Lukas Becker

Desk editor

Lukas Becker is the markets editor for Risk.net in London, and oversees editorial coverage for FX Markets. His topics of interest include over-the-counter derivatives pricing, structuring, collateral management, market infrastructure across asset classes.

He joined in 2012 as Europe, Middle East and Africa editor of Risk magazine.

He can be contacted on +44 207 316 9129, or on email at lukas.becker@infopro-digital.com

Follow Lukas

Articles by Lukas Becker

Hedge funds flock to US swap spreads on SLR easing talk

‘Trade of the year’ sees investors position for shrinking negative basis as Treasuries predicted to outperform swaps

AI ‘lab’ or no, banks triangulate towards a common approach

Survey shows split between firms with and without centralised R&D. In practice, many pursue hybrid path

Everything, everywhere: 15 AI use cases in play, all at once

Research is top AI use case, best execution bottom; no use is universal, and none shunned, says survey

HSBC appoints Benihasim as global FX head

Hong Kong-based Benihasim replaces Richard Bibbey, who moved to London to run institutional sales

Researchers, quants, strats – AI is coming for you

Survey IDs roles to be most impacted by front-office AI, but experts say many will change, not disappear

CDS panel revamp wins support, but questions linger

Role of independent members, transparency and funding of enhanced committee yet to be decided

Clearing bottlenecks blamed for muted volumes at FMX

Regulatory hurdles and market conditions have also hampered CME rival since its September launch

Talking Heads 2024: All eyes on US equities

How the tech-driven S&P 500 surge has impacted thinking at five market participants

Inside Nomura’s European equities rebuild

Talking Heads: Global chief Simon Yates also addresses US crowding and Japan’s prospects post-carry trade

Finland’s Ilmarinen goes back to basics

Talking Heads: Once one of the few funds that would enter bank risk recycling trades, recent overcrowding has seen it pivot to listed equities

Thames Water: a handy guide for worried counterparties

The UK’s largest water company – now junk-rated – has £1.3bn in swaps liabilities. Dealers ought to be safe, but face a host of headaches and questions

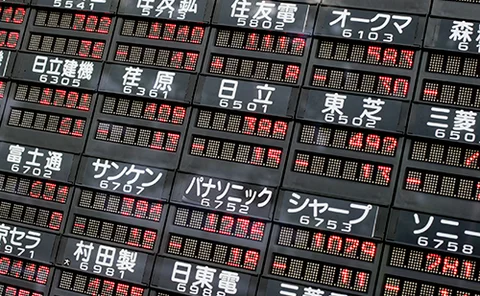

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Fee compression threatens FX algo innovation

e-FX Forum: Bank algo heads say continued revenue pressures could stifle development