This article was paid for by a contributing third party.More Information.

Seven themes to ponder as we head for 2020

By Blu Putnam, chief economist, CME Group

As we head for 2020, we wanted to shine a light on some of the major debates among market participants and policy makers that may help define price discovery in the coming year.

1) Massive QE has damaged liquidity and helped to slow economic growth

Liquidity of markets is as critical to the functioning of an economy as oil is to an automobile. When friction is reduced, everything works more smoothly. When risk management can be accomplished efficiently, businesses can accept the risks they want to take, manage the risks they want to avoid, and in the process conduct their businesses with less capital, adding to the overall growth of the economy.

One of the unintended consequences of quantitative easing (QE) or massive asset purchases by central banks has been its negative impact on the liquidity of government bond markets. In Europe and Japan, the government bond purchases by the central banks since 2015 have gotten so large as to dramatically reduce the liquidity in those markets, damaging risk management efficiency and leading to more sluggish growth, especially in Europe.

2) Trade war may take its toll on the Chinese yuan and the euro

The extent the Chinese economy is decelerating due to the trade war may lead to more capital leaving China, making the Chinese yuan the canary in the coal mine. Over the summer of 2019, as the trade war heated up, the Chinese yuan broke through its psychological line at 7.0 CNY to the USD. In the Fall of 2019, with the Chinese National Day holidays in the past, further depreciation of the Chinese yuan toward 7.25 CNY to the USD would be a sign of more weakness in the economy which might extend into 2020 leading to more currency weakness.

The trade war may expand to Europe in the Fall of 2019, which could not come at a worse time for German automobile makers and the German economy, which appears heading into a recession. If the US imposes tough tariffs on Europe, some capital might flow to the safer haven currencies of the US dollar and Japanese yen, depreciating the euro. Again, as with China, the currency movements may provide the markets with a signal as to the damage being done by an expanded trade war. We also note that the US might feel some unintended damage from expanding the trade war into Europe. German automobile makers have huge global facilities in the states of Alabama and South Carolina, and current expansion plans might easily be delayed or even canceled costing the US potential manufacturing jobs.

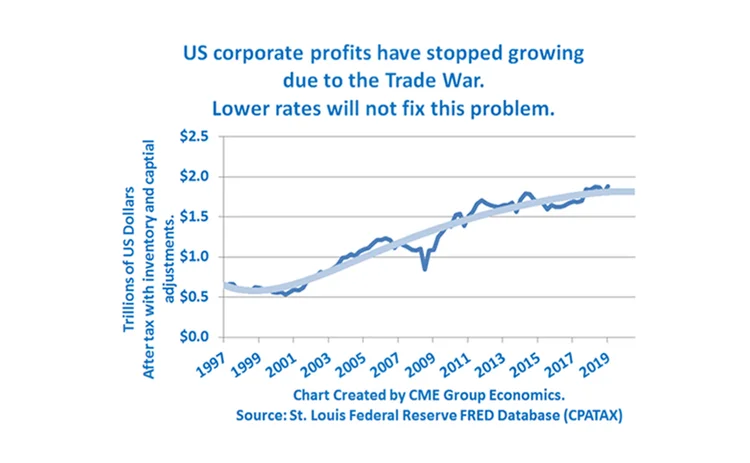

3) Trade war leading to stagnating corporate profits, equity market volatility, no US recession

The tariffs imposed as temporary bargaining chips in the trade war are increasingly looking like they will be permanent. As supply chains become more expensive, companies have to decide between two difficult choices: (1) raise prices and probably lose market share, leading to cuts in production and layoffs of workers, or (2) take the hit on profits margins to maintain market share and be ready for better times when they eventually arrive. The evidence is piling up that US companies are choosing to accept lower profit margins rather than give up market share and lay off workers. This is good news for labor markets and economies driven by consumer spending such as the US, since a recession is likely to be avoided as long as consumers keep spending. The bad news is that profit-growth stagnation is likely to lead to increased equity market volatility, and some analysts may mistakenly interpret this is as sign a recession is coming – but it is just a profits recession not a real GDP recession, at least in the US.

