Energy Risk - Volume7/No9

Articles in this issue

Who is left to manage risk?

New Frontiers

The Power Sector Model

New Frontiers

Capturing value from energy supply and trading

New Frontiers

Making sense of the new power market

New Frontiers

Quality data and solutions for a challenging market

New Frontiers

A safety net for energy traders

Will the Edison Electric Institute’s master netting agreement help reduce credit risk for energy traders? Kevin Foster takes a look at this new initiative

End of an era for GdF

Gaz de France is certain to lose its monopoly position – without it, what strategy can the gas giant adopt in a liberalised European market? Mickael Laurans reports

Power price discovery in Europe

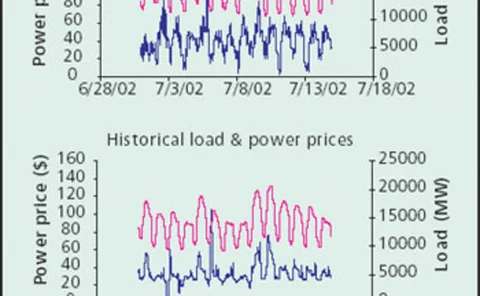

Logical Information Machines’ Sandy Fielden compares different price discovery mechanisms in European electricity markets

Weather option pricing with transaction costs

The weather derivatives market is becoming more liquid, and dynamic hedging of weather options with weather swaps is now possible, though limited by transaction costs. Here Stephen Jewson investigates the effect of such hedging on option pricing

How much can you take?

Given recent events, energy firms need to fundamentally re-think how they estimate their risk tolerance. Maria Kielmas asks what has prompted this soul-searching

Entergy-Koch reaps the benefit

While its quiet discipline made Entergy-Koch Trading one of the less glamorous energy trading houses during the Enron boom years, its steady business model is now paying off, as James Ockenden reports

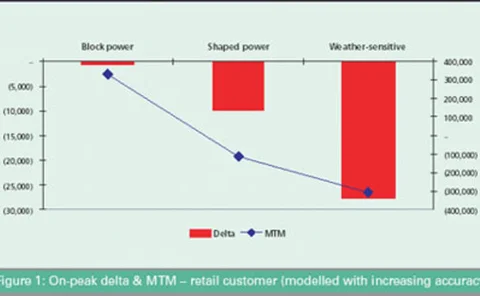

A mark-to-market u-turn

A reversion to the old, non-mark-to-market regime for accounting for energy trading contracts is changing the energy supply business, reports Catherine Lacoursière

Weighing up the options

The Brazilian energy market is set for more upheaval as the incoming president seeks a compromise between his campaign promises of greater state control over energy and the goal of attracting foreign investors into the sector. Maria Kielmas reports

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

A long road to deregulation

Prospex Research’s Ben Tait reports on Spain and Portugal’s progress in integrating their power markets. High ambitions for deregulation are proving difficult to achieve

All clear for energy

Several organisations have brought over-the-counter clearing to the US energy markets over the past six months. Kevin Foster assesses their progress and asks whether they can all survive

FAS 133: increasing transparency

Standard & Poor’s Jack Kennedy and Neri Bukspan believe new Financial Accounting Standards Board rules for US energy traders will make it easier to measure a firm’s risk management ability, liquidity position and equity capital