Swaps data: Sonia growth spreads down the curve

New figures show boom in sterling OIS swaps is not limited to short-dated trades

Last month’s article looked at some of the products that – if regulators have their way – will replace Libor-linked instruments before Libor itself can die. It was a popular piece, but the analysis was hampered by the absence of recent data on global cleared swap volumes by tenor. On its face, rapid growth in Sonia-referencing interest rate swaps looked encouraging – but to say how encouraging, you’d need to see liquidity propagating along the curve, rather than pooling exclusively in the shortest tenors.

As luck would have it, I have since managed to get my hands on such data – so, let’s go back and take a closer look.

Sonia swaps

In sterling, the Bank of England took over as the administrator of Sonia in April 2016. Two years later, it reformed the benchmark by including bilaterally negotiated transactions alongside brokered transactions, with a resulting three-fold increase in the underlying population, averaging £50 billion ($65.4 billion) daily.

At the same time, the working group on sterling risk-free reference rates selected Sonia as its preferred benchmark and has been working to catalyse a broad-based transition to Sonia. Let’s see what the data reveals about the progress so far.

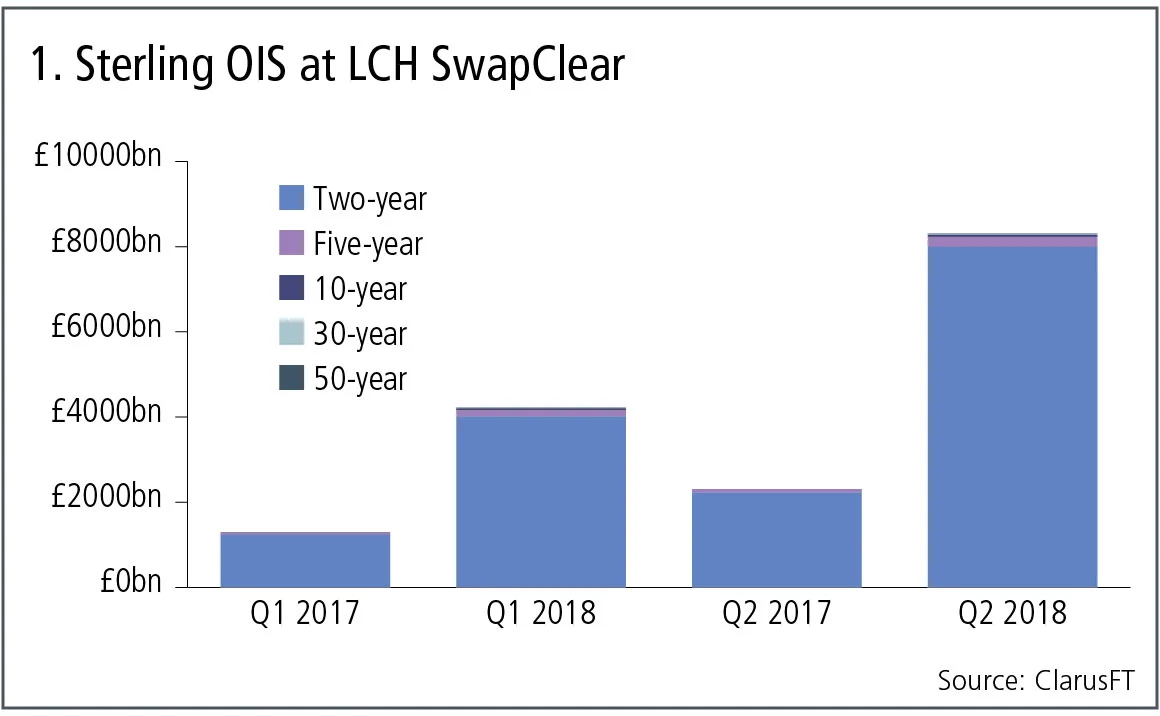

Figure 1 shows:

- Large increases, comparing quarters in 2018 with a year earlier.

