Feature

Top 10 op risks 2021: resilience risk

Industry survives biggest real-world stress test, but challenges remain for firms and regulators

Top 10 op risks 2021: IT disruption

Integrity of core systems paramount as risk managers battle outages and hacks in work from home era

Optimisation firms prep for SA-CCR boom

Flush with new cash, vendors ready rebalancing services ahead of risk-sensitive leverage framework

What lies beneath: Nomura’s iceberg balance sheet

Collateral received by the Japanese bank exceeds its total on-balance-sheet assets – does it matter?

All roads lead to Bergamo: Euronext eyes new home for its tech

Market participants fear a “horrible” relocation project and more room for latency arbitrage

Softer US NSFR could skew global repo pricing

US banks benefit from Treasury repo exemption, while EU banks report only end-quarter ratios

Funds rush to take the temperature of their portfolios

Big investors, including BlackRock, are using new metrics to measure their funds’ carbon emissions

Banks boot up next-gen FX hedging bots

Automated FX hedging can save money and time, proponents argue. But corporates have qualms

Quants pitch strategies for when bonds no longer work

Investors are flocking to alternative diversifiers of equity risk

Held in suspense: late futures orders blamed for Covid meltdown

Buy-side use of average pricing contributed to rash of failed trades and give-ups last March

UK Treasury opens door to ditching Mifid open access rules

Champion of competition in derivatives clearing may throw in the towel

European funds fret over merits and risks of ethical labels

Managers unsure whether to “aspire to” or “run away” from new ESG classifications for funds

The slow corporate embrace of CSAs

Risk.net research finds 28 of 50 large companies now have CSAs – but has the trend run its course?

The lonely Londoners: doubts plague UK quest for equivalence

Planned MoU won’t automatically bring equivalence, leaving firms in limbo for unknown duration

Bonds fall from favour as shock absorbers for equity losses

Ultra-low rates force investors to rethink role of fixed income as diversifier

Quants find new ways to identify inventive companies

Novel uses of patent and other data could help tell trailblazers from phonies

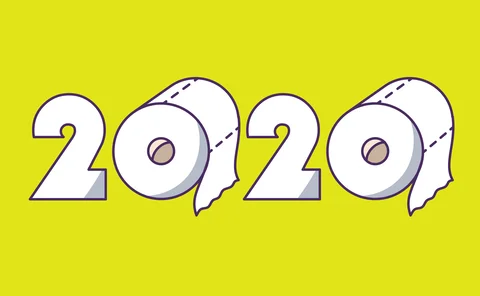

Review of 2020: chaos on a roll

Vanishing liquidity, the Ronin collapse, XVAs – the pandemic wreaked havoc in risk transfer markets

Investors eager for next round of China financial reforms

Asia Risk 25: Bond futures and credit default swaps the missing pieces

Asian banks bite back at big tech

Asia Risk 25: Asian lenders eye technology and data to help tame disruptors on their turf

Japan weighs benchmark options as sun sets on Libor

Dominance of risk-free rates in local swaps markets post-Libor is no foregone conclusion, dealers say

Markets search for FX factor as rates fall flat

Traders signal shift to currency strategies, but is it passing fad or permanent fixture?

Must do better – Apac slow to curb control risk

Asia Risk 25: Even as the level of regulatory scrutiny peaks, meaningful change eludes the region’s banks

Margin rules snare FX options users

US banks forced to post margin on ‘naked’ trades, with buy-side firms soon to follow

How buy-to-hold accounting shuffle boosts US bank capital

Banks gamble shrinking AFS portfolios will bring down stress capital buffer, G-Sib surcharge