Monthly credit data review: UK corporates’ post-Brexit slide

UK financials show steady post-Brexit decline in credit quality; EU financials now on par

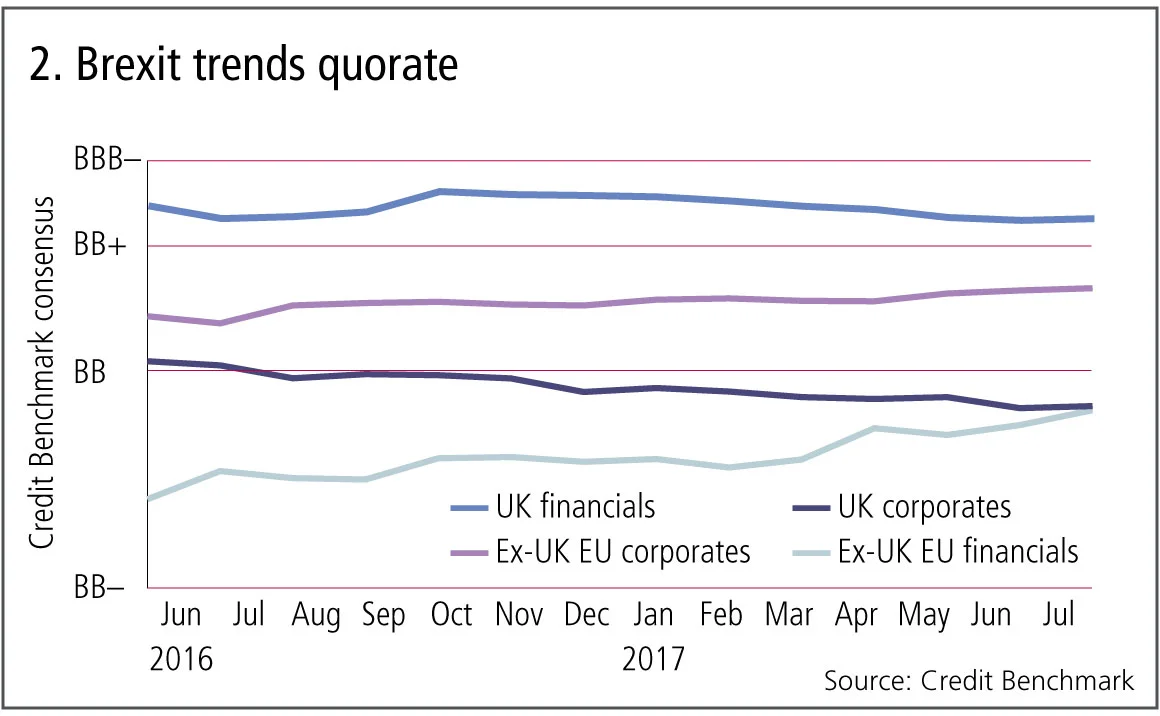

It’s all there in the data, analysts are fond of saying. Since the UK voted to leave the European Union in June 2016, there has been a steady deterioration in average credit ratings for UK corporates and – since the end of that year – for UK financial firms, too. At the same time, EU corporates and financials have both shown steadily improving average consensus ratings, with the result that the credit quality of EU financials now matches that of UK corporates, and could soon move higher.

