Infrastructure

Sponsor's article > Is 8% for all seasons?

Considering the potential pro-cyclical impact of Basel II and the limited effectiveness of countervailing influences, David Rowe concludes that making the 8% ratio of capital-to-risk-adjusted-assets a discretionary policy variable should be part of the…

Citi has war chest but high standards, CFO says

Citigroup has “stored excess capital” to allow it to make acquisitions during periods when price-earnings multiples in the financial services industry are depressed, as is currently the case, according to Todd Thomson, chief financial officer at the New…

The consulting conundrum

Gone are the Y2K days, when consultancies could exploit their strong positions and bill their clients big money for questionable services. The roles have been reversed for financial services firms, and consultancies are having to back up their ‘smoke and…

Ferc calls for risk manager vigilance

William Hederman, director of the office of market oversight and investigations (OMOI) at the US Federal Energy Regulatory Commission (Ferc), today urged energy risk managers to alert his office to any suspicious market practices.

Exceptional Rates of Failure

With industry exception rates so high that the word exception is hardly appropriate, some firms are taking drastic steps. Among them: demanding that partners meet minimum standards to continue getting business.

ABN Amro delves into global OTC oil and gas derivatives

Dutch bank ABN Amro has started to offer its clients oil and gas hedging services, as part of its financial markets business, which incorporates debt capital markets, structured lending and risk management activities.

New CDO issuance picked up in April, says Goldman

The collateralised debt obligation (CDO) market witnessed a turnaround in new issuance in April, according to research from Goldman Sachs in New York. But the year-to-date new issue of CDOs in the US and European markets is still down by more 20% and 50%…

Emerging markets credit derivatives index debuts

JP Morgan Chase has begun formally showing prices on its Emerging Markets Derivative Index (EMDI) – a tradable portfolio of five-year credit default swaps (CDS).

Tremont Advisers pushes new fund of hedge funds benchmark

Tremont Advisers, a fund of hedge funds with more than $8 billion in assets under management, based in Rye, New York, is proposing a new fund-of-hedge-fund performance benchmark comprising a blend of 70% three-month Libor and 30% S&P 500. If it catches…

Reference Data's Dirty Little Secret

It turns out reference data standards will make it easier for customers to switch data vendors. There are growing whispers about how positively vendors will view that.

Congress demands ratings report from SEC after no-show at hearings

WASHINGTON, DC - The chairman of a House of Representatives subcommittee that held early April hearings titled "Rating the rating agencies: the state of transparency and competition," sent a strongly-worded letter to the chairman of the Securities and…

RBS selects Algo credit to manage global wholesale credit limits

Royal Bank of Scotland (RBS) has selected Algo Credit to manage its global limits and exposures management from Algorithmics, the Toronto-based provider of risk management software.

QIS3 results released by Basel Committee

A paper outlining the results of the third quantitative impact study (QIS3) was released by the Basel Committee on Banking Supervision yesterday.

Classical volatility estimator may become unreliable, says Deutsche

Increased levels of intra-day volatility in the US interest rate derivatives market could make traditional approaches to estimating volatility unreliable, according to research by Deutsche Bank.

QIS3 results released by Basel Committee

A paper outlining the results of the third quantitative impact study (QIS3) was released by the Basel Committee on Banking Supervision yesterday.

FMCL launches Asian oil forward curve data

The Forward Market Curve Limited (FMCL) has launched the first module of its ForwardMarketCurve (FMC) product – an all-broker methodology for achieving robust and accurate price discovery in forward commodity markets.

Pitfalls and alternatives

Correlation

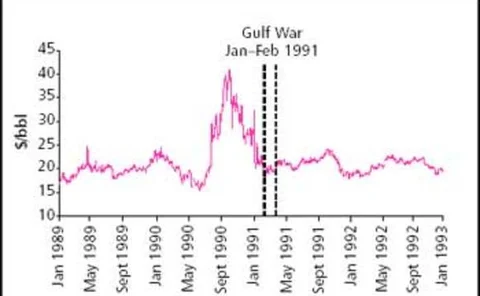

A formula for high prices

The US chemical industry is crying foul over spiralling natural gas prices, but there are measures they can take to protect themselves, as Kevin Foster discovers

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

Flies in the ointment

Outstanding issues

Bespoke panacea?

Substitution rights

Protecting the investor

Roundtable