Infrastructure/Commodities

2002 the year ahead

Market overview

Utilities: Enron’s ripple effect

Cover story

The silver lining

Enron’s collapse could ironically give a boost to the telecoms market, as Enron Broadband Services bows out of the limelight. By Laurence Neville

Job moves

QUOTE OF THE MONTH: - “The FSA has successfully put the fear of God into senior managers” Simon Gleeson, a partner in the regulatory group at Allen & Overy in London, on the FSA’s new unlimited liability rules for risk management errors Source: RiskNews,…

Fallout for energy markets

Enron’s collapse led to short-lived increases in electricity and natural gas volatility. As the markets settle down, the question now is who will fill Enron’s shoes? By Kevin Foster

Software survey 2002 |

Some online risk management products failed to live up to expectations last year, but software vendors forge ahead, developing products that support fast-growing markets such as credit derivatives and CDOs, and tools to help banks meet Basel II…

Enron and systemic risk

Regulators worry that concentrating derivatives market-making in a few major dealers poses severe systemic risk issues. Could one big player’s failure break the whole system? David Rowe says Enron is an ideal test case, with some encouraging indications

Algo includes S&P for Basel II

Algorithmics is strengthening its credit risk management offering as demand grows for more comprehensive credit solutions. It is integrating a number of Standard & Poor’s credit data products with its analytical tools and developing a new module to help…

SAP makes play for risk territory

German software giant SAP is making a firm move into the risk management industry with the further development of its range of industry solutions. The Waldorf-based firm has already developed credit and market risk components for the financial services…

Building for Basel

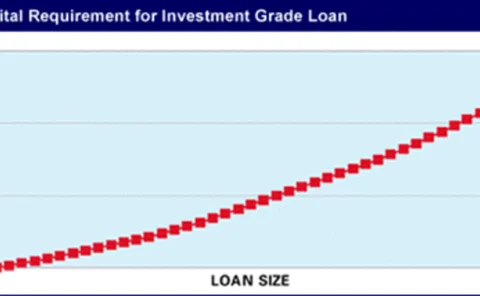

The 2005 implementation date for the new Basel II Accord – already postponed by a year – is looming large. Whilst the banking sector is steadily gearing up for the proposed changes, there are fears that some institutions may be left behind.

Is there hope in the advanced measurement approaches?

Basel II is mistaken in assuming a stable relationship between expected and unexpected losses, argues Jacques Pézier in his second article on the Basel Committee’s recent operational risk working paper.

Building for Basel

The 2005 implementation date for the new Basel II Accord – already postponed by a year – is looming large. Whilst the banking sector is steadily gearing up for the proposed changes, there are fears that some institutions may be left behind.

A perfect rating

Profile

Building for Basel

Basel implementation

ICI prospects looking bleak

Limited upside potential

Risk measurement under the spotlight

Portfolio management

A wider view of risk

Enterprise-wide risk

Regulators urged to enhance op risk oversight post September 11

WORLD TRADE CENTER AFTERMATH

Is there hope in the advanced measurement approaches?

BASLE II UPDATE

IBM targets costs and operational resilience for customers post-Sept 11

WORLD TRADE CENTER AFTERMATH

Basic shortcomings

The Basel regulators have missed their chances with their latest op risk paper, argues Jacques Pézier.