This article was paid for by a contributing third party.More Information.

Interest in COMEX aluminum is growing

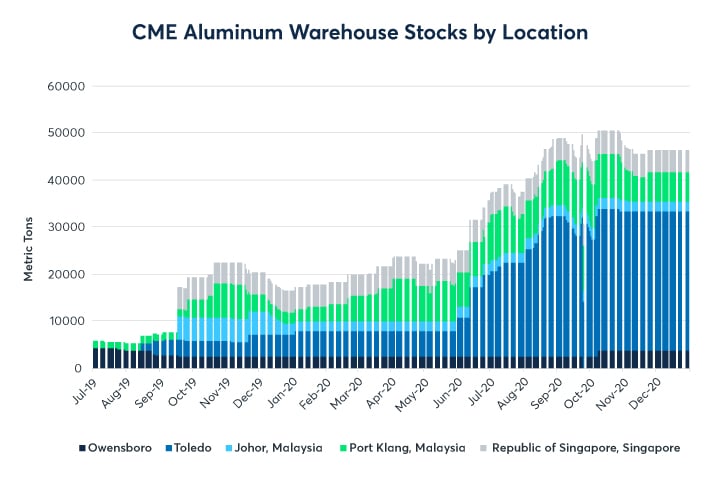

In July of 2019, after extensive client feedback, CME Group globalized the physically deliverable Aluminum futures offering by expanding our approved aluminum warehouse network to include locations in North America, Asia, and Europe.

The expanded CME Group warehousing network allows participants to deliver and take delivery of aluminum in nine locations globally, with the ability for both indoor and outdoor storage. In-warehouse inventory has increased by over 800% since the globalization, indicating how many traders are adopting the Aluminum futures contract for their physical trading needs.

Current warehouse locations:

- US ‒ Owensboro, KY; New Orleans, LA; Toledo, OH

- EMEA ‒ Rotterdam, The Netherlands; Bilbao, Spain; Antwerp, Belgium

- APAC ‒ Johor, Malaysia; Port Klang, Malaysia; Republic of Singapore, Singapore

COMEX Aluminum futures are becoming more relevant amongst the trading community. Here are a few reasons why:

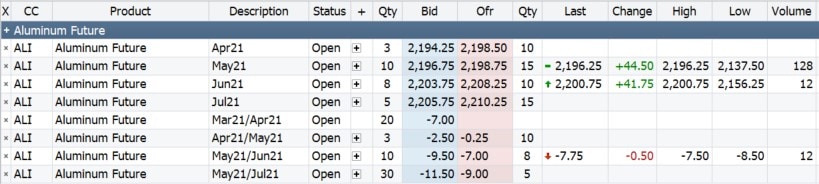

1) Simple market structure and immediate realization of profits

COMEX Aluminum futures operate on a monthly futures structure ‒ with on-screen, transparent pricing as well as the ability to transact bilaterally and clear through CME ClearPort.

Once positions are closed out, profit (or loss) is immediately realized. There is no need to novate forward closed out positions.

2) One-stop shopping for the entire supply chain

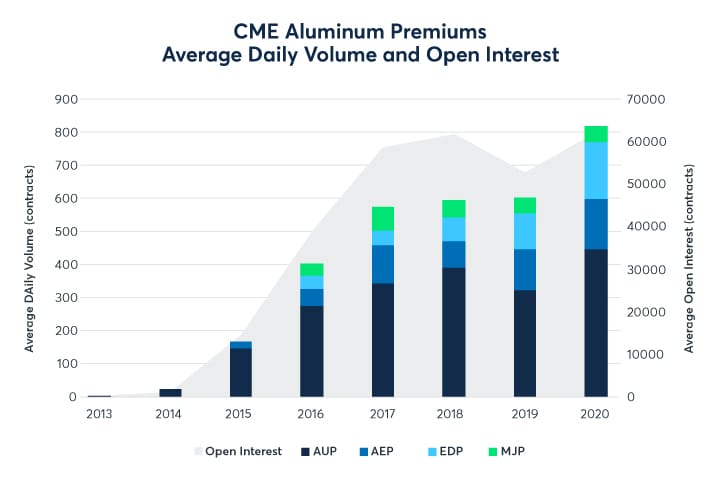

CME Group Regional Aluminum Premium contracts continue to gain relevancy as evidenced by continued increases in volume and open interest.

Regardless of your delivery region, CME Group provides a mechanism to hedge your price risk.

AUP ‒ Aluminum MW US Transaction Premium (Platts) futures

AEP ‒ Aluminum European Premium Duty-Unpaid (Metal Bulletin) futures

EDP ‒ Aluminum European Premium Duty-Paid (Metal Bulletin) futures

MJP ‒ Aluminum Japan Premium (Platts) futures

ALO ‒ Aluminum MW US Transaction Premium Platts (25MT) Average Price option

CME Group also offers financially settled futures contracts in Alumina FOB Australia Platts (ALA), Alumina FOB Australia Metal Bulletin (ALB), and Aluminum A380 Alloy Platts (A38).

