Feature

Shake-up ahead for financial technology

With a raft of financial market reforms set to alter the landscape of energy and commodities trading by the end of the year, Lianna Brinded takes a look at how financial technology needs to develop in order to keep up with regulatory changes

Energy Risk Awards 2010 - photos from receptions in Houston and London

Photos of the highlights from Energy Risk’s recent 2010 Awards ceremonies in Houston and London

Uncertainty over CFTC position limits

A new position limits regime for energy trading in the US could have a significant impact on the sector. Pauline McCallion examines the proposals and finds out about the potential implications for energy players

Hedgers’ dilemma over exchange rules

Pauline McCallion speaks to industry experts to find out what new derivatives regulations could mean for the end-users of energy hedging products

Are the CFTC, SEC and Fed equipped for their new powers?

Despite a last-minute hitch, the final text of ambitious financial regulatory reform legislation was agreed last month, which would hand supervisors sweeping new powers over financial institutions. But are regulators equipped for their new…

Data not judgement required for Nordic banks' Basel approach

Nordic banks want to use the Basel framework’s advanced approach to credit risk capital, but local regulators are insistent that data – rather than judgement – has to be the basis for the calculations. Banks don’t have enough instances of default in…

Nordic markets warm to central clearing

Regulators across the globe are intent on forcing over-the-counter derivatives through central clearing. How are supervisors in the Nordic region responding, and could the relative lack of liquidity in domestic markets hamper their efforts? By…

CDS lessons from the emerging markets

Eurozone politicians are pushing for a ban on naked sovereign credit default swaps (CDSs) – but the eurozone CDS market is relatively young. In emerging markets, where it has a longer history, CDSs are sometimes the hero, sometimes the villain – and…

Questioning collateral

European financial markets have been turned upside down by the sovereign debt crisis, with eurozone government bonds no longer regarded as completely risk-free. As a result, dealers are more wary of the correlation inherent in collateral denominated in…

EU regulators ready to act in concert?

The European Union is close to reaching agreement on a new supervisory framework, designed to reduce the room for national discretion. But Germany’s recent short-selling ban shows domestic supervisors are not afraid to go their own way to protect…

Surviving skew

Skew skyrocketed in May, breaking through levels last reached in 2008 after the bankruptcy of Lehman Brothers, while volatility and correlation also spiked. The dislocations are rumoured to have caused losses for some exotic equity books. How did dealers…

Energy companies face up to clearing requirements

Elimination of a catch-all clearing exemption in US financial reform legislation looks like bad news for big energy companies – the industry warns mandatory derivatives clearing will do untold harm. Peter Madigan reports

Dodd-Frank raises stakes in CFTC's push for energy position limits

With the Commodity Futures Trading Commission poised to implement position limits in energy markets, how will a dramatic expansion of the regulator’s power affect those plans? By John Ferry

Northern exposures

Nordea tops this year's Nordic Risk derivatives rankings

The dangers of a more liquid gold market

With other safe haven assets looking increasingly risky, investors are turning to gold in unprecedented numbers – but a more liquid market may turn out to have pitfalls in the long term. By Alexander Campbell

Sparring over global valuation

Dealers have typically used a variety of pricing models that are specific to certain asset classes and instruments. But is it possible for banks to build global models that can be used to price instruments across asset classes? Matt Cameron reports

Op risk managers need to turn on the charm

Op risk practitioners are being asked to display more people skills, which will help them to embed an operational risk culture across their firms. But even the most charismatic of managers stand little chance of being promoted above their credit and…

Clear and present danger

Transparency is a concept that has been bandied about by banks a lot lately, usually when they know the press is watching. But just how transparent are banking practices, and just how clear is the Basel approach to operational risk?

Smartphone banking has limited mobility

Mobile banking using smartphones is the next frontier for retail banking, but banks have been slow to venture into this new territory

UK FSA plays good cop, bad cop on insider trading

The UK Financial Services Authority is taking a hardline approach to insider trading, increasingly carrying out criminal investigations. But at the same time it is asking firms to work with it by providing information to build a bigger picture of what’s…

Sheen: The FSA's go-to guy for op risk

Andrew Sheen at the UK Financial Services Authority has rapidly become one of the most respected experts in operational risk, perhaps due to his clear vision of where the profession needs to go and what it must do to get there.

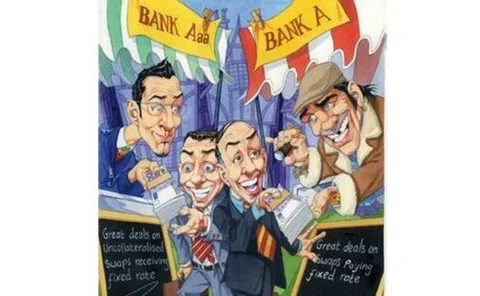

Dealing with funding on uncollateralised swaps

Many banks are now using their own cost of funding as a discount rate when pricing non-collateralised swaps trades. How are banks dealing with the difference in funding rates when quoting derivatives prices, and could this influence a client’s choice of…

Data spikes pose problems for risk management

Recent crises have drummed home that banks need to calculate risk exposures in as close to real time as possible. To do that, risk managers need to process huge amounts of data, but current systems often lack the capability. How can banks address this…

Variable annuities face more hedging challenges in Asia

Variable returns