Climate

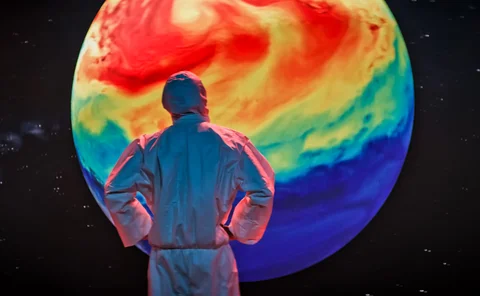

Transitioning to the low carbon economy and averting catastrophic climate change will require trillions of dollars of investment. Global capital markets have a huge role to play in mobilising and allocating this capital most efficiently, investing in new technologies and reducing investment in at-risk assets. To achieve this, climate risk in lending and investment portfolios, as well as within corporate business models, needs to be properly priced. Risk.net provides a unique platform for discussing the enormous challenges of climate risk modelling, showcasing the latest innovations, techniques and approaches to climate risk, and keeping abreast of changing regulatory imperatives.

This section features predominantly third-party content. Read more about our policy on this content here.

Turning climate risk into strategy: predictive data for resilient portfolios

Predictive analytics, shifting fiduciary duty and resilient strategies are reshaping portfolios

Riding the storm: banking in the era of climate risk

Climate-related risk is playing an increasing role in banks’ future strategies, resilience and prosperity

Integrating climate into market and credit risk frameworks: what’s next?

A webinar on climate risk, discussing how and why it needs to be integrated into short-term risk assessments

Navigating technology integration in an altered buy-side risk landscape

Luke Armstrong discusses the expanding role of buy-side risk teams, the comprehensive integration of risk factors and how technology can help risk managers navigate a dynamically shifting risk landscape

Assessing the importance of liquidity and climate risk in an evolving risk landscape

In a Risk.net webinar sponsored by S&P Global Market Intelligence, five experts discussed the challenges that evolving risks pose and how the buy side is having to adapt its approach. This article examines the key themes that emerged from that discussion

Q&A: The evolution of climate risk assessment

Prerna Divecha of S&P Global Market Intelligence discusses the changing requirements for financial institutions in developing a robust and comprehensive view of climate risk

Climate risk models and metrics: what works and what doesn’t?

Panellists at Risk Live Europe 2023 discussed what has been achieved so far in climate risk stress-testing and modelling, alongside what needs tackling next

360° of climate: indexes for every objective

This white paper explores climate strategies targeting objectives – including low carbon, fossil fuel-free and net zero – to help investors respond to the risks and opportunities of the climate challenge

Climate risk: a more positive approach pays dividends

As the world grapples with the impacts of climate change, organisations are racing to keep up with new ESG disclosure requirements and climate risk analysis methodologies. But what separates those ahead of the curve from those that are lagging? The…

Incorporating climate risk into ALM frameworks at banks

In this webinar convened by Risk.net in collaboration with SS&C Algorithmics, experts discuss the challenges and benefits of incorporating climate risk into asset-liability management frameworks at banks

Complying with climate risk framework standards for streamlined processes

Financial institutions worldwide are actively studying ways they can integrate climate risk management into their more traditional risk frameworks

Banks and financial powerhouses map out climate risks

A day after the hottest Double Ninth Festival on record in Hong Kong, experts gathered at Asia Risk Live at the Ritz-Carlton to explore how banks can manage climate risk for a net-zero economy

ESG and climate risk: special report 2022

This Risk.net Environmental, social and governance (ESG) and climate risk special report brings together a collection of articles that explore the latest issues in assessing and managing ESG and climate risk. The tide is turning, with many more firms now…

Sustainable finance, Ibor transition and China bond investment take centre stage

Sustainable finance, moving to risk-free rates, and the further liberalisation of China’s capital markets will all remain a focus for Crédit Agricole CIB in Asia-Pacific

ESG strategies: special report 2021

This Risk.net special report comprises a series of articles that reflect on the latest initiatives for consistent standardised global frameworks for measuring ESG, consider the methodologies investors are using to make measurable progress for people and…

ESG strategy, investment and risk

Sponsored Q&A

Climate risk takes scenario analysis and stress-testing to the next level

Financial institutions are facing several challenges as they prepare for the transition risk journey that will see them evaluating their existing risk and finance solutions. Ludwig Dickens, client advisor, risk business consulting, at SAS discusses what…

Did COP26 deliver?

Jaspreet Duhra, S&P Dow Jones Indices (S&P DJI), explores the opportunities that came out of the 2021 UN Climate Change Conference in Glasgow, and why S&P DJI will continue to produce rules-based indices that align with a 1.5° Celsius scenario

Assessing climate risk in bond portfolios

Running climate stress tests on bond portfolios is a nascent exercise for many asset managers. MSCI looks at what to consider when optimising bond portfolios for climate exposures

Climate risk – Special report 2021

This Risk.net special report contains a collection of articles that consider the impact rising carbon prices will have throughout the economy, discuss the challenges of modelling climate risk exposures and of integrating climate risk into risk management…

Sending the right signals: quantifying and repricing risk

Risk.net convened a panel of three experts from different fields to discuss some of the most pressing and pertinent climate-risk related issues, each offering different insight to the discussion from their respective backgrounds, providing an exchange of…