Credit markets

Basis trade opportunities decline as default market continues to tighten

The European default swap market continued to tighten substantially across certain sectors this week, correcting the recent dislocation between cash bonds and credit default swaps (CDS).

Strong Q2 causes BA protection cost to narrow 200bp

The cost of credit protection for British Airways (BA) has tightened by 200 basis points to 725bp following surprisingly strong second-quarter earnings figures released yesterday. The airline beat market expectations by pulling off a financial turnaround…

Sponsor's article > Credit derivatives: will the market keep expanding?

This article aims to give a brief overview of some of the main trends in the credit derivatives market and also proposes to analyse some of the underlying reasons why this market is experiencing such a boom.

Shifting sands in the CB market

Convertible bonds

Moody's publishes CDO hedge counterparty guidlines

Rating agency Moody's Investors Service today said it has published a series of guidelines outlining the steps by which a collateralised debt obligation (CDO) hedge counterparty can better detach its own credit risk from the CDO itself.

Portfolio allocation to corporate bonds with correlated defaults

This article deals with the problem of optimal allocation of capital to corporate bonds in fixed income portfolios when there is the possibility ofcorrelated defaults. Under fairly general assumptions for the distribution of thetotal net assets of a set…

A rollercoaster ride

Foreign exchange

All power to PRDC notes

Forex structured products

Reacting to spreads

Credit derivatives

Pooling the resources

Securitisation

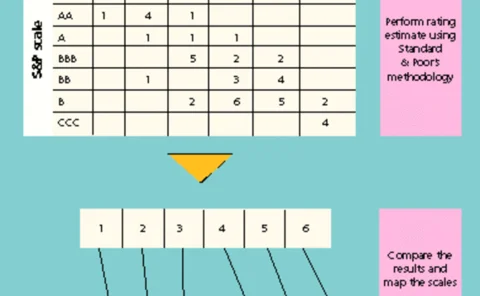

Internal risk rating systems for banks

Sponsored article

Deconstructing the market

High yield

Trouble from above

Pension funds

JPM Merits CDOs

Credit tech

Slim pickings

New Issues

Commerzbank: kaput?

Credit of the month

Deutsche Bank credit protection trades wider following Q3 losses

The cost of senior debt protection for Deutsche Bank has crept 5 basis points wider to 58bp-mid after the bank posted a third-quarter net loss of €299 million. In otherwise thin markets, credit derivatives traders in London said active buyers of…

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact. In this first column…

ING provides cross-currency swap for Samsung Card ABS

The Netherlands' ING Bank will provide the cross-currency swap for South Korean consumer finance company Samsung Card’s $400 million of cross-border asset-backed securities, said a spokeswoman for the Korean company.

Airline exposures cast shadow over CDOs and derivatives trading

Collateralised debt obligation (CDO) investors assessing their credit risk exposure should be aware that recovery prospects among airlines bonds vary dramatically from company to company, according to Goldman Sachs.