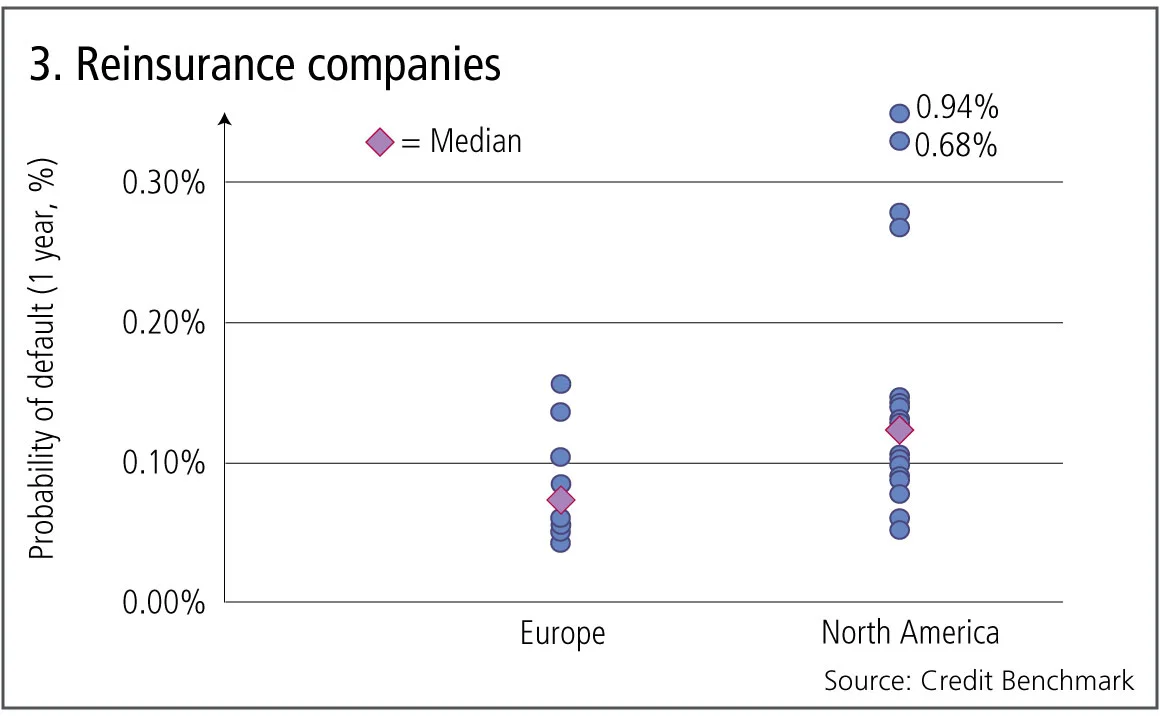

Elsewhere, hurricanes Harvey and Irma have wrought devastation on the Caribbean and the Gulf of Mexico in recent weeks – and could yet spell trouble for the reinsurance sector, this month’s review of credit quality data suggests (see box: About this data). Traditional US insurers are predicted to bear the brunt of losses – and the range of credit riskiness is already significantly wider for North American firms than their European peers, on average.

