This article was paid for by a contributing third party.More Information.

Why database marketing is increasing in importance for asset managers

Improved market presence, product viewership and brand recognition, coupled with the ability to forge long-term community followings, is making the prioritisation of database marketing a no-brainer

As investment managers settle into a post-Covid-19 world, a strategic combination of passive and active marketing – database marketing and personalised outreach – will play an important role in helping to economise spend while reaching target audiences.

Omni, a Nasdaq eVestment database marketing solution, serves more than 500 fund managers in the investment industry globally. It attests to this data marketing trend, particularly during the height of the Covid-19 pandemic when cancellations of in-person meetings and roadshows were widespread. Between 2019 to 2022, in the Asia-Pacific region alone, Nasdaq eVestment witnessed a growth jump of over 115% in new fund managers partnering with Omni.

In the competitive world of investment management, more managers are relying on Omni to leverage a variety of niche databases for the curation of content and positioning of their products to target investors. This is beneficial for managers, who can gain visibility with allocators and decision-makers that are conducting their own due diligence. In a world overcrowded with advertising, establishing a database strategy is often the difference between a product standing out or getting lost in the crowd.

Consultants and investors alike are using eVestment Analytics to view, screen, compare and chart the managers who are reporting to the database. One key benefit of an eVestment Analytics subscription is that it allows managers to view their strategies exactly as allocators do. But it also means they can conduct a consistent level of analysis on 25,000+ peer strategies, and gain an understanding of their brand in relation to other institutionally focused managers.

When well executed, a database marketing strategy can successfully increase a firm’s market presence, product viewership and brand recognition. Consultants and asset owners conduct extensive research and due diligence across investment databases long before mandates are tendered or decisions are made around asset allocation. Therefore, a well-established and consistently maintained database presence ensures products are included in these early screens, also known as ‘shadow searches’.

Another compelling factor in favour of a well-executed database marketing strategy is the building of brand awareness and a strong client community. This is especially desirable, as the past couple of years have resulted in fewer in-person interactions between managers and investors because of the pandemic. For example, the showcasing of a product or the sharing of a product insight to a targeted audience on a sizeable professional database – such as LinkedIn – can foster a community over time that will follow future developments of the product’s offerings.

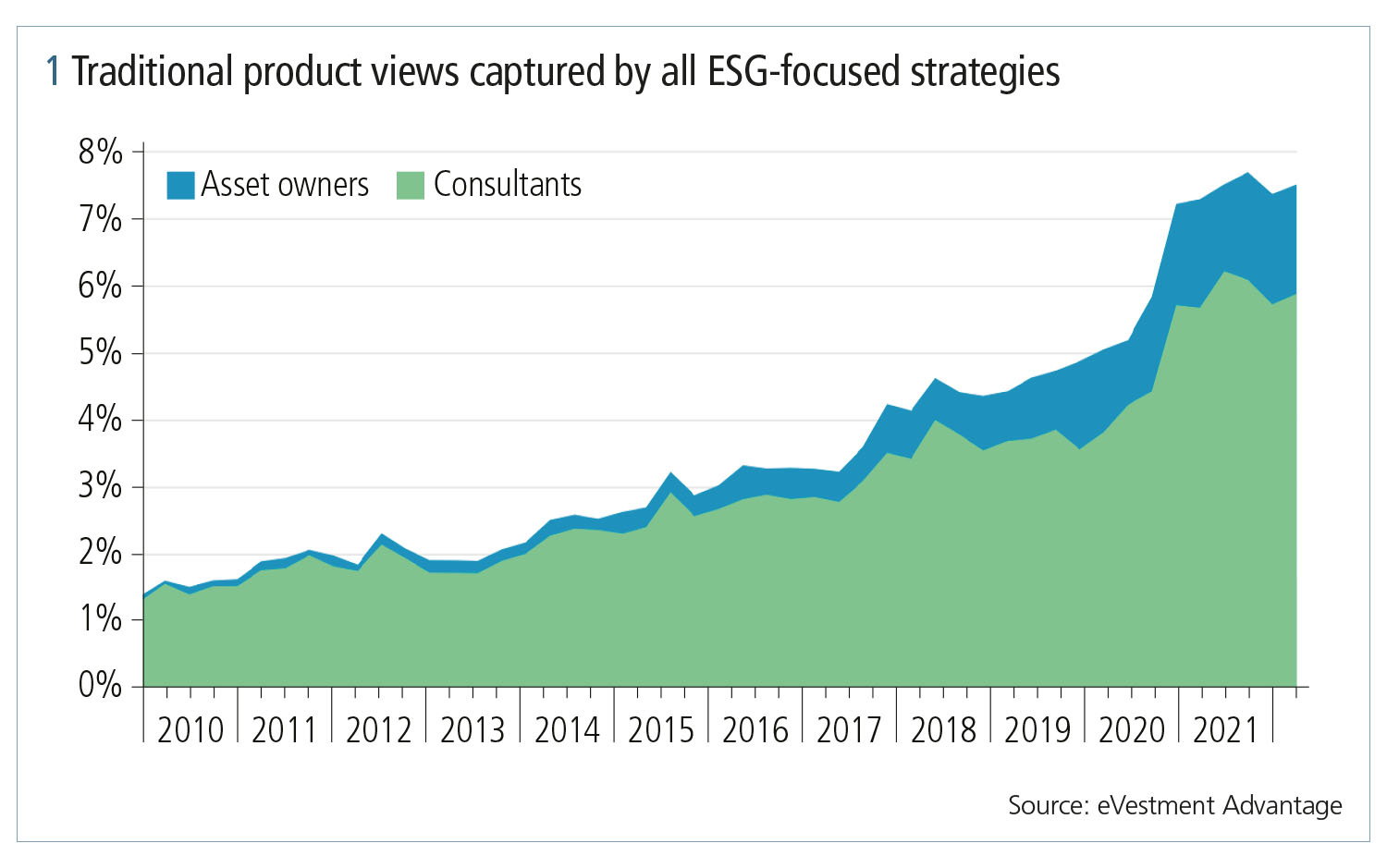

One area in which the importance of database marketing will continue to be demonstrated is environmental, social and governance (ESG). As indicated in figure 1 – captured over several recent quarters – the current surge in ESG-focused product views is expected to continue. And, because of this push, investment managers will need to be creative in implementing all segments of database marketing to stand out from the crowd while fostering a community that will hopefully remain loyal over time to its services or offerings.

Find out more

Learn how asset managers can optimise their market presence with Omni database marketing.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net