dollar against the yen last year - most notably

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Real money investors cash in as dispersion nears record levels

Implied spreads were elevated to start 2026. Realised levels have been “almost unprecedented”

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments

China eases cross-border grip in new derivatives rules

Lawyers hail return to a “more orthodox territorial approach” to regulating the market

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint

Market-makers seek answers about CME’s cloud move

Silence on data centre changes fuels speculation over how new matching engine will handle orders

Neural networks unleashed: joint SPX/VIX calibration has never been faster

SPX and VIX options can be jointly calibrated in real time with deep neural networks

Ardagh CDS outcome satisfies some, but presents more questions

Early restructuring trigger and asset-package delivery could signify a new era for European trades

Nomura’s new global markets strategy: less risk, more return

Japan’s top dealer is moving away from risk warehousing, chasing real money clients and going global