Global credit industry trends

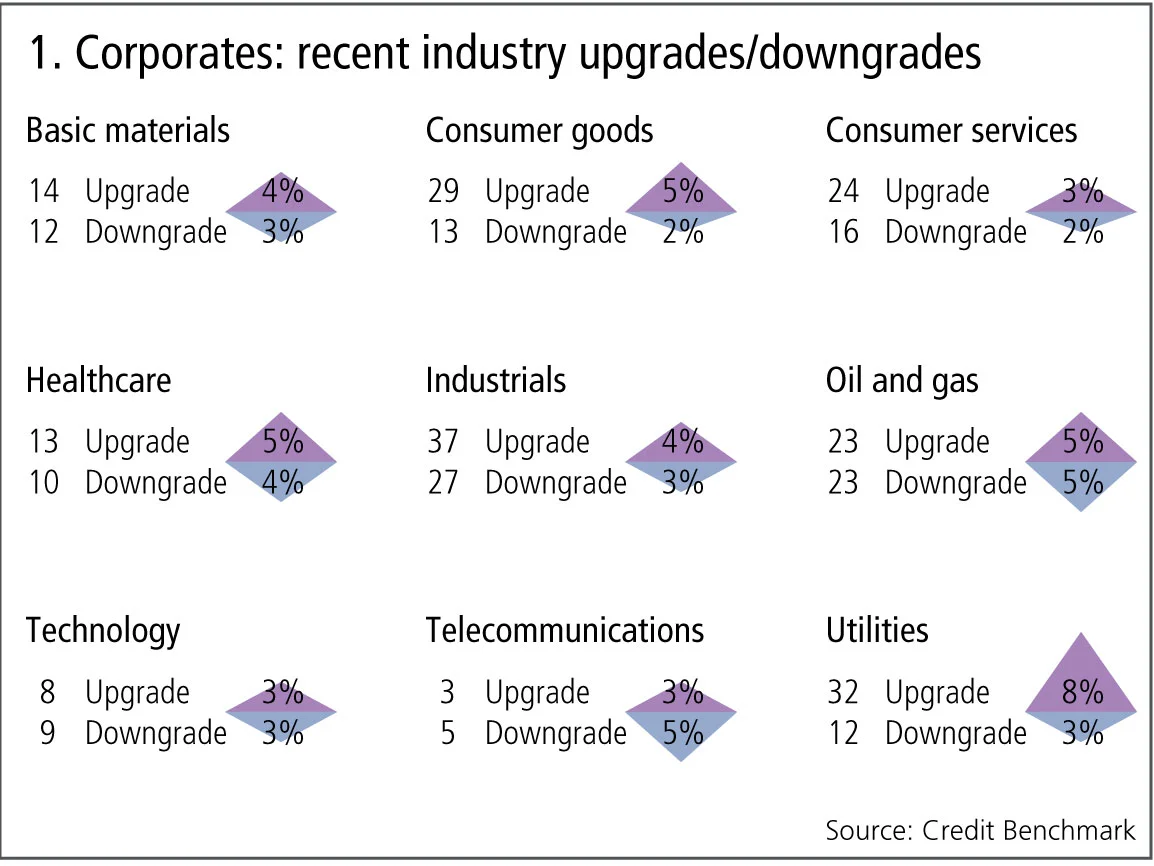

Figure 1 shows:

- Upgrades continue to outnumber downgrades in consumer goods and healthcare, although healthcare is now much closer to being in balance.

- Consumer services now show upgrades outnumbering downgrades – a reversal of recent trends.

- The run of upgrades across the global oil and gas industry continues, but the most recent data shows that downgrades are catching up. Hurricane Harvey is likely to have a significant negative impact on oil companies with exposure to the Gulf of Mexico.

- The recent trend in technology that favoured upgrades also shows a pause this month.

- Utilities continue to show upgrades outnumbering downgrades by more than 2:1.

Brexit update

Although the full impact of Brexit is uncertain, overseas earners have clearly benefited from sterling weakness over the past year. However, the general corporate credit picture is more mixed. Figure 2 shows credit trends for corporates and financials in the UK and in the EU ex-UK.

Figure 2 shows:

- There has been a slight, but steady, deterioration in the average credit consensus rating for UK corporates since the EU referendum last year.

- UK financials have also deteriorated, although this trend only became established late last year.

- EU corporates and financials both show a steadily improving trend. The credit quality of EU financials now matches that of UK corporates, and could move higher.

Reinsurance

Hurricanes Harvey and Irma set new records, in terms of strength, duration and damage. The US government will take much of the financial strain, but smaller Caribbean nations will need aid, and the region as a whole is chronically underinsured.

For the reinsurance industry, the news is mixed. Some traditional insurers – especially in the US – will experience large losses. Loss rates have been low over the past decade, which has attracted an inflow of capital into the sector from non-traditional insurance providers, including pension funds and hedge funds. The reinsurance industry expects some of this excess capacity to now drop out, which is likely to mean harder rates.

The distribution of credit risks for European and North American insurers is shown in figure 3.

Figure 3 shows:

- European reinsurance companies have median one-year probability of default (PD) of less than 10 basis points.

- The median PD for North American reinsurance companies is more than 50% higher than that of the Europeans.

- The range of credit risks for North American insurance companies is significantly wider, especially in the high-risk tail. This is partly because there are more companies in the sample (19 in North America, against eight in Europe), but the lower bounds are similar for both groups.

- Two of the North American reinsurance companies are below investment grade.

UK pension funds

The Bank of England has hinted the UK base rate may finally be about to move higher. This could also have a positive impact on long rates, including annuity rates. This would be good news for defined benefit pension schemes, which are currently facing large and growing deficits. These, in turn, have been a drag on corporate profitability – so any improvement will have benefits beyond the pensions sector.

