This article was paid for by a contributing third party.More Information.

Libor transition – Know your conversation and value impact

Ross Allen, managing director, and Ming Cheung, director of platforms and regulatory compliance at IHS Markit, explore some of the key issues with regard to upcoming changes to interbank offered rates (Ibors), including Libor, and how the service provider’s updated solutions can help

With the end of Libor as a viable benchmark interest rate looming, market participants are busier than ever engaging with their clients and counterparties to amend numerous contracts on fallback languages and rates. Meanwhile, they will need to assess the financial impact on their portfolios when almost every contract will be linked to a new risk-free rate (RFR) – or at least be met with some degree of change after 2021.

“Banks have begun engaging with clients on Libor transition, but are likely to provide options rather than advice to their clients and counterparties in the time of transition. It will be important for counterparties to seek independent advice to better understand the impact of the transition,” says Ross Allen, managing director at IHS Markit. “When considering the options for an impacted trade or portfolio, there is the need to focus on value analysis, supported by robust data. This will allow participants to accurately assess the impacts of transitioning from one reference rate to another.”

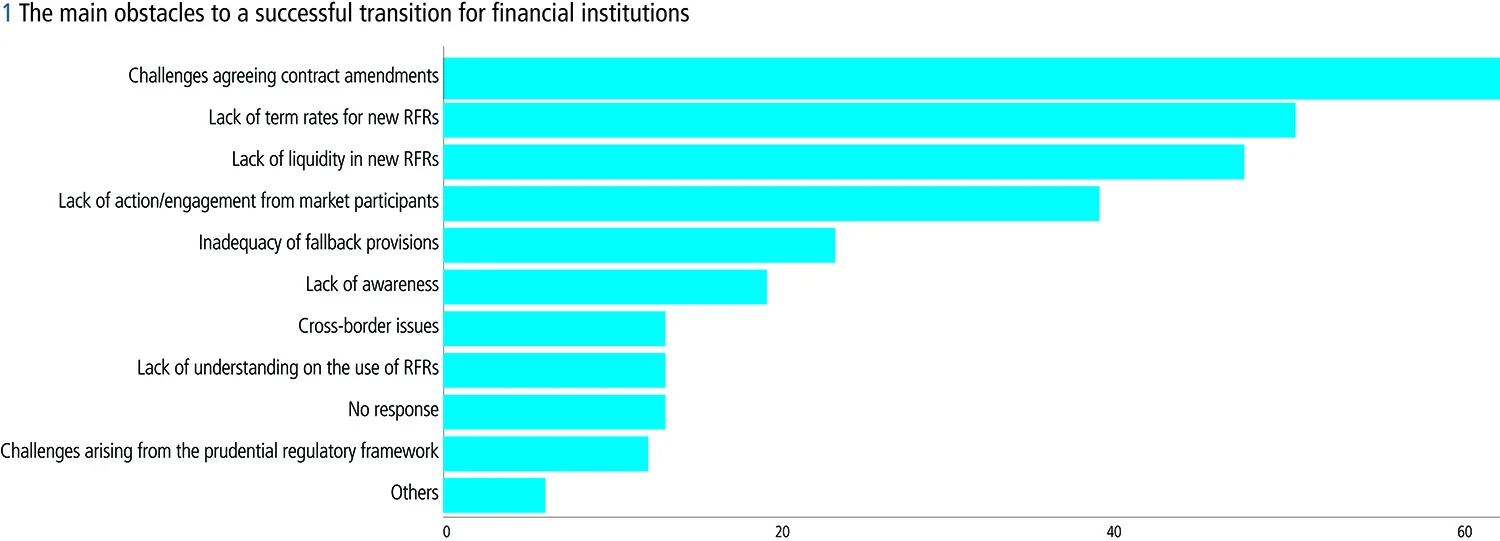

In a recent survey published by the Financial Stability Board, more than 60% of respondents ranked challenges in agreeing contract amendments as the most significant obstacle to successful benchmark transition for financial institutions. That is followed by other, more technical issues such as a “lack of term rates for new RFRs” or a “lack of liquidity in new RFRs”.

