Insurers deal with delays to Solvency II rules

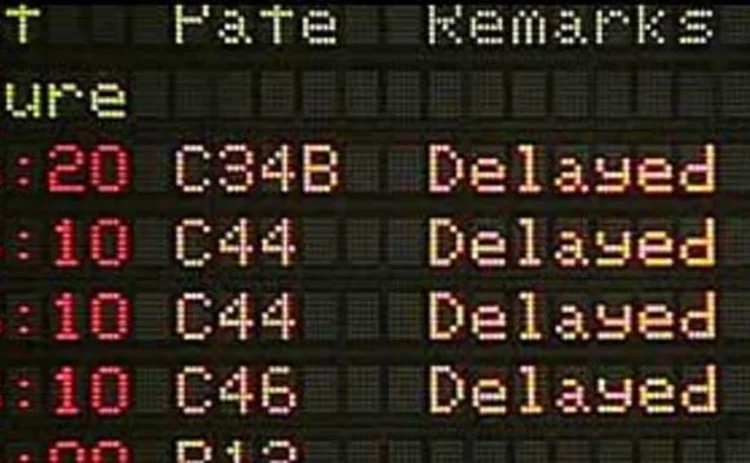

Solvency II shines a light on operational risk for insurers that is welcomed by many, but its continued delays and loss of momentum have left the industry questioning whether this focus is slowly disappearing. From the stunted growth of internal model development to whisperings about delays benefitting even the regulators, Jessica Meek investigates

Until the Basel II capital adequacy rules were published in June 2004, quantifying operational risk was not deemed necessary or relevant for financial institutions and holding capital against operational risk losses was a new concept. Since then it has become standard procedure for banks, with Basel II’s advanced measurement approach spreading steadily (albeit slowly) across the industry. In the

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら 規制

信用スプレッドリスク:銀行の貸借対照表に潜む不可解な危険

一部の銀行関係者は、EUのCSRBB規制強化の動きがリスク管理の改善にほとんど寄与していないことを懸念しています。

EUの銀行間では信用スプレッドリスクへの対応が異なることが調査で判明

KPMGが90行以上の銀行を対象に実施した調査により、負債と貸付金の取り扱い方法について意見の相違が明らかになりました。

ボウマン氏の率いるFRBは、人員削減後もかろうじて機能し続けるかもしれない

新副議長は効率化を追求していますが、元規制当局者によれば、職員の大量解雇は機能を阻害する恐れがあります。

2025年の振り返り:世界は終わりを迎えたが、特に問題はない

市場はトランプ氏が米国政策を再定義する中で回復力を見せましたが、2026年以降については疑問が積み上がっています。

香港のデリバティブ規制は、より多くのオフショア取引を促進する可能性がある

業界は、証券会社に対する新たな資本賦課が他の管轄区域よりも高いと警告しています。

IOSCOのガイダンスはヘッジ前の問題を解決するのか

買い手側は、同意要件が長年続く懸念を解消するとは考えておりません。

責任あるAIは、原則と同様に利益についても考慮すべき

ある企業が、ガバナンスを損なうことなく、融資処理時間を短縮し、不正検知を改善した方法

米国地方銀行における一時的な貸倒損失は、システム的な問題となる可能性はあるのか?

投資家はザイオンズとウエスタン・アライアンスの問題は孤立した事例だと見なしていますが、信用リスク管理者たちは警戒感を強めています。