- The first quarter of 2018 with £4.2 trillion gross notional, massively up from the first quarter of 2017.

- The second quarter of 2018 with £8.3 trillion gross notional, also much higher than the year-earlier quarter.

- Volumes massively dominated by tenors below two years, but larger slivers for tenors between two- and five-year and above starting to become visible in this year’s data.

Let’s exclude the sub-two-year bucket and focus on volume in the longer tenors.

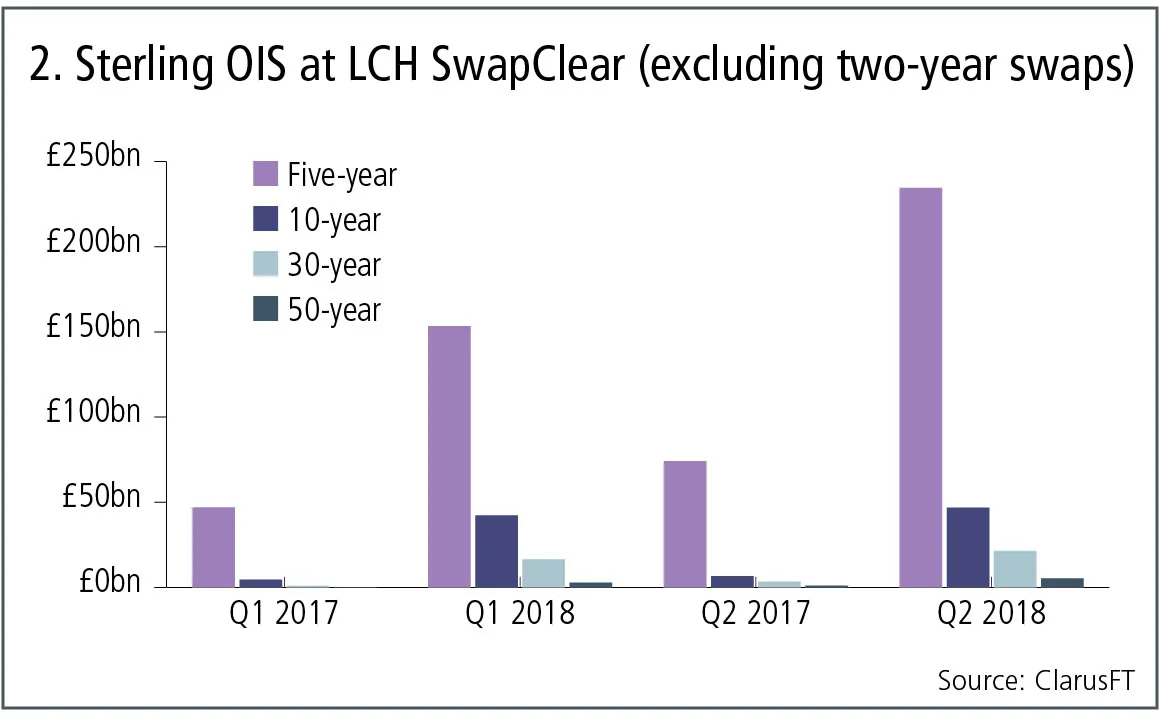

Figure 2 shows:

- The two- to five-year tenor showing strong growth and volumes reaching £235 billion in the second quarter of 2018.

- The five- to 10-year, 10- to 30-year and 30- to 50-year all showing much higher volumes year-on-year, with £47 billion, £22 billion and £5 billion respectively.

So, not huge volumes, but good increases and encouraging growth in longer-dated swap tenors. That looks like a good first step, but is it evidence of the transition regulators are looking for?

Sterling swaps

To answer that we need to look at the volume of sterling Libor swaps for the same quarters.

Figure 3 shows:

- Good increases, comparing quarters in 2018 with a year earlier.

- The first quarter of 2018 with £2.6 trillion gross notional, up 60% from the first quarter of 2017.

