Fitch’s corporate derivatives usestudy finds lack of transparency

Fitch Ratings’ recent study of hedgeaccounting and disclosure amongcorporates has revealed a somewhatsurprising lack of public disclosure of derivativesuse. The study focused mainlyon US corporates that have been reportingunder FAS 133 – the accounting rulethat should have improved the transparencyof derivatives use. And becauseof this lack of transparency, Fitch is concernedabout potential reporting and restatementrisk caused by difficultiesassociated with hedge accounting.

“The surprising thing to us was thateven though these companies had beenreporting under FAS 133 there really isn’tenough public disclosure to serve as abasis for decent credit analysis,” saysBridget Gandy, managing director at Fitchin London and co-author of the report.“To see that there really isn’t that muchuseful reporting from corporates usingFAS 133 is quite surprising.”

Fitch compared what corporates reportedunder FAS 133 with the responsesreceived from its survey of 57 corporates,and concluded that the level and qualityof current disclosure make it almost impossibleto find even basic informationfrom publicly available documents.

US companies, rather than voluntarilydisclosing something that might actuallybe useful to the user of the accounts,are reluctant to disclose anything beyondwhat is legally required. “There are certainstatements [US corporates] have tomake, but we don’t think they are particularlytransparent,” says Gandy.

More information

“If you’re an investor and you’re lookingat a company, you should be lookingat what they’re saying aboutderivatives. You should be asking themfor more information than they’re disclosingon derivatives to understand therisks they have,” says Gandy.

IAS 32, the accounting standard thatoutlines the data that should be suppliedto be compliant with accounting standardIAS 39, seems to be more prescriptivethan FAS 133. However, Gandy saysit remains to be seen whether these internationalaccounting standards makefor more transparency once they comeinto effect.

Instead of calling for more regulation,Gandy says accounting rules such as FAS 133 should be more prescriptiveconcerning the data required. As part ofthe study, Fitch has made recommendationsof the kind of information it believesshould be reported.

For risk management practices, corporatesshould disclose their philosophyand risk limits, counterparty exposuresand limits, the relationship of hedges tounderlying exposures, the sensitivity toeconomic variables, key valuation methodsand assumptions, as well as the impacton reported financial results.

In terms of interest rate hedges, Fitchrecommends disclosing notional and market-to-market amounts, a breakdown ofpay-fixed versus receive-fixed swaps, averagerates paid and received, the impactof debt repricing profile and a sensitivityor scenario analysis.

Fitch also recommends more disclosurefor foreign exchange exposures, equityhedges and forward positions, andcommodity exposures.

The study showed that a number ofcompanies have used interest rate derivativesto convert fixed-rate debt intofloating. This practice has not causedany problems while rates have been athistorical lows, but Fitch is concernedthat sharp changes in interest rates couldcause earnings volatility and possibleskew key credit ratio, even if hedge accountingis properly applied.

“Because the interest rate environmenthas been so benign, the derivatives accountingand derivatives disclosure reallyhasn’t been tested. The view of oursovereign department is that US interestrates will rise to 4% over the next coupleof years. So if we see that steep rise in interestrates maybe some of this hedge accountingwill come out as not true hedgeaccounting thereby causing some restatementrisk,” notes Gandy.

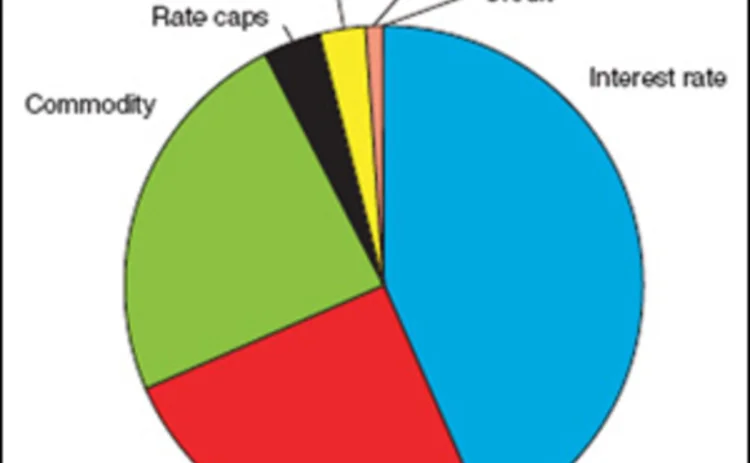

According to the study, corporates arenot engaging in widespread speculationusing derivatives. However, a number ofcompanies appear to have taken positionswith respect to future commodity and equityprices. Of the 57 companies surveyed,11% had derivatives positions intheir own shares.

Fitch found very limited use of creditderivatives among surveyed companies.Counterparty disclosure wasanother weak area uncovered by the survey.Only 26% of respondents provided details regarding counterparty credit riskand 46% of surveyed companies havederivatives agreements containing ratings-related triggers.

Fitch plans to start a survey of Europeancorporates’ derivatives disclosure inthe coming months.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

FCMs warn of regulatory gaps in crypto clearing

CFTC request for comment uncovers concerns over customer protection and unchecked advertising

UK clearing houses face tougher capital regime than EU peers

Ice resists BoE plan to move second skin in the game higher up capital stack, but members approve

ECB seeks capital clarity on Spire repacks

Dealers split between counterparty credit risk and market risk frameworks for repack RWAs

FSB chief defends global non-bank regulation drive

Schindler slams ‘misconception’ that regulators intend to impose standardised bank-like rules

Fed fractures post-SVB consensus on emergency liquidity

New supervisory principles support FHLB funding over discount window preparedness

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI

EC’s closing auction plan faces cool reception from markets

Participants say proposal for multiple EU equity closing auctions would split price formation