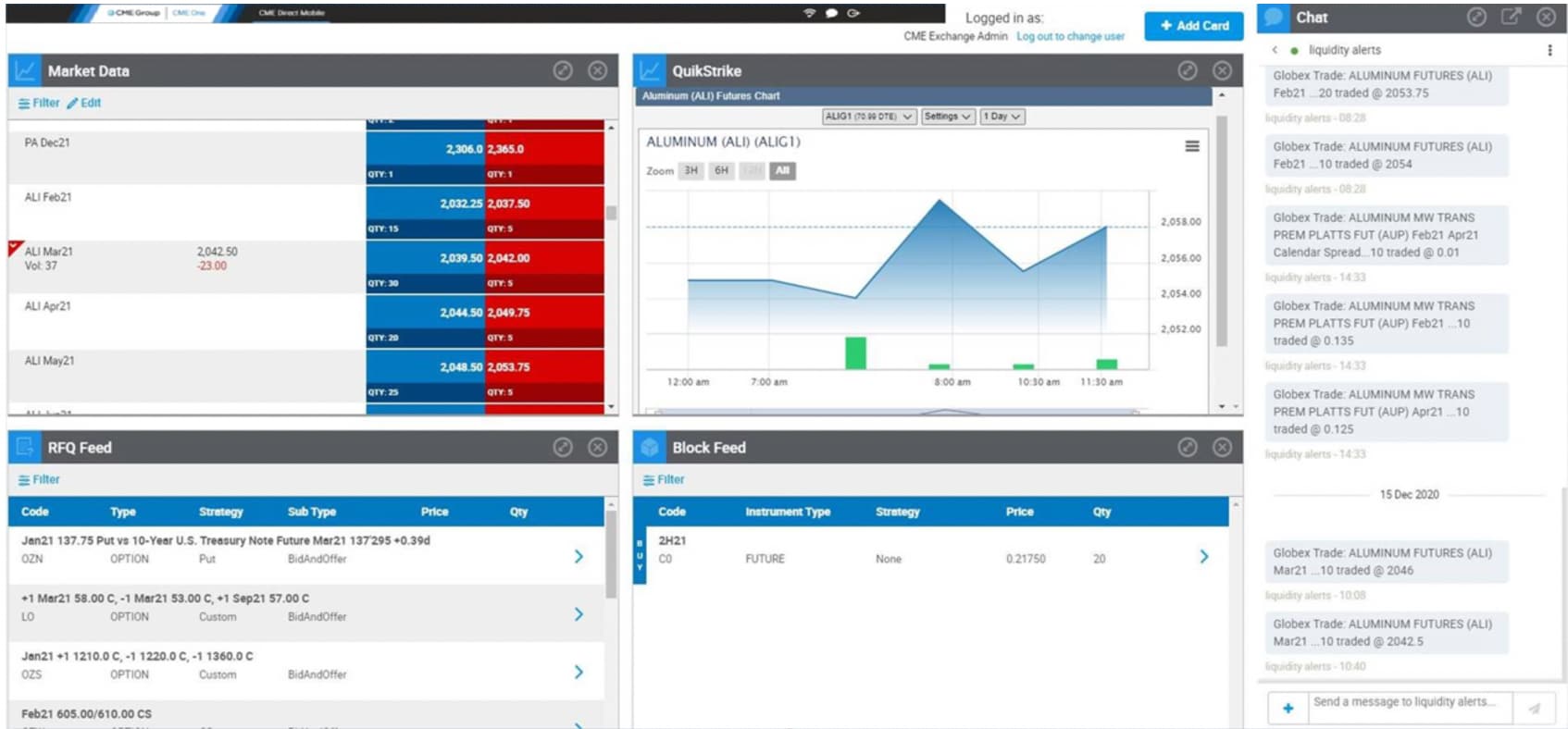

3) Commodity Direct via CME Chat

Transparency in trading is key, and Commodity Direct via CME Chat allows users to chat directly with Platts editors and other CME Chat participants to discuss the Aluminum MW US Transaction Premium (Platts) futures market activity.

https://www.cmegroup.com/trading/metals/cme-commoditydirect.html

4) Potential margin offsets

CME Clearing can provide significant margin credits between positions of Aluminum futures (ALI) and opposing positions of many other CME products. One notable offset includes a 40% maintenance margin discount when holding an Aluminum futures (ALI) position and an opposite position in Copper futures (HG). These discounts allow participants the ability to utilize their capital more efficiently.

All potential Aluminum margin offsets can be found here.

Whether you are looking to deliver or take delivery of aluminum in the US, Europe, or Asia; hedge your regional price risk; or simply garner information through other market participants, CME Group provides the tools that can help you manage your aluminum business.

5) Introducing CME Group Aluminum Auction

The Aluminum Auction provides participants the ability to anonymously transact physical aluminum in the spot market via their clearing member.

- Minimize counterparty due diligence

- Disclose attributes and location of aluminum prior to the auction

- Engage in a competitive, anonymous, and efficient tender process with a larger universe of potential counterparties

Learn more about CME Group Aluminum Auction and register here:

https://www.cmegroup.com/trading/metals/cme-group-aluminum-auction.html

If you would like to speak about any of our Aluminum or Aluminum related products, please contact us at metals@cmegroup.com.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net