As a result, the financial industry is focusing on understanding the complexity of all the documents required to successfully negotiate and amend for each contract in loan, fixed income and derivatives products. The exercise would require a highly effective, transparent and centralised management approach to handle a large amount of work in order to avoid transitional risks that may arise from accounting, conduct, hedging, legal, operational and prudential perspectives.

An additional key goal for the conversation with clients and counterparties is to identify, monitor and address the financial implications of the upcoming changes regarding Libor transition. Financial institutions need to conduct a full-scale value impact analysis as the markets and products referencing new Ibors and RFRs evolve and grow more liquid in the future.

Staying on top of the value impact will be critical under the unprecedented financial market volatility left by the Covid-19 pandemic. Market participants had their first taste earlier this year when the panic brought about by Covid‑19 sent stocks, bonds and oil prices tumbling.

The spread between three-month USD Libor and the secured overnight financing rate (SOFR) reached 108 basis points on March 19, up from 13bp the previous month.

External assistance will come in handy for the heavily regulated financial institutions when the tasks ahead are huge and evolving.

IHS Markit, for one, has positioned itself as a strong candidate thanks to its proven record in providing solutions for counterparties to manage the onboarding workflow by sharing clients’ tax, regulatory, constitutional documents and data to support account onboarding, know-your-customer, credit, tax and legal review.

The service provider has also been partnering with industry standard bearers such as the International Swaps and Derivatives Association (Isda) to enable market participants to make regulatory elections and declarations, and permission this information to their trading counterparties in its Isda Amend tool.

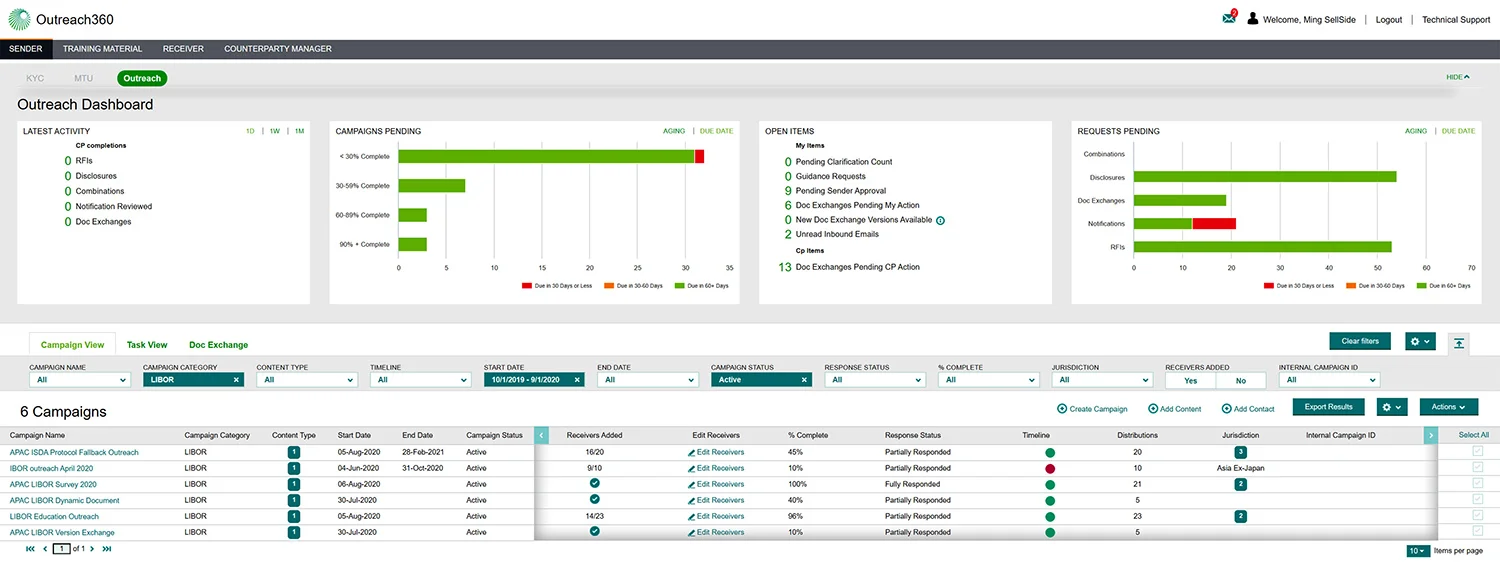

Isda Amend’s services have been integrated into Outreach360, a flexible service allowing firms to tailor controls and metric-tracking for client communication around protocol adherence, as well as audit reports for regulators as a methodical and robust process.

