Feature

Index delays leave passive bond funds in purgatory

Moves to postpone index rebalancings could backfire as rating agencies press ahead with downgrades

How carbon-cutting Drax manages currencies and credit

Interview: UK power giant uses option selling – and other tactics – to create hedging headroom

Repo rules caught in Covid’s concertina effect

Pandemic jeopardises phased rollout of Europe’s SFTR regime, raising fears of chaotic ‘big bang’ start

FX vol revived by Covid-19 – but for how long?

Traders split on whether virus impact, or central bank responses, will prove most powerful

As Covid snaps credit models, lenders turn to stress-testing

Banks enlist scenario analysis to bolster creaking default models

Energy Risk Commodity Rankings: Uncertain times

The winners of Energy Risk’s Commodity Rankings overcame some tumultuous times in 2019, learning lessons that are certainly required in today’s volatile environment

Seeing red over blue-chip swap in Argentina’s NDF fiasco

Emta protocol salve aside, peso settlement rate snafu is a warning for emerging market FX derivatives

Lighting up the black box: a must for investors?

Many contend you must be able to interpret machine learning in order to use it

The Fed’s stress capital buffer: relaxed but not relaxing

Bankers welcome key methodology improvement, but final rule could still curb dividends

Funds try to predict behaviour of mystery investors

New EU rules on liquidity stress-testing force fund managers to hunt out clues on investors

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

‘Huge role’ for quants in Covid-19 response – MIT’s Lo

Policy-maker actions or missteps will drive markets, academic says

Splits emerge over EBA’s stress test 2.0

Experts question utility of separate bank leg that won’t feed into capital requirements

Alt data lends a different light to coronavirus impact

Smog, traffic data – even movie rentals – help analysts track economic effects of virus

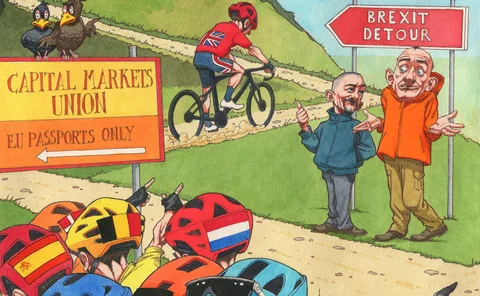

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Top 10 operational risks for 2020

The biggest op risks for 2020, as chosen by industry practitioners

E-trading takes hold for FX swaps – sort of

Bulk of trades are being executed over screen, but bolder changes have stalled

Top 10 op risks 2020: regulatory risk

New technology and reams of red tape make non-compliance fines more likely

Top 10 op risks 2020: IT disruption

Risk of downed systems, from hack or outage, continues to make op risk managers fret

Top 10 op risks 2020: data compromise

Hackers, thieves and wobbly in-house data management keep this category near the top of the list

Top 10 op risks 2020: geopolitical risk

Nationalism, trade wars and epidemics make for a heady cocktail

Top 10 op risks 2020: theft and fraud

From mega loan fraud to canteen theft, the danger is ever present

Top 10 op risks 2020: talent risk

Firms struggle to reduce headcount and fill gaps without cutting corners

Top 10 op risks 2020: conduct risk

Root-and-branch reform of bank culture remains a work in progress