Interest rate derivatives house of the year: Citi

Risk Awards 2021: Pre-spring cleaning allowed Citi to meet client needs when Covid hit markets

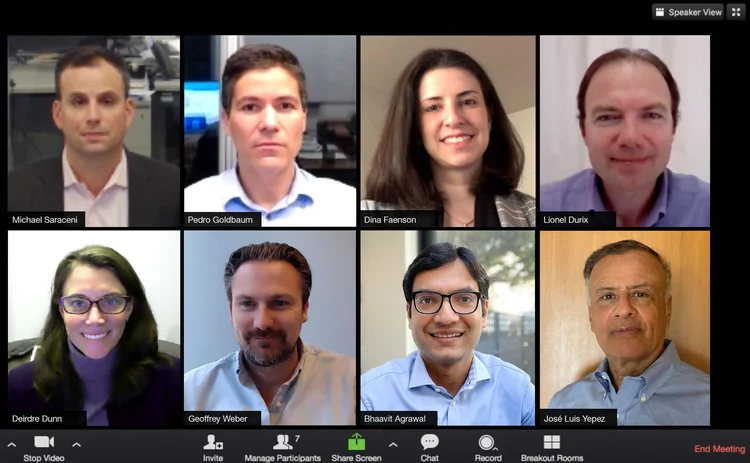

On a Sunday afternoon last February 23, Deirdre Dunn was driving over the newly built Kosciuszko Bridge in New York when she dialled into a conference call with Citi’s rates volatility team to discuss the fast-spreading coronavirus outbreak.

A day earlier, Italy had ordered lockdowns in 10 northern municipalities. Colleagues on the ground in Asia had been sounding the alarm for weeks. The team quickly concluded the virus posed a serious global threat.

“It was within that week that we really galvanised everyone around the scope of what we thought this crisis could bring, ” says Dunn, Citi’s co-head of rates. “[We] tried to be prepared and do what we could in order to operate cleanly and sensibly and be able to deliver for our customers in the volatility that ensued.”

After the call, the global vol team ran some stress scenarios to identify possible gap risks in their books. At a subsequent meeting, they pored over the results – looking at, for example, how the swaptions portfolio would perform if the Federal Reserve cut rates to zero.

That week, Citi began preparing its books for a bout of increased volatility. The rates team made a conscious effort to free up balance sheet and risk capacity. They priced certain trades to sell and shared axes with clients. Riskier exposures were either offloaded or hedged.

As the crisis unravelled, clients clamoured to exit souring trades. Hedge funds that had piled into leveraged bond/futures basis trades and off-the-run versus on-the-run positions in US Treasuries were among the first in line. The sudden surge in volatility in March triggered huge margin calls and forced many hedge funds to dump these positions as fast as possible.

Citi was ready. By the end of February, its North American linear rates balance sheet as low as it had been all year, enabling it to grow by more than 40% at the peak of the volatility in mid-March – before the Fed stepped in to backstop the market.

But the kitchen sink response from central banks created new problems for other clients. Short-end rates volatility jumped sharply as the Fed slashed rates to zero on March 15 and embarked on a series of emergency market support operations. Other central banks around the world followed suit.

That spelled more trouble for hedge funds that had sold short-end vol and bought cheaper long-dated vol – a popular carry trade, known as forward vol. One hedge fund client needed to unwind a euro version of the trade that was roughly four times the usual market size.

[We] tried to be prepared and do what we could in order to operate cleanly and sensibly and be able to deliver for our customers in the volatility that ensued

Deirdre Dunn, Citi

Having cleaned its books in February, Citi was able to absorb the position and warehouse it for a couple of days until it found a suitable counterparty to take the risk – a European real-money investor that was confident in the long-term profitability of the trade, and willing to take the market-to-market pain in the short term.

The flows coming from Citi’s booming structured notes business also helped it meet the demand from fast-money clients for rates vol during March. Sales of products such as callable notes see investors selling rates volatility to Citi, which it used to derisk its books and also recycled to clients. “That structured note flow was a very good supply of vol into the market, in the period when a lot of our clients had huge demand, so it made it easy for us to help de-risk some hedge funds,” says Pedro Goldbaum, co-head of rates at Citi.

The bank issued the equivalent of $6.5 billion of structured notes across 31 currencies in the first quarter on 2020 – a record amount, eclipsing the $2.7 billion it sold in the same period the year before.

Bhaavit Agrawal, global head of private placements for rates and currencies at Citi, says the bank’s decision to combine its structured notes platforms for rates and equities 18 months earlier allowed it to handle the higher volumes easily. The bank had also consolidated all of its primary and secondary activities across currencies and client types in a single desk. “So it was really easy and efficient for us to be able to capitalise on all the various kinds of activity that was going on in various customer segments,” says Agrawal.

During this stress period in March, Citi was also an active counterparty to a number of large, long-end dollar swap programmes. Over multiple days, the bank handled trades worth several million of DV01 – the sensitivity of a position to a single basis point change in underlying interest rates.

Toward the end of March, Citi also found itself in the middle of a delicate situation involving three US non-bank originators that were facing big margin calls on forward-settling agency mortgage-backed securities (MBS), known as TBAs.

