Central banks

RiskNews

RiskNews

We've come a long way...

Automated trading

Life, death and structures

Mortality risk

Indian banks call for additional Basel II guidance

Indian banks have called on their regulator, the Reserve Bank of India (RBI), to provide adequate guidance for the implementation of the new Basel Framework for Minimum Capital Requirements, also known as Basel II, according to a survey by the Federation…

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports

Blowing hot and cold

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

Losses & Lawsuits

LOSS DATABASE

The long road to LDI

Pension Funds: Liability-Driven Investment

Fonds de Reserve pour les Retraites

Practitioner Profile

Raiffeisenbanken und Volksbanken Lebensversicherung (R+V)

Practitioner Profile

"We are all in this together"

Comment

RiskNews

RiskNews

More renminbi appreciation expected

New angles

Webcast >> Op Risk Technology

OPERATIONAL RISK gathered together top technology executives in June to debate the future of the op risk discipline.

Can research reinvent itself?

The provision of credit research to clients is undergoing sweeping reform, as regulatory concerns grow over potential conflicts of interest and banks reassess the value of giving out freebies. Philip Moore examines what this all adds up to for investors

Editor's letter

Editorial

Risk rationalised

Risk rationalised

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

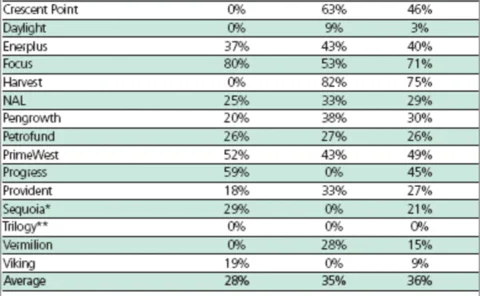

Trusts gain traction

Canadian oil and gas companies are rushing to convert to royalty trusts, despite the stigma some attach to them. This is good news for the energy-hedging market, but some still have reservations about the trust sector. By Joe Marsh