Repo

EBA warns on funding stresses from QE exit

‘Mediterranean’ banks’ reliance on repo funding could be tested by withdrawal of stimulus

Banks will not use NSFR to judge funding risk

Calibration of ratio looks “somewhat insane” when applied to real world, conference hears

Brexit threatens UK-based banks’ corporate repo funding

UK banks and UK bases of global banks fear losing valuable source of NSFR cash

BNP Paribas grows SFT assets 36%

French bank has overtaken Barclays to become the largest European SFT dealer

Counterparty risk builds at Bank of America, JP Morgan

Higher portion of RWAs attributable to more risky derivatives and repo counterparties

Benchmark bother: Europe frets over new risk-free rate

Unsecured fixing from ECB faces off against two repo-based rates, as 2020 benchmark deadline looms large

Tri-party repo switch prompts Credit Suisse liquidity boost

Swiss bank LCR surges to 226%

EU banks toughen terms for OTC trades – ECB

Credit conditions for SFT and OTC derivatives tightened over past three months

Regulatory arbitrage: a crime, or a warning?

It could be unwise to ignore disproportionate regulatory impacts on specific business lines

Deutsche Bank cuts leverage exposure by 6%

Repo exposures absorb brunt of reductions

EU must think big to overcome Brexit’s impact on markets

Post-trade reforms offer lessons for Capital Markets Union project, writes EU lawmaker Kay Swinburne

Shut the window: EU Parliament tackles leverage loophole

EU banks may have to calculate leverage ratios daily, potentially hitting their repo market share

Branching out: foreign banks seek shelter from Fed rules

Foreign banks stashing repo businesses within their branches, outside Fed’s full gaze

The evolving relationship between finance and risk

Increased regulatory requirements that are expanding the necessity for chief financial officers to be proficient in regulations and advanced big data analytics have seen the relationship with chief risk officers develop to facilitate co-operation as…

Eurex rejigs liquidity portfolio

Half a billion euros placed with commercial banks at end-March

New DTCC fee structure could lure non-bank traders

US regulator approves proposal targeted at government securities business

Prime move for Citi’s head of European rates sales

Pauwels will lead bank’s North American prime business, after a decade in rates

Softer repo treatment seen as up for grabs in final US NSFR

Funding rules for Treasury repo on shortlist of changes; lower swaps add-on viewed as done deal

Goldman: bank liquidity needs will stall QE unwind

Economists at US bank expect Fed balance sheet to drop less than $1 trillion from 2017 peak

Risk management on course to move beyond cost centre

Video Q&A: Neil Dodgson, IBM Watson Financial Services

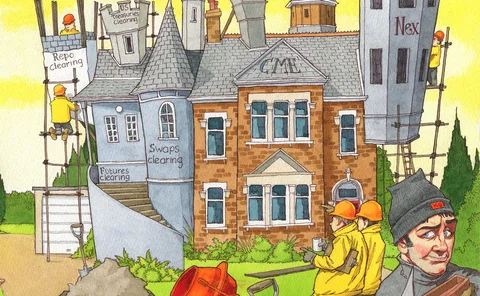

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

Deutsche Bank takes axe to leverage exposure

Target of 4.5% leverage ratio yet to be met