Credit markets

Bear and Lehman among most active CDSs in September

Amid disappointing third-quarter results, credit default swaps (CDSs) referenced to Bear Stearns and Lehman Brothers ranked among the most active in CDS trading in the US in September, according to a monthly report by New York-based inter-dealer broker…

UBS takes $3.4 billion hit

UBS will report losses of Sfr4 billion ($3.4 billion) in its fixed income, rates and currencies division for the third quarter ending September 30. The write-downs were due to legacy positions from Dillon Read Capital Management, an internal hedge fund…

Gamma process dynamic modelling of credit

The existing generation of credit derivatives models is unsatisfactory because they generally contain arbitrage, cannot describe the dynamics of the process, and are hard to extend beyond vanilla products. Martin Baxter has created a new tractable family…

Economic capital ideas

This month sees the start of Charles Smithson's fourth series of Class Notes, which will run in alternate issues of Risk through the remainder of this year and into 2008. Class Notes is an educational series, designed to pull together the threads of…

Quants' tail of woe

Liquidations of large quantitative equity portfolios prompted widespread misfiring of hitherto robust quant models. Historically unusual returns volatility and multi-billion-dollar mark-to-market losses ensued. Leading hedge fund managers talk to Jayne…

The risk of one

Fund Derivatives

Building through selling

Real estate

Credit due

Comment

Modelling South African swap spreads

Sponsored Statement

Carry on trading

Structured products

Single measures are not enough

Ashish Dev considers the contemporary relevance of three Risk articles from 2002-03

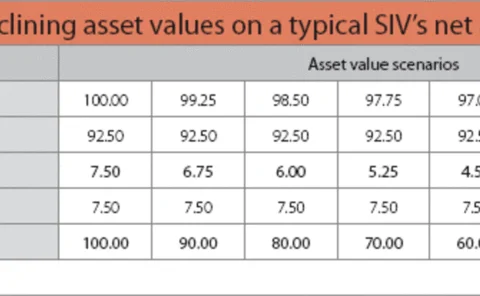

Leaking like a SIV

Structured Finance

No silver bullet

The emergence of contingent credit default swaps has presented banks with a new way to manage their counterparty credit exposures. However, they have important limitations, argues David Rowe

An unhealthy obsession

Editor's letter

Shrugging off subprime

Risk Japan conference

LLB and ABN launch first Islamic exchange-traded trackers

Liechtensteinische Landesbank Switzerland and ABN Amro have launched the first Islamic exchange-traded index trackers linked to the performance of the LLB Mena indexes. The Islamic certificates have been listed on the SWX Swiss Exchange, and ABN will…

Lehman launches quant forex strategies platform

Lehman Brothers has become the latest bank to offer clients access to various algorithmic foreign exchange trading strategies through its new Macro Quantitative Currency Strategies Platform (MarQCuS).

Isda: 38% rise in credit derivatives notional in first half of 2007

The notional amount outstanding of over-the-counter credit derivatives grew by 32% in the first six months of the year, reaching $45.46 trillion in mid-2007, according to the International Swaps and Derivatives Association.