Sovereign risk

US banks held $2.2trn of USTs on eve of tariff turmoil

AFS holdings hit record $1.04 trillion days before Trump’s tariff announcement pushed Treasury yields higher

IRC capital charges surge at Deutsche and Intesa

Risk-weighted assets covering default and downgrade of traded bonds all but double at Italian lender

Sovereign credit risk modeling using machine learning: a novel approach to sovereign credit risk incorporating private sector and sustainability risks

The authors investigate the effect of spillover effects from private sector risks on sovereign debt risk and the impact of rising sustainability risks on sovereign credit risk using the XGBoost classification algorithm and model interpretability…

SG, UniCredit, RBI most exposed to Russia as sanctions loom

EBA data shows €47bn of exposure to Russia from five most-exposed EU banks

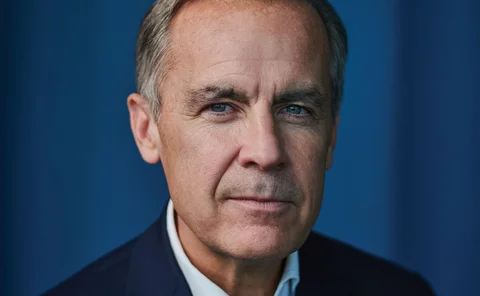

Lifetime achievement award: Mark Carney

Risk Awards 2022: The calm at the eye of the storm of post-crisis regulation and climate risk management

PGIM chops CDS book as others bulk up

Counterparty Radar: The firm’s shrinking single-name book pushed Bank of America and Citi down the rankings

Pimco, Citi top for single-name CDS trades

Counterparty Radar: Top three managers account for 75% of positions – but only Pimco sells protection on the US

Own-country risk makes up 51% of EU bank sovereign portfolios

Home government exposures up seven percentage points in 2020

Portfolio shifts aided credit RWA reductions at Dutch banks in 2020

At ING, 0% risk-weighted sovereign exposures kept a lid on RWA inflation

Banks’ claims on the public sector up a third post-Covid

Own-country debt and reserves climbed 44%

European banks held near €300bn of state-backed loans in Q3

Italian banks see public guarantee scheme loans increase the most quarter on quarter

Covid payment holidays for €224bn of EU loans ended in Q3

French, German and Italian banks saw most loans lose moratoria protection

EU banks built up own-sovereign risks through Covid crisis

Italian, Spanish and French banks in particular saw holdings of domestic government debt surge

FSB offers loud warning and muted response on climate risk

Global regulators say risks are near-term and cross-border, but propose only data collection

EU Covid policies resurrect sovereign doom loop fears

Italian banks could see holdings of home country debt increase to 17% of their total assets

OTC swaps exposures of systemic US banks fell back in Q2

Aggregate current credit exposures to hedge funds falls 42% quarter on quarter

Own-sovereign risk higher in peripheral eurozone countries

Portuguese, Greek, Italian, Irish and Spanish banks have 51% of their sovereign portfolios invested in domestic debt

Credit Suisse nets 37% sovereign RWA cut

At end-2019, 75% of its government portfolio was under the standardised approach, up from 14% the year prior

Covid-19 chaos drains Axa’s Solvency II ratio

French insurer’s regulatory capital ratio is at its lowest since the Solvency II regime took effect

EU banks diversified sovereign holdings in 2019

Yet banks in peripheral eurozone countries still heavily exposed to home government risk

Local banks’ CDSs chase Italy’s sovereign risk higher

MPS and Banco BPM creditworthiness lags Italy’s