Hedge Funds Review - 2009-01-01

Articles in this issue

Aida Fund: Aida Capital

Safety found in classical investing

New Year resolutions look at hedge funds future in 2009

New Year is traditionally the time to take stock of the past year and look forward with hope and renewed energy to the year to come. In most countries at the stroke of midnight the New Year is heralded in by making a lot of noise. The origins of this…

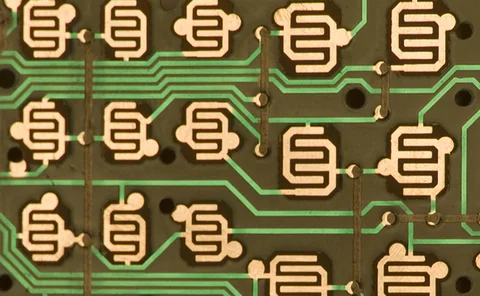

IT spending set to fall below $1bn

As hedge fund managers square up to the most precipitous market challenges in their history, the industry is likely to have to contend with the prospect of less cash, fewer assets under management and slashed technology budgets.

Trapped in a deleveraging spiral

One of the biggest seismic shifts in 2008 was away from leverage. Easy credit has gone for good. Hedge Funds Review examines what options hedge funds have now that the easy credit has dried up

Discretionary trading expects continued tough time in 2009

Discretionary trading had a rough time in 2008, suffering like many other strategies. Hedge Funds Review talks to fund managers using this strategy to find out where the strategy may be heading in 2009.

Relative value strategy fails to perform in 2008

Claimed to be designed to cope with market volatility, relative value strategies have produced disappointing performances throughout 2008. Hedge Funds Review discovers if the strategy has a future in 2009

Investable indexes - November 2008

Credit Suisse /Tremont Hedge Fund Index - Dow Jones Hedge Fund Benchmarks - Frontier Capital Multi-Asset Platform Fund - Greenwich Global Hedge Fund Index - HFRX Global Hedge Fund Index - Lyxor Global hedge Fund Index

Eddington Macro Opportunities Fund: Eddington Capital Management

Searching for stellar managers

Funds face tough climate as investor confidence wanes

Will investors regain confidence in hedge funds and requests for redemptions reverse?

Alternatives as inflation hedges

Most of modern asset pricing theory and portfolio selection analysis is based on fund separation theorems. These, in a nutshell, advocate that performance and risk are two conflicting objectives that are best managed separately.

Industry tackles valuation anxieties

The methodologies and processes used to value illiquid securities in hedge fund portfolios have become a hot topic for managers and investors alike. Hedge Funds Review examines some of the challeges and issues facing managers and administrators

Island prepared to fight

Rising out of the Irish Sea, the Isle of Man does not at first glance appear the ideal home for hedge funds. Over the last few years, it has aggressively courted the hedge fund world and believes it is now poised to become one of the major players

Standard bearer for the future

The prominence of the Hedge Funds Standards Board and its role in championing hedge funds has increased since the appointment of a permanent chairman in July 2008. Chairman Antonio Borges believes he and the board have a crucial role to play in helping…

Japan presents tough environment for hedge funds seeking investment

Although Japanese investors appear keen to invest in hedge funds, the environment for selling products in the country is difficult and highly regulated. Hedge Funds Review explores the challenges facing funds seeking Japanese investors.

LGIM Japan Alpha Fund: Legal & General Investment Management

A promising outlook for Japan