Securitisation

The leaders of the pack!

family office leadership summit

Subprime hope

As the fallout from the troubled US subprime mortgage market continues to spread, Laurence Neville looks at what the future holds and examines some important factors that must be addressed to ensure its survival

Running dry

The UK has seen an old-style bank run like those of the nineteenth century. German lenders have struggled to prop up failing conduits. Contagion from the US has reached Europe but not in the way anyone expected. Subprime lenders, in particular, have been…

Talking point - The leveraged loan logjam

With the value of delayed leveraged loans nearing $400 billion, will sufficient liquidity return to the market to get these loans off the lending banks' balance sheets? Credit asks four experts

The contagion will spread

All eyes have been on the residential mortgage-backed sector but, as our new columnist points out, commercial real estate may be the next to provide some nasty surprises

Bad luck, bad timing and bad bets ..

Extreme levels of volatility and parched liquidity have shaken up the global hedge fund industry. Nikki Marmery reports on the winners and losers in the summer's relentless ride

Un accenno di panico

Commento

Agenzie sotto accusa

Agenzie di rating

Berating agencies

Rating Agencies

Rischio contagio

Subprime europei

Conduit concerns

Taiwan credit

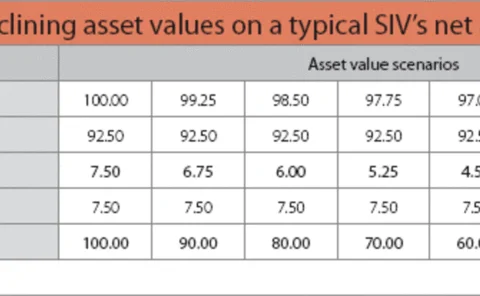

Leaking like a SIV

Structured Finance

Credit funds: Behind the rhetoric

As fund after fund succumbs to emergency measures to halt redemptions, shore up funding or sell off structured credit assets, the terms used to describe them are too often blurred and confused.

Collateral damage?

credit

Take coverrrrrr!

insurance

No sign of immediate end to volatility rollercoaster

Moves by central banks to inject liquidity into the troubled financial markets have been welcomed by investors, but grounds for pessimism still persist in the form of ratings actions on SIV-lite deals

The Big Interview: Joseph Mason

The Big Interview

Now what for the credit market?

As confusion reigns in the global credit markets, we asked four top investment banks to put their cards on the table, and publish their medium-term outlooks. Report by Nikki Marmery

Rating agencies in the firing line

Rating agencies

Brushfield Capital CDO

This month's deals are particularly deserving of mention given the recent market turmoil. We highlight Brushfield Capital's CDO, the Dalradian CLO and Gazprom's $1.25bn bond