- The second quarter of 2018 with £3.2 trillion gross notional, up 80% from the second quarter of 2017.

- Much more even distribution – relative to Sonia swaps – of gross notional by tenor, with the two- to five-year tenor the largest, generally followed by the five- to 10-year tenor.

So, no categorical evidence of a transition from sterling Libor to Sonia swaps; for that we would need to see flat or falling Libor swap volumes. But the respective rates of growth are very different, with Sonia swaps racking up over 200% growth, compared with 70% for Libor. That augurs well for Sonia’s future, but the tenor distribution shows the challenge ahead – it’s a long way from posting comparably meaningful volumes in tenors above two years.

Europe

The situation in Europe is very different. Declining Eonia volumes since the European Central Bank launched its large-scale asset purchase programme have resulted in the ECB working group recently selecting Ester – a brand-new rate – as the replacement for Eonia. For Euribor, the jury is out while reform efforts are underway.

Let’s take a look at euro swap volumes for both indexes to size the task ahead.

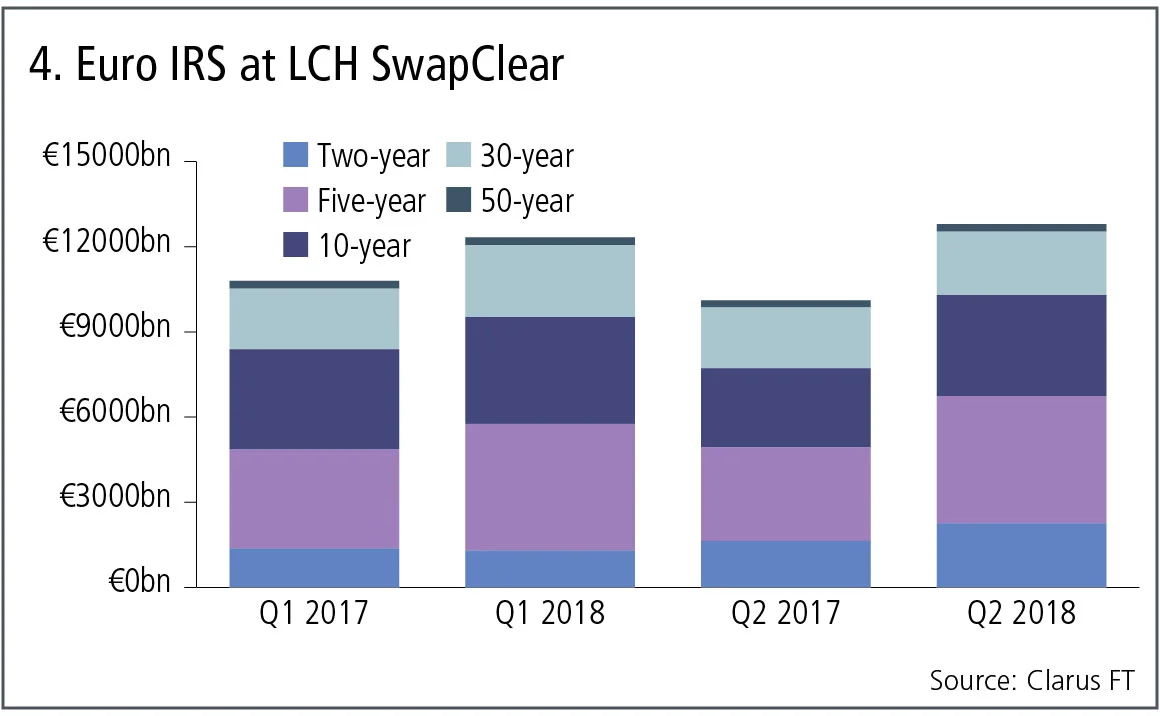

Figure 4 shows:

- Modest growth, comparing quarters in 2018 with a year earlier for Euribor swaps.

