China bond buyers tiptoe through credit analysis minefield

State backing for domestic companies is hard to gauge, as new investors are discovering

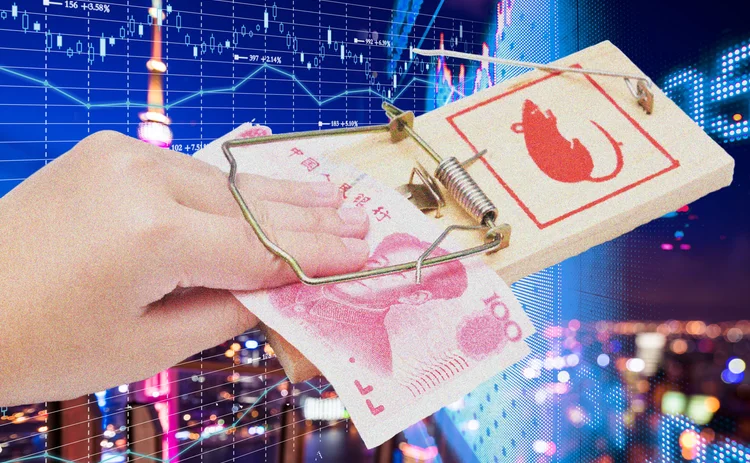

Buyers of Chinese corporate bonds must deploy the usual tools of credit analysis: earnings ratios, debt levels, cashflow, and more. But there is a powerful factor that can outweigh all others: state support.

Putting a value on state support is a thorny business, and experts believe China’s burgeoning bond market is littered with mispriced credits ready to trap the unwary investor.

“The problem

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Morgan Stanley sees the elephants in the room

Talking Heads 2025: Hedge fund crowding means macro markets have fatter tails, argues fixed income co-head Jakob Horder

Pension schemes prep facilities to ‘repo’ fund units

Schroders, State Street and Cardano plan new way to shore up pension portfolios against repeat of 2022 gilt crisis

Stablecoins: good as the buck, or breaking the buck?

Collateral concerns and iffy auditing have raised fears of a ‘de-pegging’ event – and possible contagion across crypto and beyond

Wanted: radical ideas for inflation modelling

Hedge funds echo Mervyn King’s calls for a new approach to inflation modelling post-2022 crisis

SEC, Treasury warn against zero haircuts for Treasury repos

Gensler and Liang say more conservative treatment of hedge fund trades is desirable

UK pension funds hand over more assets to LDI managers

Transfer of assets is a pre-emptive move to avoid repeat of September’s collateral crunch, trustees say

Pension buyouts: rock-bottom prices mask unease over risk

US insurers will digest $40bn in pension assets this year but tight pricing and an economic downturn could lead to reflux

Copping out on climate change: buy-side risk survey

Only 9% say front-line staff have climate role today – specialists call for better metrics and link to pay