The originators lock in mortgage rates with borrowers assuming a proportion of them will close on the loans. The locks last 30–60 days on average, and to hedge the interest rate risk the originators sell TBAs in the market. When the loans close, the originators get them guaranteed by a government-sponsored entity (GSE), such as Fannie Mae, and settle the TBAs with these newly printed agency MBS.

It was really easy and efficient for us to be able to capitalise on all the various kinds of activity that was going on in various customer segments

Bhaavit Agrawal, Citi

When the Fed started buying MBSs to support the market in March, the price of TBAs skyrocketed. This left the non-bank originators – which are typically less capitalised compared with their bank peers – facing unprecedented incremental margin calls that they couldn’t afford to fully pay.

If a non-bank originator sold a $100 million 2.5% Fannie Mae TBA on March 18 at just over $99, settling in May, they would have owed over $4 million in margin by March 27 after the Fed’s buying pushed up the price to over $104. While the Fed reduced its MBS purchases from that date, TBA prices and margin calls remained elevated through most of April.

Three non-bank originators were in this position with Citi. While they were able to pay some of the margin they owed, it created a margin shortfall for the bank.

But Citi did not want to pull the trigger on the originators for a number of reasons. First, it didn’t want to enforce the margin call and tip the firms into bankruptcy over what was essentially a timing issue; assuming a sufficient number of loans closed, the non-bank originators could settle the TBAs with newly created agency MBS. And as the loans closed and interest payments were made, future cashflows could be used to pay down the margin calls.

Neither Citi nor the GSEs thought the rate cuts would prevent the mortgages that had already been originated from closing, known as the pull-through rate. The negative convexity of mortgages also means that when rates fall, there is a limit to how high MBS prices can go before homeowners pre-pay and refinance at lower rates.

The rates team engaged with Citi’s risk department to design a process to run the exposure. The affected clients agreed to have regular calls with the risk team to keep them abreast of their financial situation.

“We did calls with chief financial officers to get comfortable with what they were doing. Many of them were very appreciative I think, and therefore, in good faith each day would be trying to add a little bit more incrementally to their posting and running an open dialogue on how the financials changed each day,” says Dunn.

By early May, the crisis had eased, and MBS prices came down. The April expiry TBAs were settled with bonds, and closing mortgages provided enough cashflow to pay down the remaining margin owed.

Citi continued to have a strong year after the markets settled down. It ranked number one by DV01 for US dollar interest rate swaps on Tradeweb, and number four at Bloomberg. Its performance was bolstered by a new pricing engine that allowed the bank to adjust levels based on a wider range of factors than client tiers, such as depth of market and volatility.

Away from the platforms, a trader at a one US GSE says the bank had grown in the past year and a half to become their top counterparty, and is their first call for trades linked to the US secured overnight financing rate. One large UK pension fund says Citi has made big strides this year in the Sonia market, and cited how well it had managed the move to a virtual world since March.

Citi’s structuring teams also won plaudits. A source at one large US asset manager lauds Citi for its deep understanding of its business, hands-on problem solving approach and overall solutions orientation. “It’s really rare to find a team that has such ownership and care they could have been on our own team,” says the source.

One highlight, which also showed off its emerging markets reach, saw the bank put its Kairos platform to work to repack $250 million of 15-year social development loans from a Panamanian bank. The debt was then sold to UK and Japanese real-money investors.

The loans were classed as an environmental, social, and corporate governance asset, which was a selling point for the investors. A guarantee from the US-based Multilateral Investment Guarantee Agency (Miga) was attached to the cashflows, making them an AAA agency exposure. Citi retained the non-guaranteed cashflows and subsequently sold most of this exposure to other clients.

Lionel Durix, head of rates and currencies structuring at Citi, says the team’s understanding of the needs of multilateral agencies helped bring the deal together.

“We talked to Miga and they told us they wanted to take more exposure to emerging markets, and wanted to invest specifically into Panama, and that social responsible part of the economy. So we approached the Panamanian bank and got the interest,” says Durix.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Awards

Market data provider of the year: S&P Global Market Intelligence

S&P Global Market Intelligence has consistently met demands across Apac’s fast‑evolving capital markets, securing its win at the Risk Asia Awards 2025

Best user interface innovation: J.P. Morgan

J.P. Morgan wins Best user interface innovation thanks to its Beta One portfolio solution

Market liquidity risk product of the year: Bloomberg

Bringing clarity and defensibility to liquidity risk in a fragmented fixed income market

FRTB (SA) product of the year: Bloomberg

A globally consistent and reliable regulatory standardised approach for FRTB

Best use of cloud: ActiveViam

Redefining high-performance risk analytics in the cloud

Best use of machine learning/AI: ActiveViam

Bringing machine intelligence to real-time risk analytics

Collateral management and optimisation product of the year: CloudMargin

Delivering the modern blueprint for enterprise collateral resilience

Flow market-maker of the year: Citadel Securities

Risk Awards 2026: No financing; no long-dated swaps? “No distractions,” says Esposito