- The first quarter of 2018 with €12.3 trillion ($14.1 trillion) gross notional, up from €10.8 trillion in the first quarter of 2017.

- The second quarter of 2018 with €12.8 trillion gross notional, up from €10.1 trillion in the second quarter of 2017.

- The two- to five-year tenor is the largest, followed by the five- to 10-year tenor, with both the sub-two-year and 10- to 30-year tenor also showing massive volume.

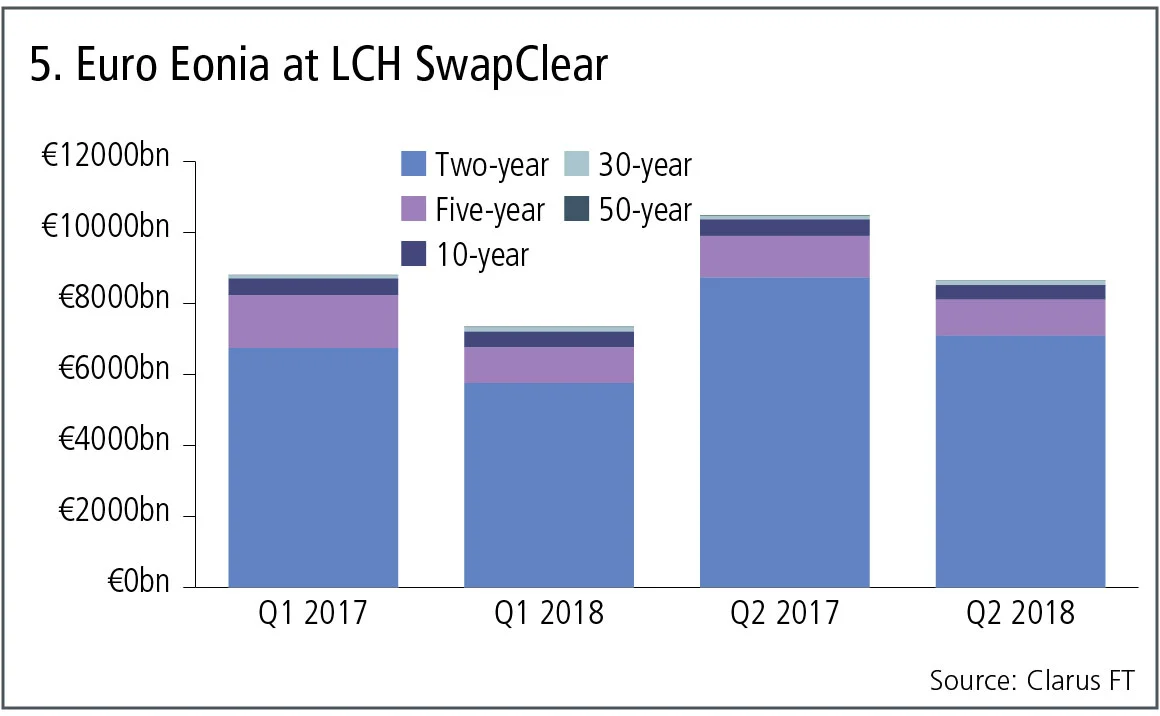

Figure 5 shows:

- Declines in Eonia volumes from a year earlier.

- The first quarter of 2018 with €7.3 trillion gross notional, down from €8.8 trillion in the first quarter of 2017.

- The second quarter of 2018 with €8.6 trillion gross notional, down from €10.5 trillion in the second quarter of 2017.

- While the sub-two-year tenor volumes dominate, there is substantial volume in the two- to five-year tenor and reasonable volume in the five-to 10-year tenor too.

Given the massive size of these volumes and the fact the ECB will only commit to publishing Ester by October 2019 – currently only a 10-day lagging pre-Ester is published – there is a lot of work to do. I’m not sure if the connotation here is more carrot or stick, probably equal measures of both are in order.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why