Part 2: The Problems with Trade Processing Infrastructure

Foreword

Introduction

Part 1: What the Infrastructure Needs to do

Trades and Products

Where do Trades Come From?

The Purpose of the Infrastructure

Typical Infrastructure

Part 2: The Problems with Trade Processing Infrastructure

The Problems

The Evolution of Technical Complexity

The Regulatory Challenges

The Complexity Cycle

Part 3: Historic Approaches to Transformation

BAU/Incremental Change

Front-to-back Re-engineering

Functionalisation, aka “Factories”

Front-to-back Systems

The Golden Middle

Simplification

Part 4: New Approaches to Infrastructure

Digital

Cloud and Utilities

Artificial Intelligence and Robotics

Big Data and Analytics

Blockchain/Distributed Ledger Technology

Distributed Ledger Technology: Hybrid Approach

Nirvana?

Almost everyone agrees there is a problem with the highly complex and expensive trade processing of investment banks and the markets divisions of general banks. Regulators, central banks, politicians, bank managements, management consultants, software vendors, the fintech world and the internal IT departments themselves all seem to be in agreement. The succession of large-scale programmes to “transform” infrastructure indicate there must be some major problems because managements spent so much time and money trying to fix them.

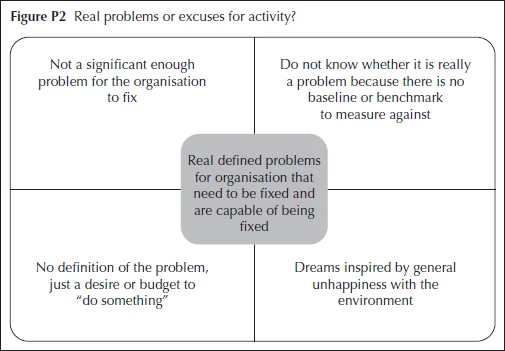

The “problems with problems” come when they are not really defined, when they are only a problem for some parties but not for others, when a problem is created simply because someone wants to gain money or power by purporting to fix it, or where the problem is actually just an aspiration for something that is probably unachievable.

Rolling out a new system without having defined the problem can make achieving success difficult. Setting out on a transformation project without an objective baseline to measure success against, not even knowing whether the project has succeeded or failed, can lead to an even worse

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net