One-stop repapering exercise

Across all asset classes, client categories and various contracts, a task as simple as inserting legal names and contact information in an outreach campaign can seem time-consuming and prone to errors. A systematic, transparent and traceable step-by-step dashboard is the best way to go.

Outreach360 and similar tools will act as an online secured platform that allows financial institutions to manage all of the communications and outreach requirements on a single auditable platform. Outreach360 users can load client information, set up multiple outreach campaigns – for different client types, for example – and execute their contract negotiations digitally.

Clients must be educated through the repapering exercise. This is why the communications and process need to be transparent and with clear audit trails to provide evidence if required in the future.

In particular, ‘tough legacy’ contracts will benefit from the above approach, as those contracts may bring legal risk to financial institutions. As financial institutions move away from Libor, instruments that have no realistic ability to efficiently allow for revising fallback language is an ongoing problem.

The industry generally agrees that legislative power should step in and provide a safe harbour from litigation. However, if things go south, financial institutions need to protect themselves.

Impact analysis

As the contract amendment process dealing with the Libor transition is in place, understanding the financial impact of that amendment will be a critical next step. Tools such as IHS Markit’s Portfolio Valuation allow customers to assess the impact of transitioning from one reference rate to another for their trades or portfolio.

Once the portfolio is analysed, idiosyncratic trades may be revealed where that value transition from Libor may not be advantageous to the particular position one holds. The ability to opt out of individual trades from the protocol thus becomes necessary. Other important features in the valuation tool are scenario analysis and curve building.

2020 has proved that, during stressed periods, the fundamental rates of Libor and RFRs can pose great differences. The dynamic spread between Libor and RFRs means one needs to assess the historical spreads and work out how they will influence the existing portfolio, pricing exercise and new products.

This year – despite the disruption caused by Covid‑19 – the financial industry is steadily moving towards more RFR adoption. The sterling market is leading this transition, with up to 50% of the interest rate swaps market being RFR-based. In contrast, the US dollar market for SOFR is still catching up, with only about 1% using RFR as opposed to Libor. Keeping up to the liquidity and curve building is an important exercise for all the financial institutions ahead of the December 2021 deadline.

Asia‑Pacific concerns

The Asia‑Pacific region represents one of the fastest-growing capital markets, putting Ibor reforms and Libor transition high on the agenda for the financial and non-financial organisations operating in the region. What is perhaps less obvious is the extra work that may be needed as their local regulators finalise the changes to their local currency benchmarks.

Organisations in the region usually have exposures to core Libor currencies – US dollar, sterling, euro, yen and Swiss franc – and non-Libor, or local, currencies. The challenges for them to transition away from Libor is not so different to that of an institution in Europe or North America, but the fragmentation of Ibor reforms and the Libor transition timeline in local currencies means that a secondary impact may be delayed.

There could also be a mismatch in some cross-currency hedging activities. As the Libor currencies transition to RFRs, one of the changes would be if one uses a credit-sensitive benchmark and is swapping to an RFR, which creates a mismatch and an extra basis by which one needs to manage or hedge.

“Many of the immediate problems with the Libor transition remain the same in Asia as elsewhere. Organisations must focus on the five core Libor currencies and manage that transition and within the specific timetable,” says Allen. “A secondary consideration [for them] is the local, or non-Libor, currencies and how they transition to local RFRs. Market participants in the region need to understand how the local transition will work, how adoption rates and liquidity develops and what the value transfer will be for their positions or portfolio as they transition from a credit-sensitive Libor to an RFR.”

To learn more

For impact analysis, get 1-month free access to IHS Markit’s capital markets data: IHS Markit’s Price Viewer and capital markets data

Get a free contract amendments consultation and demo of IHS Markit Outreach 360: IHS Markit’s contract amendments solution, Outreach 360

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net