Collateral: Modelling, Pricing and Optimisation

Giovanni Cesari, Zlatko Filipovic and Gordon Lee

The Basel III Enhancements to Counterparty Risk Capital Charges

The Regulation of Counterparty Risk in Over-the-Counter Derivatives Markets

The Non-Internal Model Method for Counterparty Credit Risk

On Credit Valuation Adjustments and Regulatory Capital

American Monte Carlo: A Practitioner Approach

Best Market Practice for Calculation and Reporting of Wrong-Way Risk

Central Counterparty Risk

CVA Risk Management Post-Crisis

Re-Thinking CVA: Valuations, Counterparty Credit Risk and Model Risk

Should Derivatives Dealers Make A Funding Value Adjustment?

Adjoint Algorithmic Differentiation: Real-Time Counterparty Credit Risk Management in Monte Carlo Simulations

Stress Test of Counterparty Risks and Dynamic Hedging of the CVA

Dynamic Stress Testing of Counterparty Default Risk

Collateral: Modelling, Pricing and Optimisation

There are several ways of mitigating potential future credit exposure with a given client. Among the most common and effective is having collateral agreements in place. Managing collateral pools, and deciding what kind of asset to post to a client and what to do with existing assets in the pool have become extremely challenging for large broker-dealers.

In many financial institutions, collateral management has traditionally been a back-office role. It has mainly consisted of having a team of collateral managers just to ensure that the legal obligations of matching exposure to posting collateral were satisfied. The value of the optimisation of such posting was often secondary to this process.

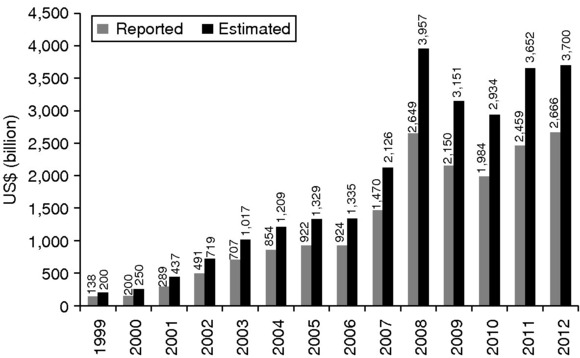

The 2007–9 global financial crisis has placed the importance of collateral management centre stage. According to the ISDA Margin Survey 2013 report (International Swaps and Derivatives Association 2013), the amount of collateral being called has increased multiple times since the end of 1990s, as we can see from Figure 14.1.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net