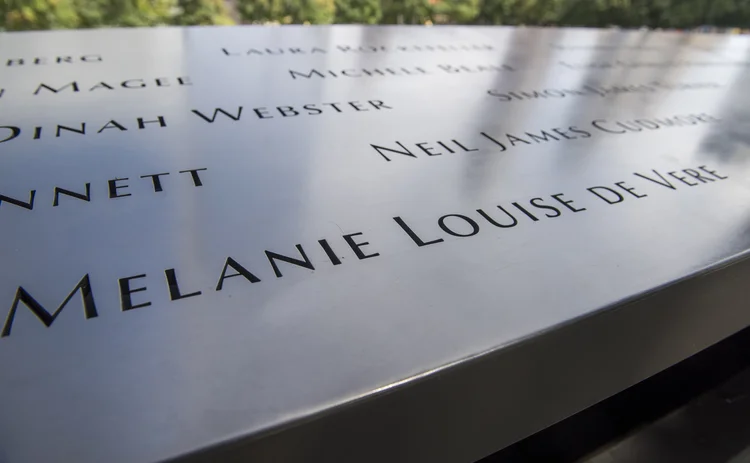

Melanie de Vere

By Ruth de Vere, sister

Melanie is a much-loved daughter, sister, auntie and friend who lost her life aged 30 in the North Tower on September 11, 2001, alongside a number of other Risk Waters colleagues who were attending a breakfast meeting that fateful morning.

The events of that day had a huge impact on her family and close friends, and there were some very dark days. But 20 years on, we are now able to look back at Melanie’s short life with fondness, remembering the good times and wondering what she would have achieved in life had she not been caught up in the events of that day. We are sure she would have married, had children and achieved her dreams and aspirations, of which there were many.

Melanie had an enthusiasm and energy for life which shone through in both her professional and private life. She will be remembered for her friendship, loyalty, humour and fun-loving approach to life. She was a great person with a fabulous smile who did not deserve what happened to her on that day, and would have loved the opportunity to continue her journey through life.

We are comforted that in her short life she didn’t waste any time and lived it to the full, as endorsed by the huge turnout for her memorial, with many fun stories and experiences shared by family and friends. Unfortunately we could not have a funeral for Melanie as no remains have ever been found, but as a family we spend time reflecting on each anniversary and have had the opportunity to visit Ground Zero in New York on a number of occasions.

If you would like to view all the articles in our 9/11 commemoration, click here

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance

Allocating financing costs: centralised vs decentralised treasury

Centralisation can boost efficiency when coupled with an effective pricing and attribution framework