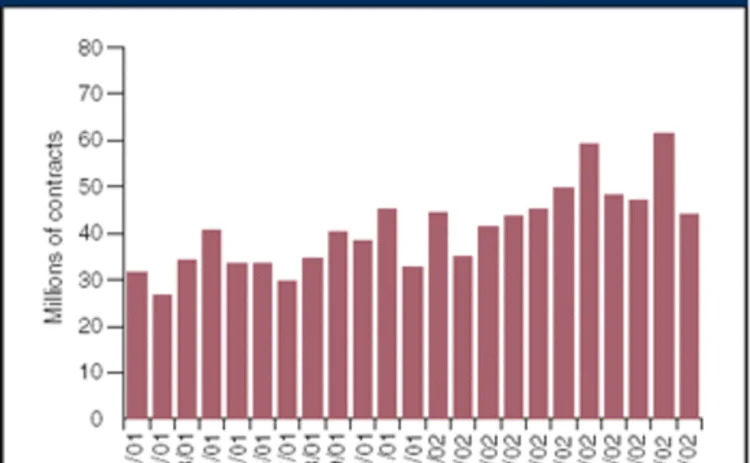

Winds of change blow for the CME

Everything looks rosy at the Chicago Mercantile Exchange. So what’s new for 2003? Keith Brody reports

The CME is the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Exchanges

Nasdaq leads push to reform options regulatory fee

Proposed rule change would pare costs for traders, raise them for banks and defund smaller venues

Asia’s ETF assets on the rise – HKEX presents the results of Asia ETF survey 2019

Asia’s total ETF assets surged by 23.9% in the first half of 2019 thanks to an increasing adoption of ETFs into investment portfolios. According to a survey conducted by Hong Kong Exchanges and Clearing (HKEX), asset expansion in Asia’s ETF market is set…

NYSE Offers Exchange-Calculated Bitcoin Index, with More to Come

NYXBT will initially be based off data from Coinbase Exchange.

Deutsche Börse to set up Europe's first multi-asset RMB platform

German exchange group signs joint venture deal with CFFEX and Shanghai Stock Exchange

Exchange Revenue Figures Rise, Fall; Data Revenues Continue Steady Increase

A mostly positive mix of Q1 results also yield big increases in data revenues for some exchanges.

Lift-off for ASX Aussie dollar swap clearing business

Volumes jump following revamp of Sydney bourse's clearing incentive scheme

Exchange Data Revenues Make Positive Start to 2015

Acquisitions made up for some shortfalls in exchange revenues