Feature

With a bang or a fizzle?

Basel II

Reining in India

India

Introduction

Introduction

A two-pronged approach

Hedge funds

Introduction

Regulation and compliance

Gas storage parking lot full

More US natural gas storage is needed if price spikes are to be alleviated in the coming months experts believe, but construction interest is limited, finds David Watkins

Successful networking

Germany's virtually non-existent gas market has been given a shot in the arm by the country's network regulator, which has banned anti-competitive grid access contracts. Could this be the start of a success story, asks Oliver Holtaway

The regulation debate

Following a series of price spikes, consumer groups in the US are rallying against the deregulation of electricity marketswith some success. David Watkins investigates

Less is more

With Phase II of the European Union Emissions Trading Scheme set to be rolled out, Miles Austin investigates whether it will deliver greater emission reductions than Phase I

An uncertain future

European natural gas demand is expected to rise in the next three decades. But, as Anouk Honore finds, the overall picture is not easy to predict, and depends on what happens in individual countries – particularly Italy and Spain

Depending on Russia

Europe's increasing dependence on Russia for gas supplies throws up new risks that must be assessed. Understanding political risk is key, but the biggest risk to supply could be the lack of investment in the sector, finds Roderick Bruce

Richest US state hedges to dodge blackouts

The US state of Connecticut is rolling out an innovative method of power contracting which it hopes will alleviate some of the state's energy woes. If effective, the model could spread to other states, writes Elisa Wood

Moves to maturity

While many obstacles to the liquid short-term trading of gas in Europe remain, the market infrastructure is showing some signs of maturing. Oliver Holtaway looks at hub development in the European gas markets

Gateway to Europe

Turkey has ambitious plans to open its rapidly-growing gas market up to competition. Yesim Akcollu looks at how realistic these plans are

In defence of VAR

High profile losses such as those at hedge fund Amaranth last year had people questioning risk management tools, particularly value-at-risk. But Chris Schlegel and Andrew Kosnaski believe VAR would have given adequate signals to traders in the volatile…

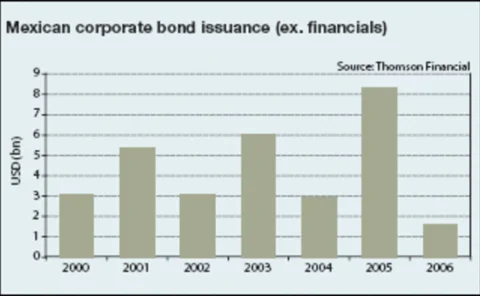

False dawn for first loss

CDO equity