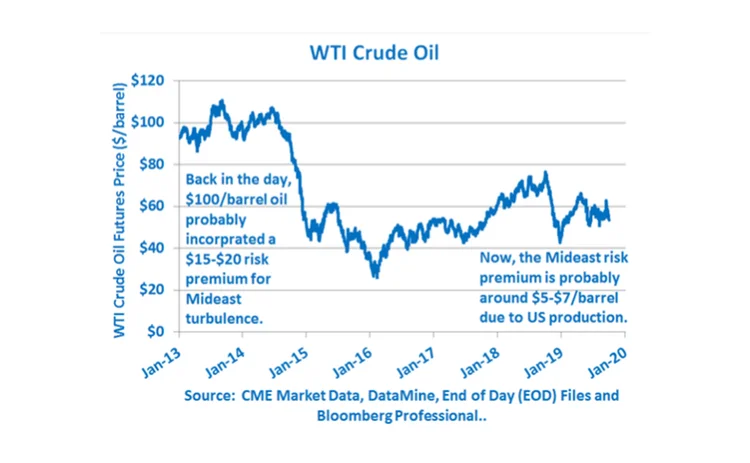

4) Middle East oil shocks no longer pack the punch they once did

With the US having taken the #1 position as the world’s largest oil producer and with US exports of oil surging, shocks to the world’s oil supply emanating from the Middle East no longer pack the punch they once did. Not to belittle the $5/barrel upward jump in oil immediately after the Saudi processing facility was damaged by a drone strike in mid-September, but a decade or more ago the same event would have probably caused a $15 or $20/barrel upward price movement. Indeed, in less than two weeks, the market totally erased the oil price spike. This does not mean future unexpected Mideast disruptions to the world’s oil supply cannot cause big price movements, but it does suggest market participants have come to realize the important role played by the US, and the Permian Basin in particular, in stabilizing global oil prices.

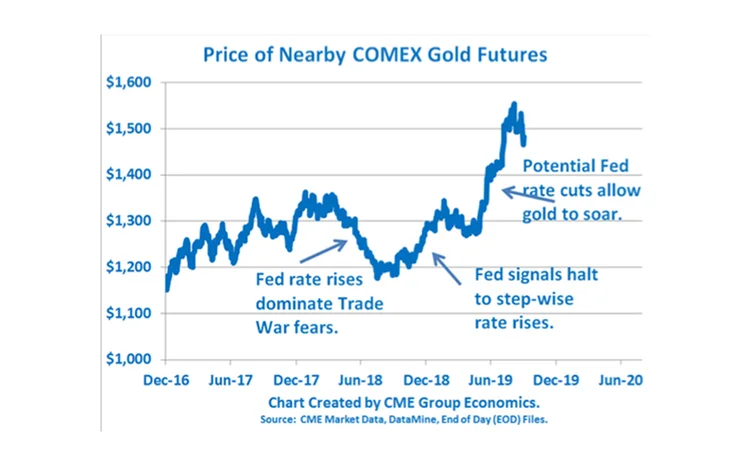

5) Gold: responding to global tension or rate expectations?

Gold is often considered a safe haven asset in uncertain times, and these times are certainly full of uncertainties. The debate on the gold market, however, has shifted to focus on the relative importance of interest rate expectations compared to global fears. Gold powered upward from $1,200/ounce to the $1,500/ounce territory in two bursts. First, gold surged in late 2018 on the back of Federal Reserve (Fed) rate expectations shifting dramatically from many more hikes coming in 2019 to the Fed going on hold with no hikes. Then, gold moved even higher in the spring of 2019 as rate expectations shifted again from no hikes to a few cuts, which were delivered by the Fed in July and September. Where to now? There is no shortage of global tensions, from the trade war to Saudi oil disruption to Hong Kong protests to Brexit. Yet, the gold price has stagnated as rate expectations have shifted toward fewer cuts and possible rate stability in the US. Time will tell what now drives the gold price; however, our attention is glued to any shifts that might occur in Fed rate expectations.

