Asset management

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade

Safe havens no longer safe, quants fear

Equity-debt correlation breakdown and negative bond yields make investors nervous

Buy side eyes outsourced trading amid Covid disruption

Pressure on trading continuity drives in-house desks to look outwards

Some quants fear more deleveraging to come

Buy-siders brace for further selling after hedge funds dumped risk in March

Global macro views combine with quantitative models to produce consistent returns

The team behind River and Mercantile Group’s global macro strategy team operates under two key principles: that macro is the most important aspect of any investment decision and that decision-making should incorporate both systematic and discretionary…

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

US Treasury market holds its breath after high drama

Intermediation broke down after off-the-run bonds were dumped on banks

Funds try to predict behaviour of mystery investors

New EU rules on liquidity stress-testing force fund managers to hunt out clues on investors

Alt data lends a different light to coronavirus impact

Smog, traffic data – even movie rentals – help analysts track economic effects of virus

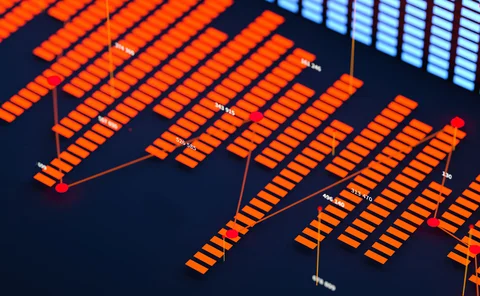

Factor strategies seesaw in coronavirus-hit markets

Quants struggle to second-guess ongoing effect of virus on investments

‘Quantamental’ approach convinces Morgan Creek CEO

Proponent of big-picture investing sees growing role for machines, but with caveats

Caveat pre-emptor: Man ESG chief talks snubbed markets

Robert Furdak is sparking discussions about responsible trend following in unsustainable stocks

Fuzzy data stalls ESG alpha hunt

Quants searching for ESG signals have reached very different conclusions. Mostly they blame the data

The age of ethical investing, but can quants cope?

Systematic managers grapple with ESG demands of clients

ESG like a new factor, alt managers say

Shift of capital to sustainable investing predicted to disrupt established strategies

Wells Fargo uses machine learning for performance attribution

Clustering algo delivers speedier and more accurate explanations of portfolio returns

Man and machine need each other – Systematica CEO

“The errors made by humans and robots are different,” says Leda Braga

Don’t invest in bad ESG companies, hedge funds told

Managers have seen a “sea change” in attitudes to sustainability

Ripping up the old asset class labels

Outmoded classifications of securities may be concealing market risk. AI has a better idea

Quants – pick your alt data wisely, says Goldman MD

Investors must balance risk of false signals versus missing out on alpha, says Matthew Rothman

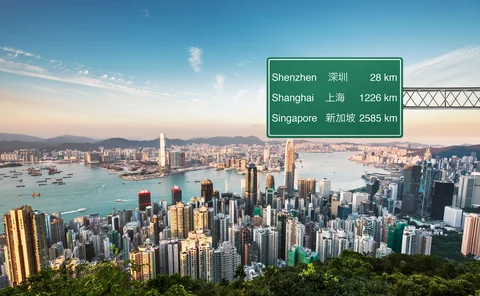

Fund managers look beyond Hong Kong as instability bites

Contingency planning for Hong Kong protests could turn into structural shift for asset management industry

CFTC urged to cement relief from a non-cleared margin rule

Industry seeks permanent right to specify two minimum transfer amounts: for initial and variation margin

Ex-Credit Suisse quants embrace machine learning

Founders of XAI Asset Management grapple with unsupervised learning and the problems of explainability