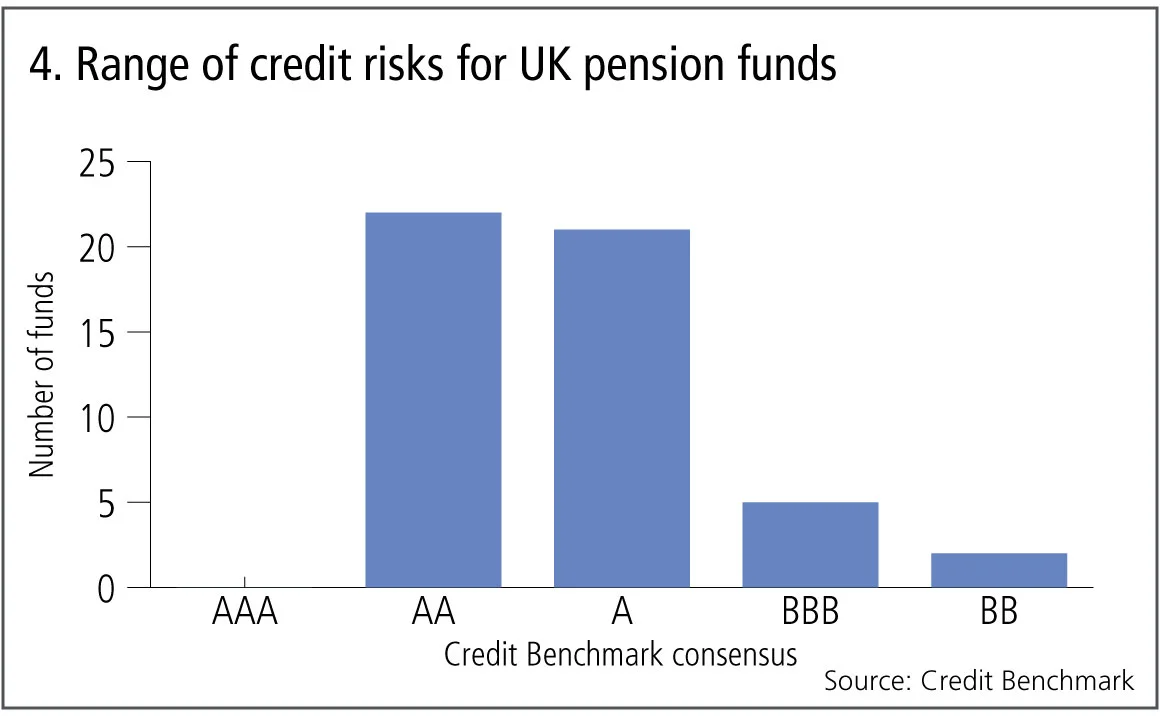

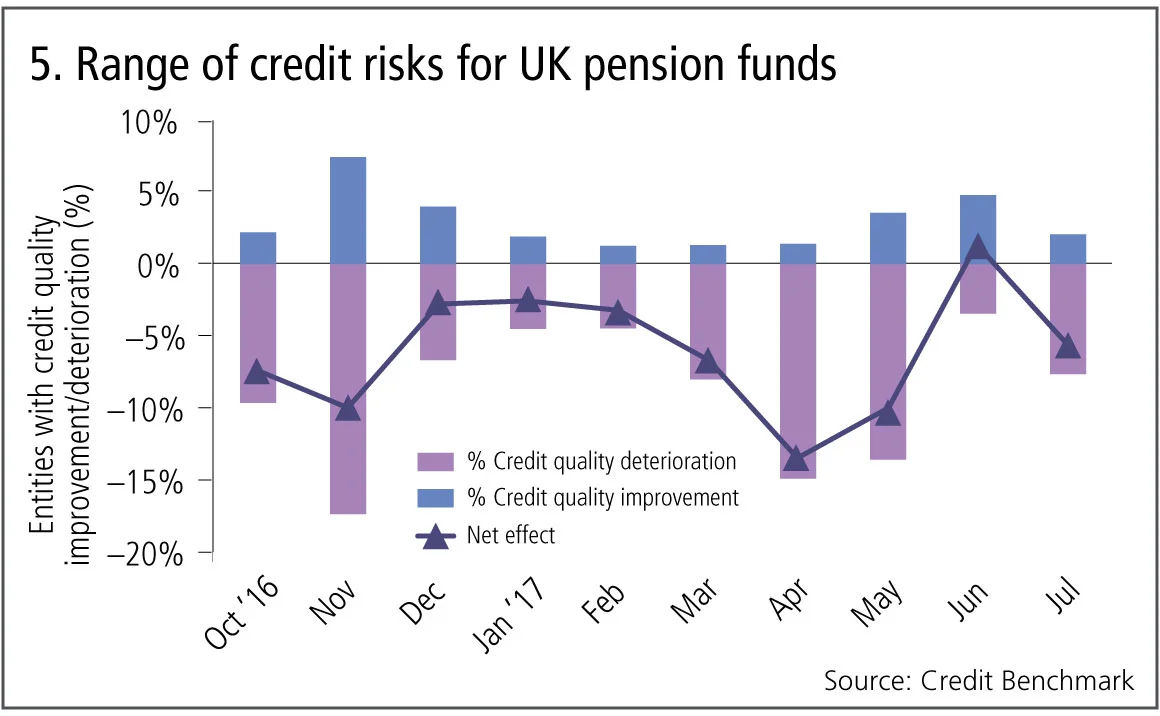

The range of credit risks for 50 UK pension funds and credit risk trends in UK pension funds over the past 10 months are shown in figure 4.

Figures 4 and 5 show:

- There are no funds with consensus ratings of AAA.

- The majority (43) have consensus ratings of AA or A.

