Front-to-back Systems

Front-to-back Systems

Foreword

Introduction

Part 1: What the Infrastructure Needs to do

Trades and Products

Where do Trades Come From?

The Purpose of the Infrastructure

Typical Infrastructure

Part 2: The Problems with Trade Processing Infrastructure

The Problems

The Evolution of Technical Complexity

The Regulatory Challenges

The Complexity Cycle

Part 3: Historic Approaches to Transformation

BAU/Incremental Change

Front-to-back Re-engineering

Functionalisation, aka “Factories”

Front-to-back Systems

The Golden Middle

Simplification

Part 4: New Approaches to Infrastructure

Digital

Cloud and Utilities

Artificial Intelligence and Robotics

Big Data and Analytics

Blockchain/Distributed Ledger Technology

Distributed Ledger Technology: Hybrid Approach

Nirvana?

From the arrival of the iron ore on Monday, that iron ore was in a car going out to a client on Friday.

– Norman Bodek on the Ford Model T production line

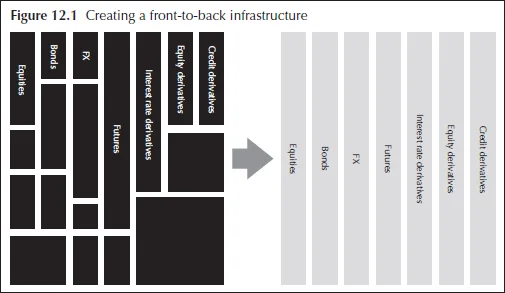

If multiple systems interacting is one of the root causes of the complexity described in this book, surely the obvious answer is the front-to-back system? It is a system that does all (or at least most) of the trade processing for one or more asset classes from trade capture to settlement. At the very least, it would get rid of all the breaks between systems that are involved in processing each asset class.

In this chapter, we will describe the origin of the idea and explore the way some of the main types of front-to-back system can provide a front-to-back solution for one or more asset classes. Using a front-to-back system can be very successful in some contexts, but the key value of this chapter is to help the reader understand the key factors that influence success or failure (see Figure 12.1).

DEFINING THE APPROACH

In Part 1 of this book, we traced the evolution of markets infrastructure away from front-to-back systems to a loosely coupled infrastructure of many

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net