Wheat wooed

AWB, formerly the Australian Wheat Board, is, in the words of treasury general manager Gordon Morriss, a “peculiar animal”. It is probably the only monopoly marketing authority in the world that counts risk management as an integral part of its business. By Roger Hogan

AWB’s business is diverse, operationally and geographically. Its original purpose – to pool and export wheat produced by Australian farmers – remains its core activity but, since deregulation in the mid-1980s, AWB has become increasingly involved in domestic trading and in other grains. After privatisation in 1988 and listing on the Australian Stock Exchange in 2001, it reconfigured itself with the acquisition, in August 2003, of Landmark, a large rural services business that, among other things, supplies fertiliser to farms and acts as an agent in wool, livestock, real estate and rural finance and insurance.

During this period, AWB branched offshore with an office in Geneva, where it now sources non-Australian grains for its overseas customers. “The organisation had a change in focus three or four years ago,” says AWB’s treasury general manager, Gordon Morriss. “We recognised that, while our primary responsibility was to service Australian growers, we were selling to 40-odd countries and had at least 140 customers around the globe. Their actual demand for grain is for more than the Australian market can supply. So we took the view that… we should look at meeting their requirements from other regions around the globe.” In March, AWB announced plans for an office in New Delhi, where it will accumulate locally grown grains to sell to mills in India.

Ring-fencing

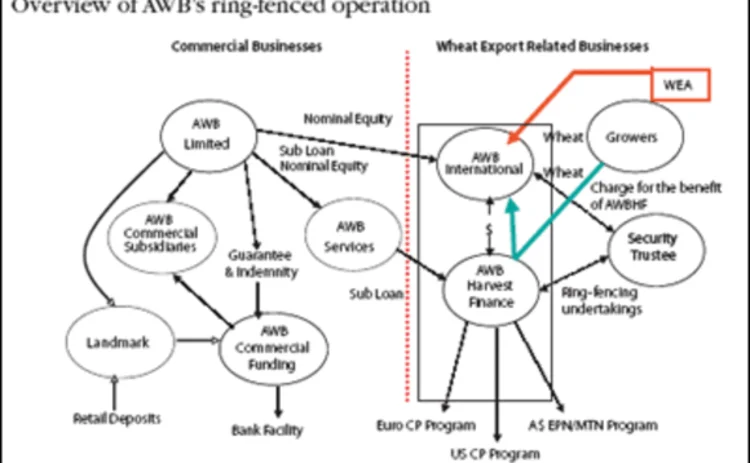

Underpinning this spread of activities is a ring-fenced operational structure, designed by Morriss and his team (see graphic). The commercial business, which includes Landmark, falls under AWB Ltd, while AWB International manages the wheat exports. As part of its pooling business, AWBI provides finance to growers through AWB Harvest Finance, which is funded through short-term debt programmes in the euro, US and domestic markets.

AWBHF has an AA- long-term and A-1+ short-term credit rating from Standard & Poor’s and a short-term rating only, P1, from Moody’s Investors Service. The ratings help keep its cost of funds competitive, and the ring fence quarantines them from the BBB rating assigned to AWB Ltd.

According to Morriss, this “reinforces and enhances the operations of the independent board of AWBI.” Treasury and other AWB staff, are employed by a subsidiary of AWB Ltd, AWB Services, which provides personnel on a fee-for-service basis to the rest of the group. It manages cash flows, debt and foreign exchange exposures – particularly those of the wheat pool that, in a normal year, generates revenues of between US$2 billion and $3 billion, all of which have to be converted back to Australian dollars.

Management model

Morriss describes the relationship between the wheat pool and AWB in terms of a funds management model, in which AWB’s role is to maximise returns to growers by managing three risks: forex exposures, supply logistics, and the commodity price. AWB is reimbursed by each year’s pool with a base fee, plus a fee determined by its performance in relation to each of the risks. Of these, only forex is treasury’s responsibility, with price hedging and logistics managed by another business unit (AWB is one of the largest single hedgers in wheat contracts on the US futures markets).

The forex strategy, which is to maximise returns to growers and protect the pool against large increases in the Australian dollar against the US dollar, is heavily options based. According to Doug Alvares, assistant treasurer foreign exchange, about 80% of the exposure is hedged with options, with the rest in forward contracts or the physical market. This can change, however. “Our [treasury] policy allows us to interchange between them, depending on our views, and we have an opportunity to lead or lag the benchmark with approved ranges.”

Current hedging looks “very good” as a result of the greenback’s weakness. Last year’s pool results, when the Australian dollar was trading between $0.70 and $0.74, were more typical. “Our initial aim was to protect the currency in case it got well above 72 to 73 cents,” says Alvares. There was sufficient optionality in the portfolio to cover any downside, but the trade was one way. However, says Alvares: “We were well covered before the currency broke above 72 cents.” The 2003/04 pool is expected to outperform its forex benchmark – which AWB declines to disclose – by more than 100 basis points (pools run for more than 12 months to include a period for marketing). The 2002/03 pool outperformed its benchmark by more than 200 basis points.

While this year’s pool is also likely to perform strongly in forex, outperforming the benchmark for 2005/06 will be a greater challenge. “We always focus on outperformance of the benchmark, but we are always cognisant of what the exchange rate means for growers,” says Morriss. Obviously, a rising Australian dollar does not help exports. “We always have to look at ways to minimise that exchange rate.”

Political support

AWB’s corporate structure, and treasury’s role within it, might seem complicated, and some growers have expressed concern about what they see as a lack of transparency and the potential for conflicts of interest. As the largest of the remaining grains-marketing monopolies, it is frequently the subject of calls for further deregulation, but the Liberal-National Party coalition government, which has a track record of economic reform, continues to support it. One argument is that AWB’s single-desk marketing role equips it for dealing with the single desk grain purchasing authorities in countries such as Indonesia, China and Iraq, which account for much of Australia’s wheat trade.

As far as Morriss is concerned, diversification remains a key part of AWB’s strategy, and treasury’s role will continue to be aligned with that. Short-term projects include diversifying the debt finance of the commercial business, which consists of bank lines. Morriss expects to set up a combined commercial paper and medium-term note facility “in the next 12 months.” Far from changing its business and risk management model, AWB sees the potential to export it. “One overseas wheat board has come to talk to us about our model, and some of the bankers advising [it] have come to us and asked if they can take our ideas to [it],” says Alvares. New Delhi, evidently, is not AWB’s last stop.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…