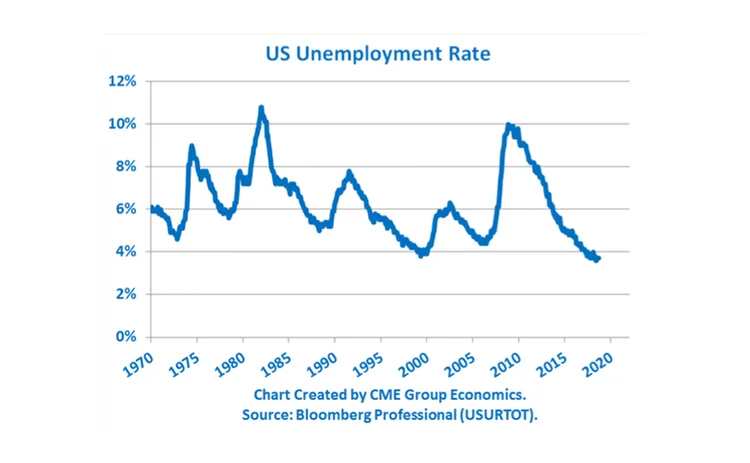

6) Fed to return to data-dependency

The Fed’s experiment with using the trade war as the primary driver to forecast a slowing economy and justifying rate cuts in July and September of 2019 had the unintended consequence of putting the Fed in the middle of the trade war political debate and giving the appearance, at least, the Fed was lowering rates at the request of the White House rather than because of economic data. After all, the Fed is charged with a dual mandate of encouraging full employment and maintaining price stability. US unemployment is the lowest in 50 years and measured inflation is very close to the Fed’s 2% target. The Fed could have taken a few victory laps for achieving its twin objectives, but it chose the forward-looking yet more politically charged path. Having made two rate cuts in 2019, however, the Fed may decide to go back to data-dependency, which simply means that any further rate cuts would be triggered by a rise in the unemployment rate to above 4% or a sharp drop in measured core inflation. Fed Chair Jay Powell has made it clear that if economic weakness surfaces, the rate cuts will be quick and be accompanied by a return to QE (asset purchases), but the Fed is unlikely to opt for negative rates as they do not seem to have worked in Europe.

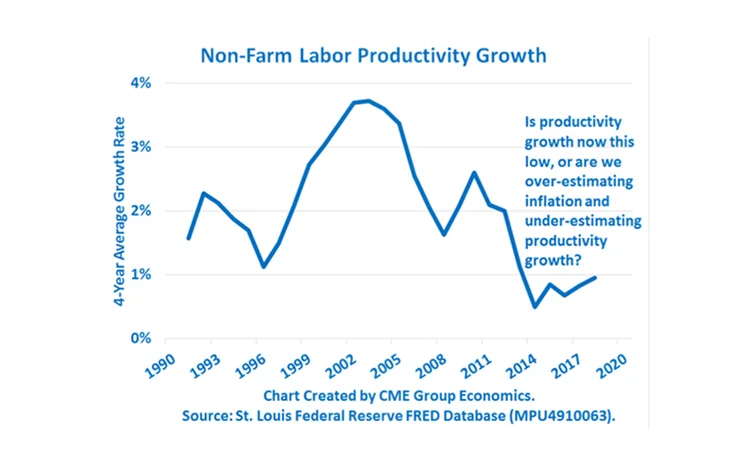

7) Are we over-estimating US inflation and under-estimating productivity growth?

The arithmetic of real GDP is that it grows when the labor force grows (not much happening now in the US) or when labor productivity grows. The labor productivity data suggests relatively sluggish growth, but is this correct? The calculation of real GDP depends on how one measures inflation. The government statisticians first measure nominal GDP – the total amount of goods and services in the economy at today’s prices. Then, they deflate nominal GDP growth by the inflation rate to estimate real GDP growth. So, if inflation is over-estimated, then real GDP growth and labor productivity growth will be under-estimated. Think about it. With all the advances in technology and efficiencies in the modern economy, the price level is incredibly hard to measure because the characteristics of the goods have expanded such that they provide much more value than they once did. Moreover, with automation and technology advances, services can be delivered with a total lower wage cost. If US inflation is more like 0.5% rather than 1.5%, then that would add 1% to real GDP growth and labor productivity growth. And, it would help explain why bond yields keep trending lower as they respond to the realities of lower inflation and not the measured inflation rate.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author(s) and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net