News

Charles Stanley acquires Sutherlands

Charles Stanley Group, the stockbroker and financial services company, has announced its takeover of Edinburgh-based bond brokers, Sutherlands.

Portugal’s first synthetic securitsation on tap

Banco Comercial Portugues (BCP) and Kreditanstalt für Wiederaufbau (KfW) are bringing to market the first synthetic securitisation transaction in Portugal. A portfolio consisting of Portuguese small and medium-size enterprise (SME) loans will be brought…

Isda issues new guidelines for derivatives transaction settlement

The International Swaps and Derivatives Association has published a set of guidelines for the matching, netting and settlement of cashflows arising from over-the-counter derivatives transactions.

CFTC allows US firms to trade on EEX

The US Commodity Futures Trading Commission has permitted US companies to trade power derivatives on the European Energy Exchange with immediate effect, EEX said Thursday.

Babson Capital hires Kung for alternatives

Babson Capital, the Massachusetts-based asset management firm, has hired Edward Kung as alternative product manager.

Axiom makes bid for European CDS market

Axiom Global Partners, the New York-based inter-dealer brokerage, has launched its electronic credit default swap (CDS) broking platform in the London market.

Citigroup to rebuild after major credit derivatives defections

Barclays Capital has poached eight New York-based credit derivatives traders from Citigroup, including Doug Warren, a managing director, as well as Jonathan Koerner and Gregory Tell, both directors.

Morley makes fixed-income appointment

Morley Fund Management, the London-based subsidiary of Aviva Group, has appointed Mark Watts as head of global fixed income.

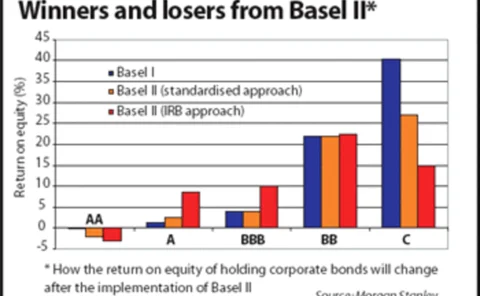

Basel II to boost bank bondholdings

Basel II could have a major impact on the bond markets, according to a new report from Morgan Stanley.

E-Capital launches ethical CDS index

E-Capital Partners, the Milan-based financial advisory company that specialises in socially responsible investment (SRI), has launched an index for ethical credit default swaps (CDS).

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…

Static emissions price “does not reflect fundamentals”

The European emissions trading market, with its static price over the last four to five weeks, “is not a good market,” and does not reflect fundamentals, said Chris Rowland, managing director of utilities research at Dresdner Kleinwort Wasserstein.

Commerzbank to close FX trading and sales in London

Commerzbank is to close its trading and sales operations in London for foreign exchange.

Risk management salaries increase dramatically, says financial recruitment specialist

Salaries in risk management have increased significantly, according to Morgan McKinley, a financial recruitment firm. Demand for credit risk analysts has been particularly strong, but other areas such as operational risk and market risk continue to be…

Former Deutsche traders launch hedge fund

Two former Deutsche Bank traders have launched a New York-based hedge fund, becoming the latest in a string of former investment bank employees to enter the business.

TCW Group hires CDO manager

Los Angeles-headquartered asset manager, TCW Group, a subsidiary of Société Générale, has hired Edward Steffelin for its New York office.

More banks get China derivatives licences

More banks have won approval to trade derivatives onshore in China, with JP Morgan Chase and UFJ among the latest to be given the go-ahead from the China Banking Regulatory Commission (CBRC).

Isda taps new chairs

The International Swaps and Derivatives Association has elected a new chairman and vice-chairman. Jonathan Moulds, head of cross-product strategic trading at Banc of America Securities, has been elected chairman, while Michele Faissola, global head of…

BNP Paribas brings securitisation origination into financial institutions group

BNP Paribas has incorporated securitisation origination into its financial institutions debt capital markets (FIG DCM) team in order to strengthen and broaden coverage.

Barclays to issue commodity-backed CDO

Barclays Capital, the investment banking arm of London-based Barclays Bank, is to issue a synthetic collateralised debt obligation (CDO), backed by a series of commodity swaps.

Energy traders urged to pre-register for risk poll

Energy traders wishing to take part in Energy Risk/Risk’s 12th annual Commodity Rankings can now pre-register to vote to avoid missing important voter updates and deadlines in the magazines’ annual survey of the energy business.

Volkswagen announces first true sale securitisation

Volkswagen Bank announced this week its intention to securitise some €1.1 billion in auto loans using the German True Sale International (TSI) platform.

BarCap boosts illiquid credit trading

London-based investment bank, Barclays Capital, has hired Kevin Gribben as a director in its illiquid credit trading division.