Feature

IFRS 9 and the loan loss lottery

As reserves for bad loans balloon, banks grapple with measuring Covid-era credit risk

CFTC block trade plan gets cold shoulder

Industry divided over swaps reform proposal, and advisory committee casts doubt on need for it

Why investors are stuck with flawed VAR models

Buy-side risk survey: VAR wasn’t much use in March, but it is ingrained in the industry

Transparency vs clarity: the Mifid swaps conundrum

Participants want better OTC transparency, but say Esma’s efforts at clarity could muddy the picture

Asia debt market suffers SOFR inertia

Issuers of floating rate notes stick with Libor in absence of term version of risk-free rate

Before and after the Covid-19 storm: buy-side risk survey

Wide-ranging survey reveals what worked and what didn’t in March – and what will change as a result

UK’s tough legacy fix spells trouble for US Libor transition

FCA will have little control over how synthetic Libor rates are used in other jurisdictions

Investors rethink ops resilience for a pandemic-proof future

Shift to remote working sees asset managers focus on comms, tech and cyber risks

Concerns roil prop clearing waters in wake of ABN losses

State-backed lender insists few clients have defected – but sharks circle, post-Parplus

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

Oil funds want to reduce risk. Will investors let them?

Despite posting big losses, funds that track front-month contracts remain popular with investors

Synthetics sweetener teases European banks

As structural woes resolve, regulators remain split on preferential capital treatment for STS deals

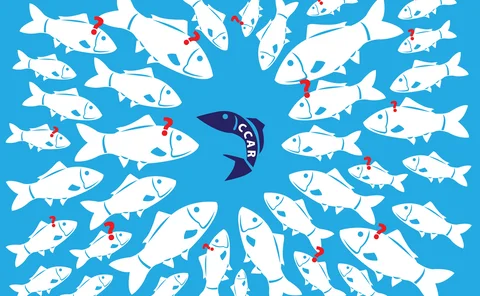

How the Fed’s Covid stress test got stuck in the middle

Experts fear CCAR add-on has neither informed investors nor guided capital management

The scientists probing the human mind for an investing edge

Recent advances in behavioural finance could give rise to new quant models and strategies

Bruised, not broken: execs say Libor switch on track despite Covid

Compressed timeline for transition may leave smaller firms struggling to meet end-2021 deadline

Risk Technology Awards 2020 – Coping with Covid uncertainty

Scenarios scrapped, rules revised and holes plugged – how the winners of the Risk Technology Awards 2020 are adjusting to the Covid‑19 pandemic

Conduct risks stalk banks in Libor transition

As replacement rate concerns become more pressing, firms fear Libor lawsuits and regulatory wrath

Investors at the gates: MMF reforms fail the Covid test

After MMF rescues return, regulators urged to rethink rules on gates and sponsor support

Rise of ethical swaps brings hedging questions

Banks ponder how to offset risks of ESG derivatives – or whether hedging is even desirable

Credit problem: SOFR faces uphill struggle in loan market

Furnishing Libor’s replacement with a credit-sensitive spread is proving to be a Sisyphean task

China bond buyers tiptoe through credit analysis minefield

State backing for domestic companies is hard to gauge, as new investors are discovering

Clearing banks feel pinch as rates turn negative

Negative returns on dollar deposits at Eurex, Ice and LCH spur talk of business model change

FX traders sound alarm on tagging ‘abuse’

Front running and tag refreshing concerns abound on semi-anonymous trading platforms

Covid scenarios: finding the worst worst-case

As pandemic trashes historical data, a Risk.net tie-up with Ron Dembo’s new outfit tests promise of polling