Return of the loan market

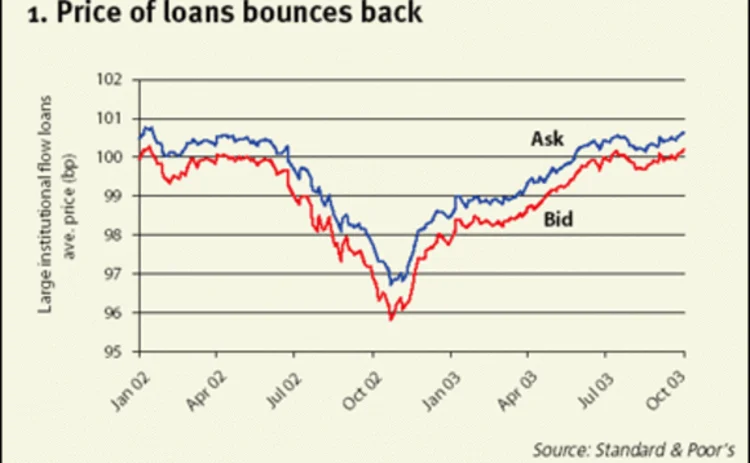

The leveraged loan market has seen a surge in demand this year, delivering returns that other asset classes can only dream of. Steven Miller reports on the factors behind thissuccess story, and discovers that the only short-term barrier to growth is a shortage of supply

The high-yield bond market may seem an attractive proposition for investors focused on current income, but over the past year, savvy accounts have picked up on a less well-known alternative: the market for syndicated leveraged loans. Buoyed by ebbing defaults, surging asset prices and low volatility, the loan market is riding a wave of its own, generating risk-adjusted returns that outpace other

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Economics

Global investment outlook: 2026 and beyond

Broadening, steepening and weakening: Franklin Templeton’s top investment ideas for 2026 and beyond

Webinar – Nowcasting the US economy

Join CME Group Chief Economist, Blu Putnam, as he shares insights using alternative data and nowcasting to monitor developments in the US economy.

Fed Funds Futures in a Post-ZIRP World

As the FOMC returns to more active management of its key target rate, Federal Funds futures have experienced dramatic growth.

Challenging economic pessimism: an optimistic note

A contrarian, upbeat view of the long-term economic outlook

Economists, like hedge fund traders, need open minds

Economists, risk managers and traders must learn the lessons of crisis, says Kaminski

Fed wrong not to start QE tapering, says UBS economist

The surprise decision by the Federal Reserve last month not to scale back its quantitative easing programme will create more volatility, says economist