- Five are rated as BBB.

- Two out of the 50 are viewed as non-investment grade (BB+ or lower). These are London Borough of Bexley and Tyne & Wear.

- A trend towards credit quality deterioration over the past 10 months.

- This sample includes the Pension Protection Fund, viewed as AA.

Developing economy sovereigns

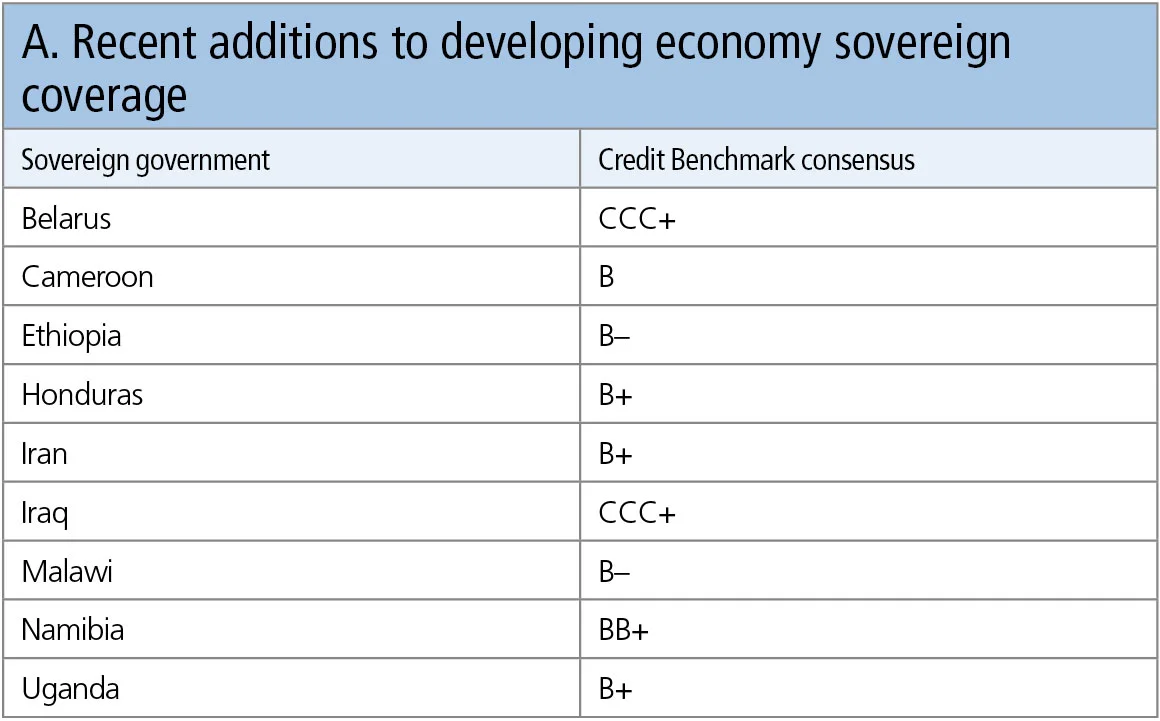

Table A shows the Credit Benchmark consensus for a number of developing economy sovereign nations. Most of these have only now appeared in the bank-sourced dataset, which implies banks are doing increasing business with these sovereign governments. By implication, they are probably also beginning to extend credit to major corporates in these areas.

Table A shows:

- Most of the recent African additions – Cameroon, Ethiopia, Malawi and Uganda – are in the consensus ratings range of B– to B+. Namibia stands out as BB+, just below investment grade.

- Consensus ratings are now available for Iran (B+) and Iraq (CCC+). The case of Iraq, in particular, shows how quickly banks can move into areas of new business as soon as the security situation improves.

- Belarus has recently made the news, conducting joint military exercises with Russia. Russia has recently been moved to investment grade, but Belarus has a long way to go. The current consensus rating is CCC+, the same as Iraq.

More generally, it is worth noting credit views in the B and C categories tend to be more divergent across contributing banks. There are also significant divergences – positive and negative – compared with the main rating agencies.

About this data

The Credit Benchmark dataset is based on internally modelled credit ratings from a pool of 15 contributor banks. These are mapped into a standardised 21-bucket ratings scale, so downgrades and upgrades can be tracked on a monthly basis. Obligors are only included where ratings have been contributed by at least three different banks. The dataset covers more than 10,000 names and is growing by 5% per month.

David Carruthers is the head of research at Credit Benchmark, a credit risk data provider.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia